[ad_1]

Sula Vineyards IPO Review: India’s most popular wine brand Sula is coming up with its Initial Public Offering. The IPO of Sula Vineyards Limited will open for subscription on December 12th, 2022, and close on December 14th, 2022. It is looking to raise Rs 960.35 Crores, the whole of which will be an offer for sale.

In this article, we will look at the Sula Vineyards IPO Review 2022 and analyze its strengths and weaknesses. Keep reading to find out!

Sula Vineyards IPO Review – About The Company

Sula Vineyards Limited stands as India’s largest wine producer and seller as of March 31, 2021. The company is a market leader in the Indian wine industry in terms of sales volume and value and holds around 52.6% share as of Fiscal 2021.

The company is not only a leader across its variants that ranged from red, white and sparkling wines but also across segments such as ‘Elite’ (INR 950+), ‘Premium’ (INR 700-950), ‘Economy’ (INR 400-700) and ‘Popular’ (<INR 400).

The company owns the flagship brand “Sula,” along with other popular brands that include “RASA,” “Dindori”, “The source,” “Satori”, “Madera” and “Dia”.

The wine company has a presence in n 25 states and six union territories in India and n over 20 countries, including Spain, France, Japan, the United Kingdom, and the United States.

Business verticals of the company

Wine Business: Production of wine, the import of wines and spirits, and the distribution of wines and spirits.

Wine Tourism Business: The sale of services from ownership and operation of wine tourism venues, including vineyard resorts and tasting rooms.

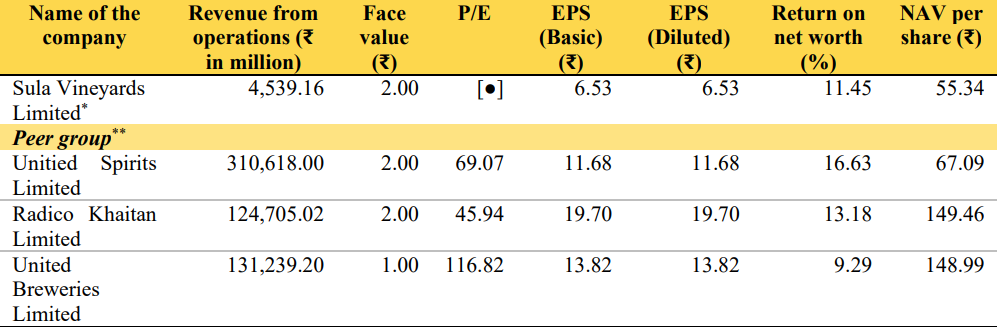

competitors of the company

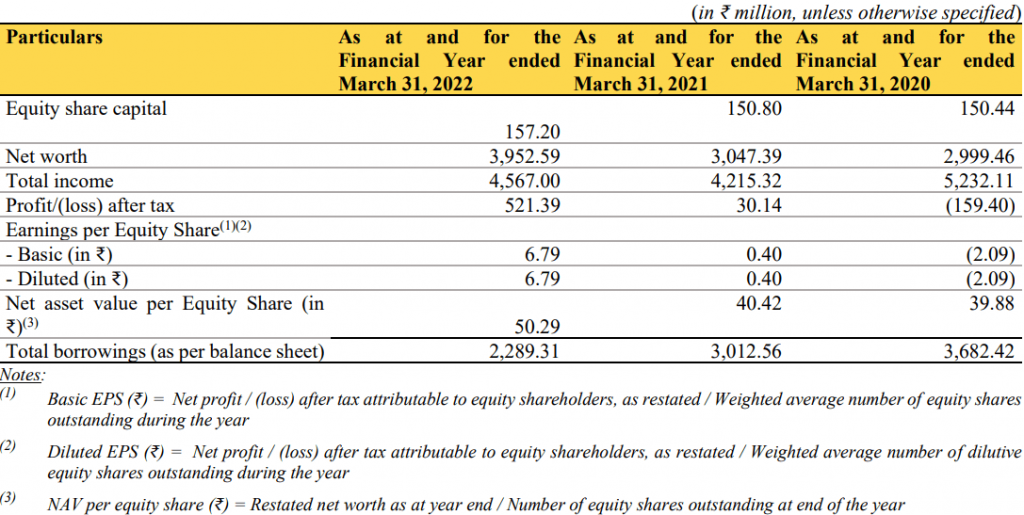

Sula Vineyards IPO Review – Financial Highlights

Sula Vineyards IPO Review – Industry Overview

India is one of the fastest-growing alcoholic beverage markets in the world, growing from a small base of 1.3 liters per capita of recorded consumption in 2005 to 2.7 liters in 2010.

However, India’s per capita consumption of wine is less than 100 ml. The contribution of wine to overall alcohol consumption in India is less than 1% against the world average of close to 13%.

Despite this, the Indian wine industry is growing at a much quicker pace at 18.3% by value between FY 2014 to FY 2019. Further, it is projected to grow to 3.4 million cases, from the current 2 million cases, by FY 2025 with a CAGR of more than 14% in volume.

Indian alco-beverage market is the third largest market in the world after China and the USA by volume in terms of the actual alcohol content of alco-beverages in CY 2020. It is further projected to grow at 11% per annum in value terms for the period between 2021 to 2025.

Strengths

- The wine market in India will remain concentrated and thus have high barriers to entry.

- The company is an established market leader in the Indian wine industry with the leading brand “Sula”.

- It is the largest wine producer in India with the widest and most innovative product offering.

- The company has the largest wine distribution network and sales presence in the country.

- The company is a pioneer of wine tourism in India, which has led to a strong D2C presence.

Weaknesses

- The legal, regulatory, and policy environment in which they operate is evolving and subject to change.

- The company stands to benefit largely from the current high import duties on international wines. Any changes in the rates will affect the business.

- The products of the company are highly reliable in the taste and preference of the company. Any changes in the trends will negatively impact their business.

- The wine industry in India is seasonal. In addition to that, the wine tourism business is also cyclical in nature and thus can result in fluctuations in cash flow for the company.

- The company is subject to various risks such as technological risks and foreign exchange risks.

Sula Vineyards IPO Review – GMP

The shares of Sula Vineyards Limited traded at a premium of 9.52% in the grey market on December 8th, 2022. The shares tarded at Rs 391. This gives it a premium of Rs 34 per share over the cap price of Rs 357.

Sula Vineyards IPO Review – Key IPO Information

Promoters: Rajeev Samant

Book Running Lead Managers: CLSA India Private Limited, IIFL Securities Limited, and Kotak Mahindra Capital Company Limited.

Registrar To The Offer: KFin Technologies Limited

| Particulars | Details |

|---|---|

| IPO Size | ₹960.35 Crore |

| Fresh Issue | – |

| Offer for Sale (OFS) | ₹960.35 Crore |

| Opening date | December 12, 2022 |

| Closing date | December 14, 2022 |

| Face Value | ₹2 per share |

| Price Band | ₹340 to ₹357 per share |

| Lot Size | 42 Shares |

| Minimum Lot Size | 1 (42 Shares) |

| Maximum Lot Size | 13 (546 Shares) |

| Listing Date | December 22, 2022 |

The Objective of the Issue

The Net Proceeds from the Fresh Issue are proposed to be utilized:

- To carry out the Offer for Sale of up to 25,546,186 Equity Shares by the Selling Shareholders.

- To achieve the benefits of listing the Equity Shares on the Stock Exchanges.

In Closing

In this article, we looked at the details of Sula Vineyards IPO Review 2022. Analysts remain divided on the IPO and its potential gains. This is a good opportunity for investors to look into the company and analyze its strengths and weaknesses. That’s it for this post.

Are you applying for the IPO? Let us know in the comments below.

You can now get the latest updates in the stock market on Trade Brains News and you can also use our Trade Brains Screener to find the best stocks.

Start Your Financial Learning Journey

Want to learn Stock Market and other Financial Products? Make sure to check out, FinGrad, the learning initiative by Trade Brains. Click here to Register today to Start your 3-Day FREE Trail. And do not miss out on the Introductory Offer!!

[ad_2]

Image and article originally from tradebrains.in. Read the original article here.