[ad_1]

wildpixel

SPY: Two Down Years Are Rare

With the final trading day of 2022 concluded on December 30, we enter 2023 with cautious optimism. The S&P 500 ETF (NYSEARCA:SPY) (SPX) posted a 2022 total return of about -18%, outperforming the tech-heavy Nasdaq’s (QQQ) (NDX) -33% decline, but underperformed the Dow Jones Industrial Average’s (DIA) (DJI) -6.8% downtick.

Therefore, DJI’s more defensive and less tech-exposed weighting helped its investors avoid the hammering seen in the Nasdaq. As such, we have also seen a proliferation of media updates hammering tech stocks and highlighting the perils of a second-year bear market.

Accordingly, Bloomberg emphasized that “two consecutive down years are rare for major equity markets – the S&P 500 index has fallen for two straight years on just four occasions since 1928. However, it also accentuated that “when they do occur, drops in the second year tend to be deeper than in the first.”

Therefore optimists can seek solace with the rarity of a second-year bear market and see the Fed as “nearly done raising rates.” In contrast, pessimists see further damage to the global economy. Notably, they expect the Fed to remain hawkish for an extended period, as Piper Sandler cautioned in a recent note:

We see all rates, and especially short ones, as too low. At the moment, neither the stock market nor corporate debt appears to be pricing in the possibility of prolonged pain – WSJ

Yet, we also have the strategists from Goldman Sachs (GS) straddling between optimism and pessimism, seeing the S&P 500 vacillating “in a range of 3,750 to 4,000.” Based on the SPX’s 2022 close of 3,839, the midpoint of GS’s forecast range implies an uptick of 0.01%.

SPY: Could Its October Lows Withstand A Recession?

Hence, with confusing commentary spanning a wide range and expectations of the FOMC as it moves into data-dependency mode in 2023, we believe investors could be even more confused about what to expect for the SPY.

Optimists could consider the battering in SPY as a “fantastic” opportunity to “buy the dips” as SPY pulled back from its recent December highs.

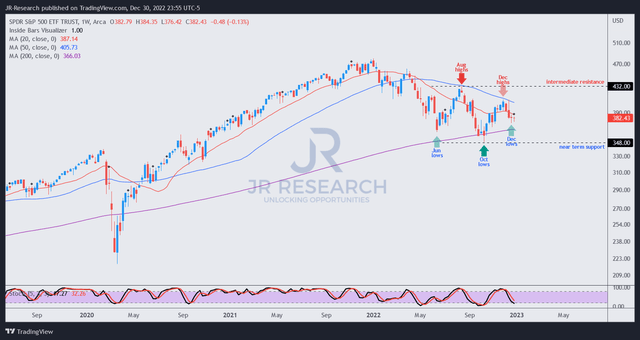

SPY price chart (weekly) (TradingView)

However, buying the dips hasn’t worked since the market staged its first deep pullback in late January, as Russia had yet to invade Ukraine. But, when the index’s recovery failed at its April highs, as sellers formed a bull trap, buying the dips (which worked marvelously from the COVID lows) turned out to be a losing strategy until June.

Therefore, even though analysts’ bottom-up earnings estimates for the SPX were pretty much on-point, macro factors such as the Fed’s hawkish stance and elevated inflation turned out to be the market’s main focus. WSJ highlighted:

The FactSet consensus prediction [for the SPX’s EPS] is for $221 a share this year, exactly as predicted, with the final quarter still based on estimates. The miss of less than $1 is the smallest in percentage terms for estimates at the end of the year since 1995, data from Refinitiv IBES show, while the consensus has on average been out by more than 9% since then. – WSJ

S&P 500: Analysts Don’t Expect A Deep Earnings Recession in 2023

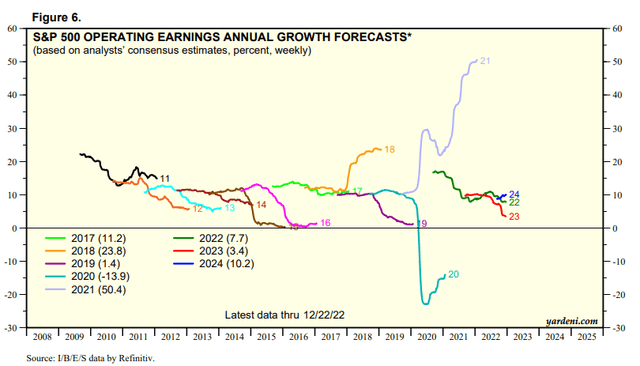

S&P 500 earnings growth estimates % (Yardeni Research, Refinitiv)

Hence, we believe investors want to know what will the market focus on in 2023? With SPY’s total return down nearly 20% YTD, could downgraded 2023 earnings estimates for the SPX help propel a recovery? Accordingly, analysts’ 2023 earnings estimates for the S&P 500 suggest a growth of 3.4% before a recovery of 10.2% for 2024.

Hence, analysts remain upbeat about companies’ ability to dodge a marked earnings recession.

But would the Fed play ball in 2023 to corroborate our thesis of a market bottom at its October lows, despite the recent pullback?

Our analysis indicates that SPX’s NTM P/E of 16.7x is pretty well-balanced, slightly below its 10Y average of about 17.7x. Hence, given the downgraded estimates, SPX’s October lows (implying an NTM P/E of 15.2x) seem reasonable if we could dodge a considerable earnings recession.

So The Critical Question Is Whether The Market Anticipates A Severe Recession

So, the question is whether the market concurs with our thesis of no severe recession, even though Tesla (TSLA) CEO Elon Musk warned investors to expect one in 2023 before green shoots of recovery could appear in 2024.

The market needs to retake its December highs before a potential re-test of the 4,300 levels (SPX’s August highs), which we expect to see robust resistance.

Accordingly, SPY seems to be consolidating constructively above its October lows, suggesting that a higher-low price structure could be forming. Hence, the price action favors our thesis so far, as SPY also moved into medium-term oversold zones.

Takeaway

As such, we believe investors who missed SPY’s October lows and looking to add to the pullbacks could consider the current levels appropriate.

But, if October lows were to be decisively breached (i.e., not a bear trap), then the market could likely be setting up shop for a deeper recession than anticipated.

Stay safe, and Happy New Year, everyone!

Rating: Buy (Revise from Hold)

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.