[ad_1]

sefa ozel

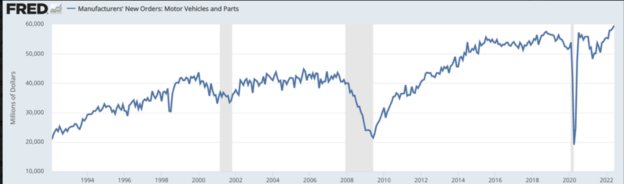

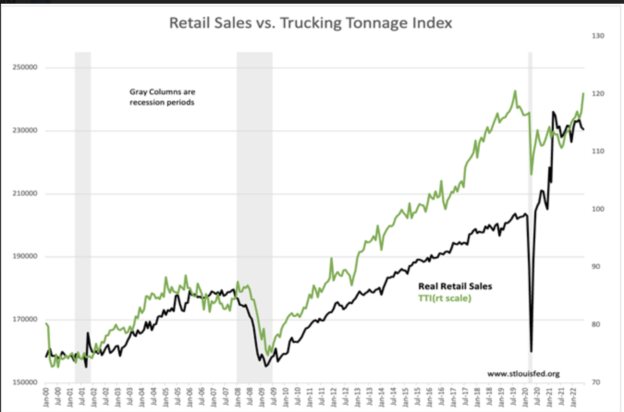

Transport issues report surprisingly strong quarters with raised guidance. FedEx (FDX), XPO Logistics (XPO), GXO Logistics (GXO) and Knight-Swift Transportation Holdings (KNX) are current suggestions. Manufacturing New Orders for Motor Vehicles/Parts has ticked to all-time highs. The Trucking Tonnage Index (TTI) is in an uptrend. Vehicles and parts remain in high demand. Allied Motion Technologies (AMOT), Cooper-Standard Holdings (CPS), Camping World Holdings (CWH), Thor Industries (THO) and LCI Industries (LCII), which are related to consumer demand, remain current suggestions.

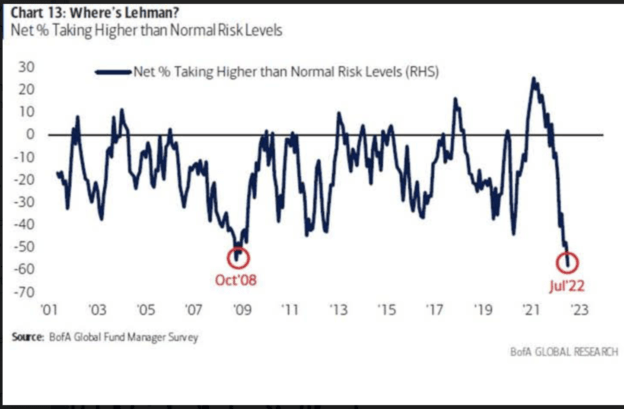

Signs are present that professional investors have hedged more than any time in past cycles. It is worth repeating the cash versus equity allocation is at levels higher than 2008. When one adds all these pieces together, the over-the-top recession fear baked into prices is about as overdone as carbonized toast.

Net % Taking Higher Than Normal Risk Levels

Source: Blooomberg

Manufacturers’ New Orders: Motor Vehicles And Parts (St. Louis Fed) Retail Sales Vs. Trucking Tonnage Index (St. Louis Fed)

When this sentiment turns, it is likely to be a quick turn, with equities rising sharply. Adding to existing positions is recommended.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.