[ad_1]

Justin Sullivan

The current tough economic period isn’t slowing down strong companies and SoFi Technologies (NASDAQ:SOFI) falls right into that category. The fintech reported another strong quarter with robust growth and a solid addition of new members. The investment thesis remains ultra Bullish after the former SPAC continues to thrive despite economic and political headwinds.

Growth Story

SoFi fell to a low below $5 due to the market misunderstanding the company had moved the business far beyond a reliance on refinancing student loans for new members. Student loans hardly account for 10% of loan originations now providing a tailwind when the moratorium is finally lifted.

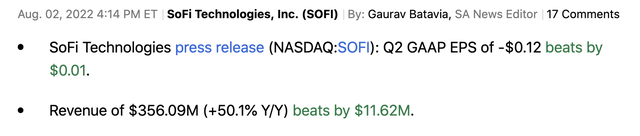

For Q2’22, SoFi reported revenues grew over 50% to reach $356 million. The company beat analyst targets as follows:

So despite a massive reduction in student loan originations by 54% in the quarter to only $399 million, the fintech still beat analyst estimates and grew revenues at a 50% clip. SoFi even felt the crush of the home loan market with those loan originations down 58% to just $332 million.

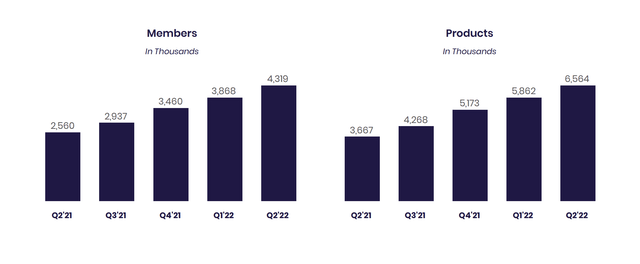

Regardless, the company saw deposits grow 135% sequentially to $2.7 billion leading to funding a 9% growth in loan originations to $3.2 billion. But the story isn’t just about loans, SoFi grew members by 450K in the quarter and most importantly nearly doubled that growth with 702K new product additions in Q2’22.

Source: SoFi Q2’22 press release

The Lending products built the business, but the Financial Services products of SoFi Money and SoFi Invest are building the next leg up for the business. In essence, the land and expand strategy is working perfectly where a member joins to refinance a student or personal loan and eventually expands into several other products offered by the fintech.

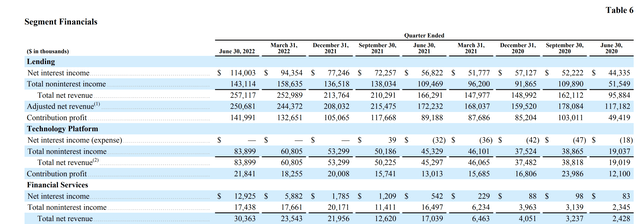

Combined with the promising Technology Platform, SoFi generated $114 million in Technology Platform and Financial Services revenues, up from just $84 million in the prior quarter. The fintech hardly had a Financial Services business back towards the end of 2020 and the Technology Platform ended 2020 with quarterly revenues of just $37 million down from the prior quarter.

Source: SoFi Q2’22 press release

The company is still driven by lending, but going forward segments like Credit Cards will drive growth. Either way, SoFi has built a robust business plan with the flexibility to shift to new products where member demand exists.

Reduced Fears

SoFi reported Q1 revenues that grew 49% and the company previously guided to 2022 revenues of $1.505 to $1.510 billion for growth approaching 50%. Analysts though predicted the fintech would only reach revenues of $1.49 billion for 47% growth due to lingering fears that the student loan moratorium would dampen growth.

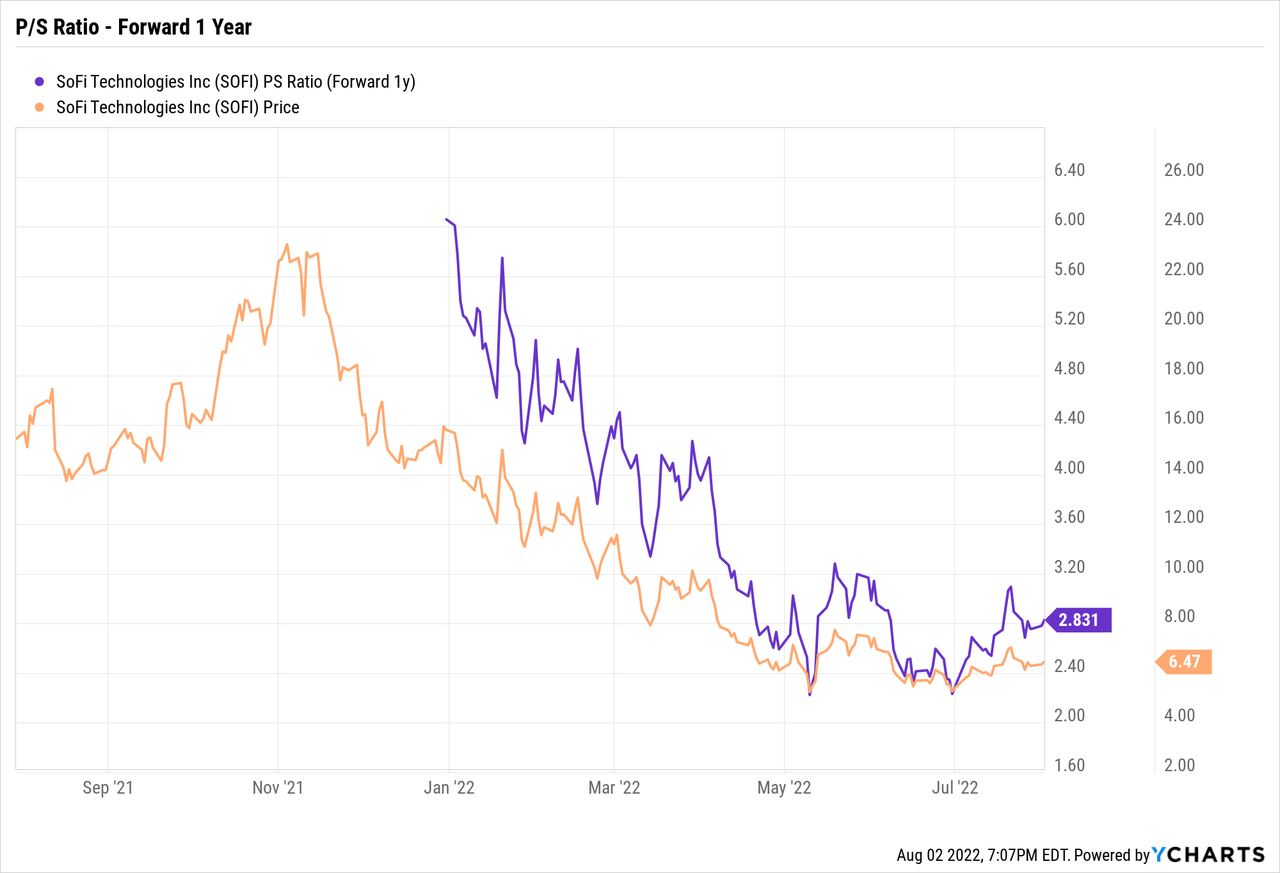

The stock entered the earnings report only trading at 2.8x the 2023 revenue targets. Any company with 50% sales growth would traditionally trade far above 5x sales and sometimes approach 10x sales targets.

As the chart shows, the reduced stock price has only contracted the P/S multiple. SoFi hasn’t seen any reduction in expectations for the business outside of small adjustments for the student loan moratorium unlikely to end until 2023.

SoFi slightly hiked 2022 revenue targets to $1.508 to $1.513 billion. The fintech maintains an expectation that the Biden Administration won’t alter the moratorium allowing student borrowers to avoid payments for the rest of the year.

The company continues to make the plea for the Federal government to approve a $10,000 loan reduction to cover most struggling borrowers while keeping loans in place for borrowers obtaining advanced degrees and having the resources to repay loans. After all, SoFi has student loan borrowers with a weighted average income of $170,000 and a FICO score of 773. These borrowers don’t deserve a federal handout intended to help low income borrowers.

Either way, SoFi has shifted the business to where an end to the moratorium provides a big tailwind to the business while the status quo has no major impact to the current strong growth prospects.

Takeaway

The key investor takeaway is that SoFi remains a huge bargain with the market previously ignoring the strong growth prospects. The fintech trades below 3x 2023 sales targets clearly within reach after another booming quarter. Any financial could definitely face weaker credit results during a recession, but SoFi focuses on lending to high income members with strong credit scores reducing the risk to the business model.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.