[ad_1]

LPETTET

By Rob Isbitts

Strategy

The iShares Short Treasury Bond ETF (NASDAQ:SHV) invests in a portfolio of US Treasury Bills which mature between 3 and 12 months out. Thus, the main activity in this ETF is rolling over T-Bills to buy other T-Bills to maintain that 3-12 month maturity range.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds

-

Sub-Segment: US Treasury

- Risk Rating: Very Low

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Hold

Holding Analysis

SHV current holds 75 different US T-Bill issues, ranging in maturity from 3 months to 12 months. The portfolio is roughly equally divided between T-Bills maturing in the next 3-6 months, and those maturing in the next 6-12 months. Technically, this mean that some reporting services will consider the 3-month maturities to be “cash” and not “bonds.” This is something investors should be aware of if that is something they focus on in evaluating this ETF.

Strengths

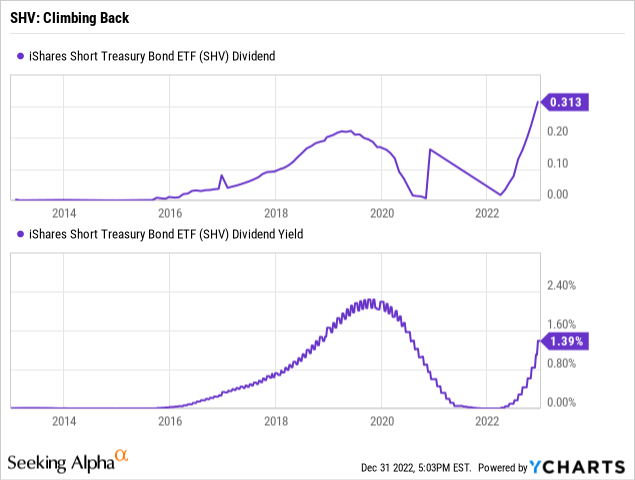

The chart below shows the history of SHV’s dividend per share and dividend yield. T-Bill prices do not move much at all. And, they are “discount instruments,” which means one buys them at below the $100 par value, and receives $100 at maturity, some months after purchase. That is a solid risk proposition.

Weaknesses

However, the reward has not typically been fruitful. The best way to summarize the weakness of SHV is to point to its long-term total return. In the past 15 years, it has averaged 0.66%. That is not a typo! In its entire 16-year history, it has returned a total of about 16%. In other words, about the average monthly move of some stocks in 2022. So SHV is only as good as the condition of the short-term bond market.

Opportunities

SHV’s plight reminds me of an episode of the popular TV Series, “Sex And The City.” In that episode, Charlotte, one of the four friends around which the show focuses, has hit her tolerance limit for the dating scene, and wants to finally find a long-term mate. She screams out to one of her friends, “I’ve been waiting for 15 years, where is he already?!”

This is how some investors might feel about SHV. This ETF has been around since January 5, 2007. And finally, after nearly 16 years in business, it appears to offer a significant opportunity, albeit in an ultra-defensive asset class, and perhaps for a limited time.

If you look at the quoted “yield” on SHV, it greatly understates what is currently taking place there. The Fed raised short-term interest rates so quickly during 2022, and the standard yield quoted in reporting services is based on all dividend payments from the ETF over the past 12 months. But when T-Bill annualized rates go from near-zero to the mid-4% range in a flash, that will mess up that annualized math.

In reality, the yield to maturity as of year-end 2022 was about 4.3%. In today’s chaotic stock and bond markets, investors considering an allocation to one of the most liquid, US Government-backed security types on the planet (Treasury Bills) finally have something to look at here.

Threats

Let’s face it: T-Bills are not sexy, and they don’t have the excitement of the city. Watching their prices move is like watching a turtle crawl. But in an era where 4-5% return in a year’s time is suddenly a rival for investor’s admiration, T-Bills are getting a lot of attention. However, there is a possibility that can be short-lived. If things get so bad in the economy that the Fed reverses course on rates, there may be a mild total return opportunity here. But since these are short-term maturities, the yields of today are not locked in for very long. So, as with many ETF investments today, SHV is best viewed as a “rental,” at least until the market regains its footing after a stressful and highly-volatile 2022 on the interest rate front.

Conclusions

ETF Quality Opinion

SHV didn’t climb from about $13 Billion in assets to more than $20 Billion during 2022 by accident. Money flows into this ETF are a direct reflection of where T-Bill rates are moving. Throughout 2022, they moved higher. And, based on the message the Fed appears to be sending to investors (even if many don’t hear it clearly yet), these rates stand a good chance of lifting further. SHV’s size, the presence of ETF giant iShares and general market conditions make this an essential tool to have in the tool box…finally!

ETF Investment Opinion

Sure, T-Bill rates can drop sharply (though that’s not what I expect in the near future). Even if they do, in this ultra-high-risk investment environment, some rate fluctuation in return for the historical stability of US T-Bills seems like something that risk-averse, yield-seeking investors should be willing to deal with.

In other words, even if SHV’s yield dropped by 1% or so, the stock and bond markets still have a lot of proving to do. After all, an investor has finite assets to work with. And in the current climate, SHV and other T-Bill-driven ETFs deserve greater consideration for a slice of that portfolio pie than we’ve encountered in a very long time. We don’t hand out Strong Buy ratings very willingly. But this is an ETF built for the current times. So despite SHV’s yield running behind the inflation rate for now, we can’t ignore the allure of 4-5% for a portion of risk-managed portfolios. SHV gets a Strong Buy rating.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.