[ad_1]

jetcityimage

The iShares 0-3 Month Treasury Bond ETF (NYSEARCA:SGOV) might be the right place to park any sloshing cash you might have in your stock account. Markets are climbing on loose holds and with real, latent threats levied at shareholders a low risk (both credit, duration and reinvestment risk) bond play is perhaps the best way to earn a meager yield while risks remain clear, high and ignored. SGOV offers all the properties necessary to earn some return on cash as you wait for better prices, but we think that the iShares Floating Rate Bond ETF (FLOT) does everything you’d want SGOV to do but strictly better.

Managing Risk

There are several things to worry about. Rates were increased but unemployment fell, and the Fed is clear that the economy must slow. Consumers know that things are bad and are spending less, corporates are optimistic and have hired up workers, but consumer spending declines means a reckoning for corporates. This is a huge latent risk that comes with likely further aggressive rate hikes and a large fall in employment. Markets, that are recovering just 10% off pre-invasion levels, are not acknowledging that several key things have been durably drawn away from equity markets. Liquidity is lessened by rate increases, spending is lessened by the same, and any levitation of employment is unsustainable after the economic disintegration caused by the war.

Who knows exactly what will happen, but when the bear case is firing on all cylinders right now, with the price the only thing not responding, why risk capital in buying the bull here when staying to the sidelines will only cost a couple of points in lost performance while providing massive optionality benefits.

SGOV Breakdown

Something like SGOV can really fit in the current environment. The durations are short, so interest risk is minimal. So is credit risk, and treasuries are one of the best ways to get good FX exposure for current investors. Reinvestment risk is also low because these prices are going to be stable come what may. The ETF costs only 0.12% in annual fee and the YTMs on short-term instruments aren’t that bad right now at 1.9%.

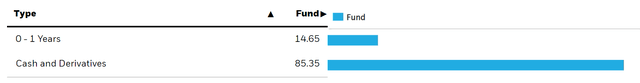

Moreover, the SGOV ETF is substantially in cash right now.

85% of the portfolio stands on the sidelines, and is likely being allocated on a rolling basis as we speak into new short term treasuries to keep yields up at close to reference rate levels around 2%. But the instrument itself has a dividend yield of 0.3%, which is half of FLOT. Moreover, fees are temporarily being waived and normalize at 0.12%, which eats away most of the yield.

Conclusions

This is really just a cash instrument in all effects, but it provides a modicum of yield and runs cheaply as an ETF. Given latent issues could surprise the economy and markets over the next couple of months, as the monthly Fed meetings add to the speculative swelling in markets, having cash invested in safe instruments with short maturities, so you can just wait for payout, will give you options to profit off a very unsteady market. In the worst case, your fears are unfounded and the rest of your portfolio is fine, with the money in SGOV yielding a little bit for your troubles. The issue is the instrument is not very liquid, but you are unlikely to get short-changed with an asset whose underlying assets are so stable. In that regard, maybe something like the FLOT which is more liquid might be better, especially since it flexes a little better with the yield. Moreover, FLOT offers a higher dividend yield to ETF holders, and its fee is only marginally more. FLOT seems to do everything that SGOV does but a little better. We’d go with that. But the principle of waiting out the market with what’s essentially a cash equivalent makes sense.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.