[ad_1]

MCCAIG

Investment Thesis

Sociedad Química y Minera de Chile (NYSE:SQM) has reported sizzling revenues, exactly as I said it would. In fact, I’ll openly state that SQM’s results were actually better than I expected.

And how have its shares reacted? They are down since the results came out.

So, what’s troubling investors? One word, China.

As we go through the positives and negatives facing this investment, keep one thing in your mind, this stock is priced at approximately 6x this year’s free cash flows.

Flows Before Fundamentals?

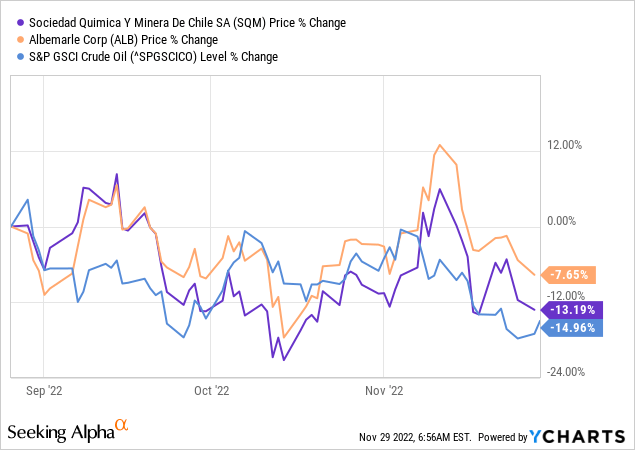

The commodity trade has been very volatile in the past three months. In the graph that follows I highlight SQM against a peer, as well as, against crude oil. Crude oil? You may ask, what’s crude oil got to do with lithium?

Before I answer that question, let’s get some context.

Recall, 76% of SQM’s gross profits come from its lithium business. So, what happens in the lithium market has an overarching impact on the rest of the business. Put another way, any discussion over SQM’s Iodine or Specialty Plants Nutrition (”SPN”) is a distraction, in my opinion.

Now, oil prices should have minimal correlation with SQM’s prospects. In fact, in some way, high oil prices should dampen lithium margins, since you need a lot of energy to make one lithium EV battery.

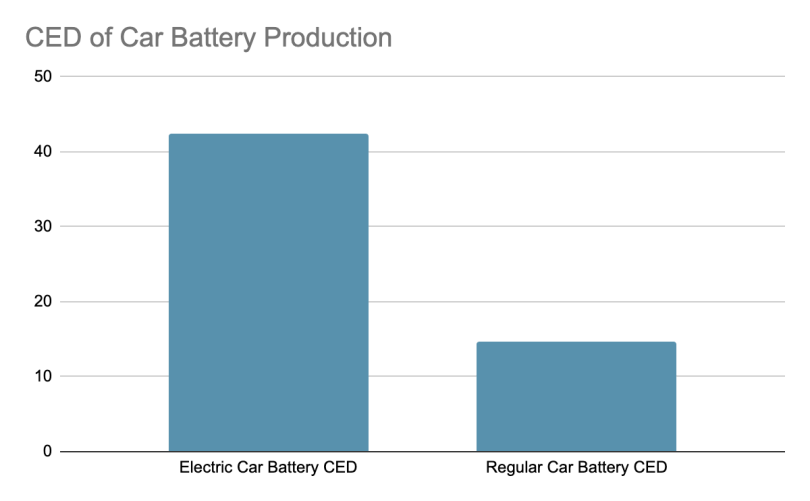

Cumulative energy demand (CED)

What you see above is that one EV battery requires about 3x the cumulative energy of a regular car battery.

So, this would assume that in some way, oil, which is used in lithium mining, should trade indirectly with SQM’s future prospects. And yet, here we are.

Instead, what I believe we are seeing is the effect of financial capital flows. Flows before fundamentals.

Revenue Growth Rates Incredibly Strong

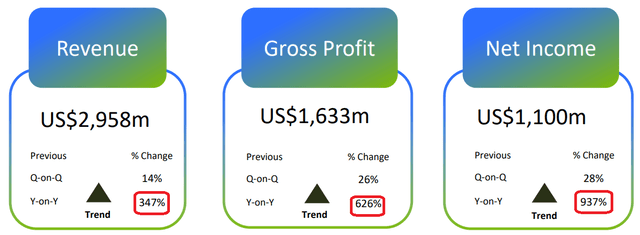

SQM Q3 2022

In the graphic above I’ve highlighted the y/y comparisons. Simply put, not only are SQM’s revenue growth rates incredibly strong, but those excess revenues are percolating through its income statement, and making its bottom line net income jump 10x.

Thus, on the back of these results, why is SQM’s share price not only moving up or just sideways, but in fact falling in the past several days post-Q3 results?

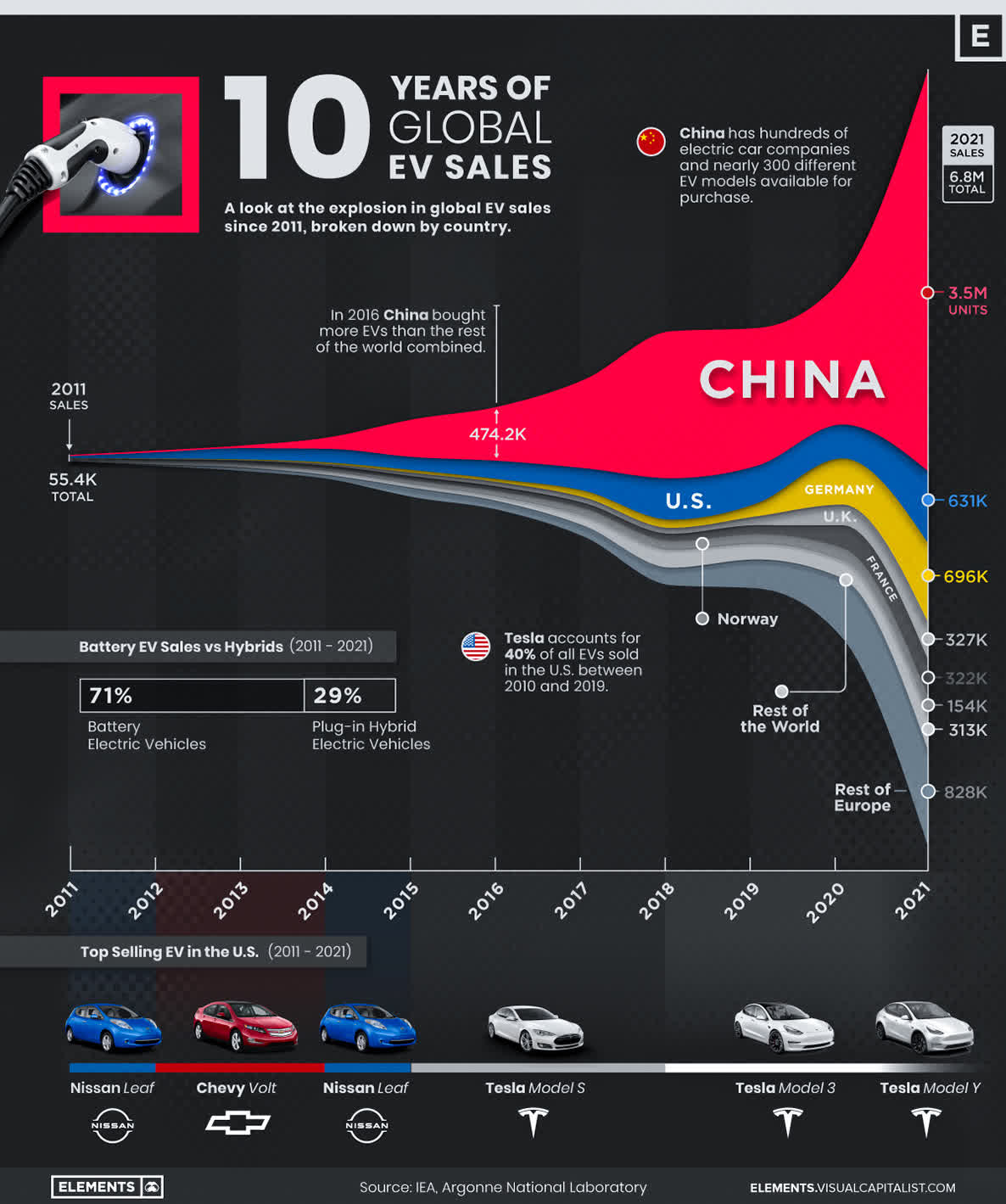

Simply put, investors are struggling to quantify what’s a reasonable growth rate for 2023. More specifically, we know that the demand for EVs is mostly coming from China. And China has a problem.

Visual Capitalist

Perhaps better said, China has two problems. In the first instance, its economy is struggling at present. And secondly, with substantial parts of the country in lockdown, it’s going to dampen demand for EVs.

Separately, there are also concerns about China reducing some of its subsidies toward EVs. However, I don’t know if that’s going to be enough to break the demand for EVs.

But all together, investors have no doubt that 2022 was a heroic year for lithium prices. Now looking ahead, investors have come to expect materially more muted growth rates.

SQM Stock Valuation — 6x Free Cash Flow

I know that inflation together with rising costs means that in 2023, SQM’s free cash flow margins have significant heads. Meaning that unless revenues increase by at least 15% to 20%, that would mean free cash flows in 2023 will not be as attractive as in 2022.

Meanwhile, for this year, according to my estimates, 2022 SQM’s EBITDA will be around $5.5 billion. And I estimate that SQM will have approximately $1 billion of capex requirements. That means that the business will make approximately $4.5 billion in free cash flow in 2022.

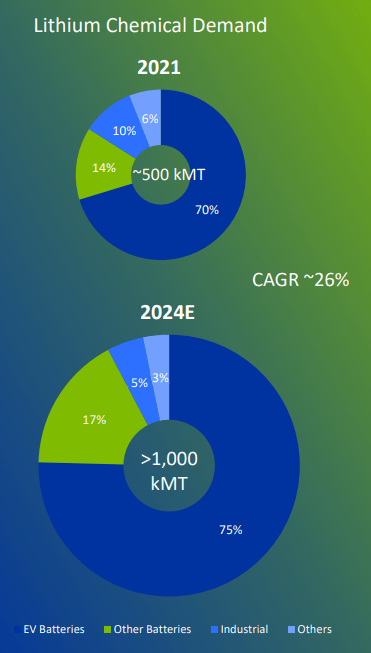

This puts SQM priced at approximately 6x this year’s free cash flow. So we know that lithium demand is clearly positive, see below.

SQM Q3 2022

Overall lithium demand is expected to grow by approximately 26% CAGR until 2026. But what about prices? Realistically, I have no idea where lithium prices will go next year.

Nevertheless, we should form some assumptions. Thus, as we look ahead to next year, I maintain that we should expect to see lithium prices remain robust. That doesn’t necessarily mean another year of growth in lithium pricing. But rather a year of healthy and stable pricing. Again, that’s not the same as 2022.

The Bottom Line

SQM is well-positioned to participate in the strong lithium market. Also, its stock is cheaply priced at 6x this year’s free cash flows.

That being said, there are two negative considerations that are weighing on the stock. In the first instance, this is a Chilean company. How much risk is that? I don’t know. I just recognize that right now, what’s perceived to be a ”foreign” investment gets a large discount compared to US-based companies.

In the second instance, the bulk of SQM’s prospects are directly tied to China’s EV market. And with that country in economic turmoil, I believe that’s yet another consideration weighing down expectations.

All that being said, I believe that paying approximately 6x this year’s free cash flows for what may be one of the most valuable commodities of the next several years is probably cheap enough.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.