[ad_1]

bunhill

Starwood: Well-Diversified Portfolio Mitigated The Fed’s Rate Hikes

Starwood Property Trust, Inc. (NYSE:STWD) is a diversified real estate investment trust (REIT) with exposure in the US, Europe, and Australia. Its business model is mainly driven by its Commercial and Residential Lending segment, which accounted for about 94% of its Q3 distributable earnings.

It also has an Infrastructure Lending segment, which invested about $183M in energy infrastructure projects in Q3. The company’s Hotel business is well-positioned to ride the continued travel recovery. However, the Fed’s rate hike rampage has impacted the company’s investing segment. Accordingly, management highlighted that the current macro climate is not conducive, given the high funding costs and relatively low returns, as Starwood President Jeffrey DiModica highlighted:

We will time those things when it makes sense. I don’t think that as I look at the equity opportunities today, where cap rates are and where borrowing rates are for us. If we were to be a buyer, that we could get cash returns anywhere near 10% on any core asset. The reality is, in a lot of cases, you’ll have negative leverage. And buying new core real estate is going to have very low cash yields today. (Starwood FQ3’22 earnings call)

Despite that, Starwood’s diversification has also helped the REIT overcome the impact of the Fed’s rate hikes which have affected its investment cadence. With a Commercial Lending portfolio primarily based on a floating rate (99%) and senior-secured, it also boasts ample liquidity of $1.3B.

As such, we believe STWD remains well-positioned to benefit as the Fed tapers its hiking cadence, which has impacted the growth in its distributable EPS.

Accordingly, Starwood posted a distributable EPS of $0.51 in FQ3, registering a -2% YoY growth. Notably, it decreased from Q2’s 0% growth and substantially from Q1’s 52% increase.

But Macro Headwinds Could Still Impact Starwood’s EPS Growth In 2023

However, Starwood is projected to post a 54.4% decline in its distributable EPS for FQ4’22, which we believe has likely been contemplated in its October lows.

Hence, we are also surprised that the market has de-rated STWD from its December highs, as bears returned in a hurry to press down its recovery momentum.

So what happened? We believe the market is likely pricing in the impact of worsening macro headwinds against Starwood’s forward earnings, given the Fed’s hawkish stance through 2023. Also, the mitigation from the uplift on its floating rates tailwind is expected to reduce as the Fed slows down its rate hikes. However, if the Fed keeps its Fed fund rates (FFR) at its current median estimate of 5.1% through 2023, it could further impact Starwood’s Commercial segment, particularly in its Office vertical.

Starwood CEO Barry Sternlicht has also made clear what he thought of the Fed Chair Jerome Powell and his FOMC’s decision to hike rates at a record pace:

I think the gap in spreads is a function of the pace and uncertainty of what the Fed has been doing. And again, I think the Fed is making a really bad mistake. On the other hand, it has its positives which the crash will be very quick and very evident to them over the next 6 months. So I think he’s lost his mind, Powell, and I don’t understand what they’re doing. (Starwood earnings)

With this in mind, investors need to assess whether the pessimism over Starwood’s distributable EPS has been priced in? While the pullback from its December highs could have surprised some investors, we believe its October lows would hold robustly.

STWD: Valuation De-risked

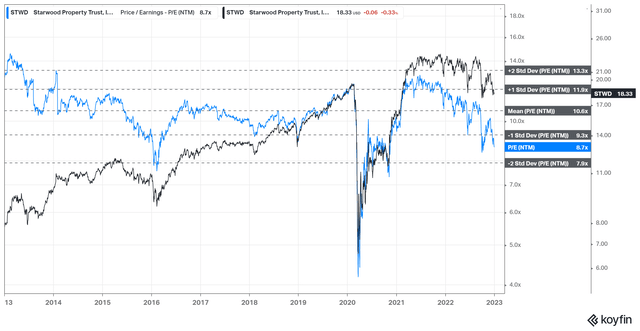

STWD NTM Distributable P/E valuation trend (Koyfin)

Also, STWD’s valuation has been battered significantly. Its NTM Distributable EPS of 8.7x has moved below the one standard deviation zone under its 10Y average.

Moreover, its NTM dividend yield of 10.5% is way above its 10Y average of 8.75%.

Takeaway

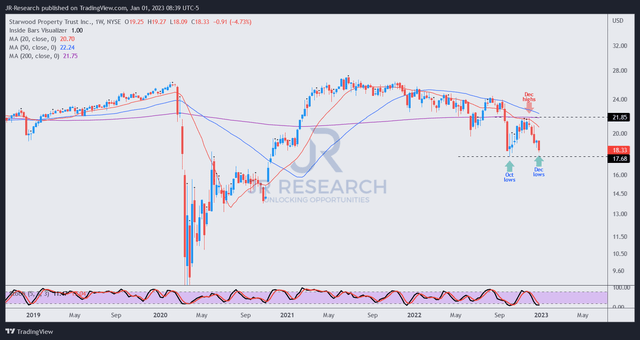

STWD price chart (weekly) (TradingView)

As seen above, STWD has pulled back closer to its October lows, likely freaking some investors who bought its panic selloff in October.

We assessed market operators could be shaking out some weak hands while also pricing in a worse FY23 for Starwood as it attempts to manage macroeconomic headwinds.

Therefore, more conservative investors could consider waiting for a potential re-test of its October lows or a constructive consolidation phase before adding more positions.

As usual, given the bearish bias, averaging in progressively is encouraged.

Rating: Buy

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.