[ad_1]

Scott Olson/Getty Images News

The only time to eat diet food is while you’re waiting for the steak to cook.” ― Julia Child

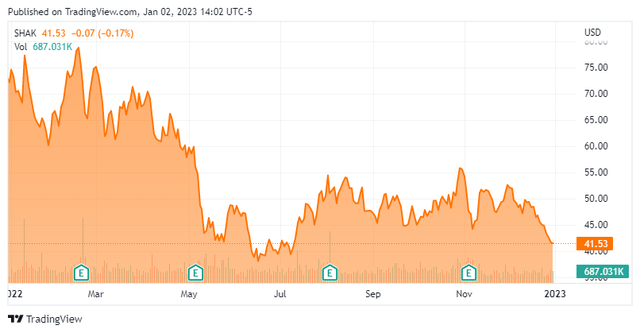

We put Shake Shack (NYSE:SHAK) in the spotlight for the first time today. The stock was down more than 40% in 2022 despite impressive revenue growth. Can the shares rebound in 2023? An analysis follows below.

Company Overview:

Shake Shack is headquartered in New York City. The original Shake Shack opened in the city in 2004. The company has since grown to over 400 locations system-wide (both company-owned and franchise). These include over 260 in 32 U.S. States and the District of Columbia, and over 140 international locations across London, Hong Kong, Shanghai, Singapore, Mexico City, Istanbul, Dubai, Tokyo, Seoul, and other countries. The stock currently trades just above forty bucks a share and sports an approximate market capitalization of $1.75 billion.

February Company Presentations

Third Quarter Results:

On November 3rd, the company posted third quarter numbers. Shake Shack had a non-GAAP loss of six cents a share, in line with expectations. Revenues rose over 17% on a year-over-year basis to $227.8 million, slightly better than the consensus. Same-store sales were up 6.3%, it should be noted, less than the current rate of inflation during the quarter. The consensus was looking for 5.2% growth in same-store sales. Revenues consisted of $219.5 million from company-owned restaurants and $8.3 million of licensing revenue. During the quarter, Shake Shack opened 2 new domestic Company-operated restaurants and six new licensed stores, including locations in China and Korea. Margins benefited from labor costs dropping to 29.4% of sales compared to 31.1% in the same period a year ago.

Analyst Commentary & Balance Sheet:

The analyst community was hardly impressed with the company’s third quarter results. Since that quarterly report was posted, six analyst firms including Wedbush, JP Morgan, and Credit Suisse have reissued Hold, Sell, or Neutral ratings. Price targets proffered range from $45 to $57 a share. Only BTIG ($60 price target) maintained a Buy rating on the stock after results.

Approximately eight percent of the outstanding float in the shares is currently held short. A beneficial owner added just over $725,000 to his stake in the firm in July. The Chief Commercial Officer sold $225,000 worth of shares in mid-July and another nearly $215,00 of stock in October. These were the only insider transactions in this equity during 2022.

The company ended the third quarter with just over $335 million worth of cash and marketable securities on its balance sheet after posting a net loss of $2.3 million in the quarter. The company has just under $245 million in long-term debt.

Verdict:

The current analyst firm consensus has the company losing just over 40 cents a share in FY2022 even as revenue growth comes in a tad past 20% for the year and the company posts some $900 million in sales. They see losses narrowing to six cents a share in FY2023 on similar revenue growth. It should be noted that the twenty analyst firms that have posted projections for the next fiscal year have a wide estimate range (a profit of 23 cents a share to a loss of 53 cents a share).

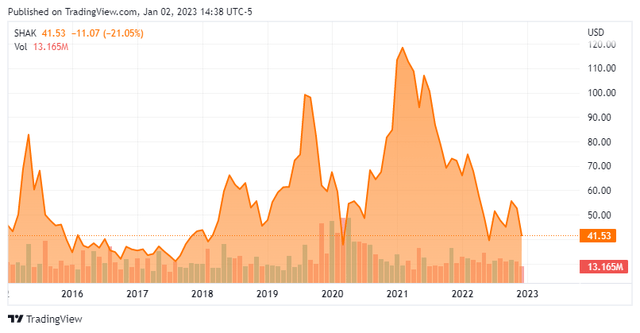

The shares trade close to where they became public eight years ago and the company is not profitable yet despite solid sales growth. The stock did soar during the pandemic lockdowns and the aftermath in 2020 but has lost approximately two-thirds of their value from those highs.

The company is struggling to produce organic growth above the current levels of inflation. In addition, 2023 looks like it will be a tough year for the restaurant sector. Inflation remains at historically high levels; the average consumer has lost buying power due to these surging prices for 20 straight months now and both Europe and the United States could very well see a recession on the near-term horizon.

This helps explain why the analyst community seems almost completely on the sidelines for the moment around this equity, despite just over 20% overall revenue growth. While management seems to be managing current headwinds nicely and the company’s balance sheet is in good shape, there does not appear to be any compelling reason to own the shares at these trading levels.

There is only one right way to eat a steak – with greed in your heart and a smile on your face.”― Soumeet Lanka

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.