[ad_1]

Sitthipong Pengjan

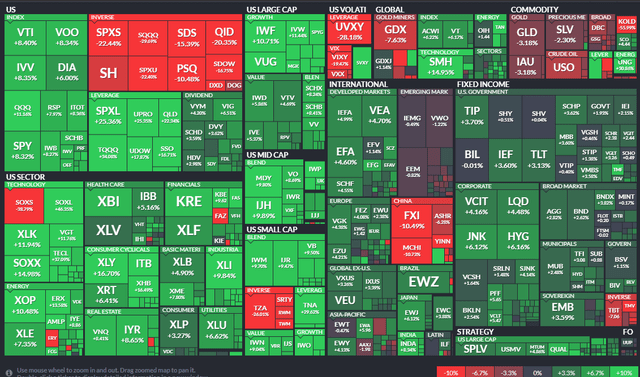

The Consumer Discretionary sector (XLY) has led the market higher over the last month (ETF performance heat map below). Retail stocks have generally seen a bounce, but some uncertainty lies ahead with the pivotal back-to-school shopping season underway. The back-to-school period is actually the second-biggest shopping time of the year (the December holidays are number one). Meanwhile, China is always a question mark. There’s one luxury goods firm at the heart of it all: Tapestry (NYSE:TPR).

One-Month ETF Performance Heat Map: Discretionary Strong, China Weak

According to Bank of America Global Research, Tapestry is a leading specialty retailer positioned in an appealing segment of the market (affordable luxury). Tapestry is comprised of the Coach, Kate Spade, and Stuart Weitzman brands and is best known for accessories (especially handbags). Its products are primarily sold through retail stores, outlet stores, and online. The brands have a strong presence in select department stores and specialty retailer locations.

The $8.5 billion market cap Consumer Discretionary stock is sensitive to both the domestic consumer and macro issues in China. Not surprisingly, TPR is down 17% from a year ago but bottomed with many China-sensitive stocks much earlier than the broad U.S. stock market and Consumer Discretionary sector in 2022.

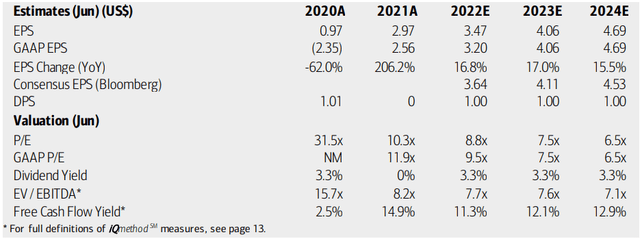

On valuation, Tapestry trades at a scant 10.9 times last year’s GAAP earnings, according to The Wall Street Journal. TPR sports a solid yield for a small retailer: 3.0%. A potential bullish feature ahead of its earnings date in mid-August is an elevated 9.9% short interest. BofA analysts see the retailer’s earnings per share growing nicely through 2024 at an above-market rate. Given a low earnings multiple and impressive growth rate, shares look cheap. Its EV/EBITDA is reasonable, and the company has a high free cash flow yield.

TPR: Earnings, Valuation, Dividend Forecasts

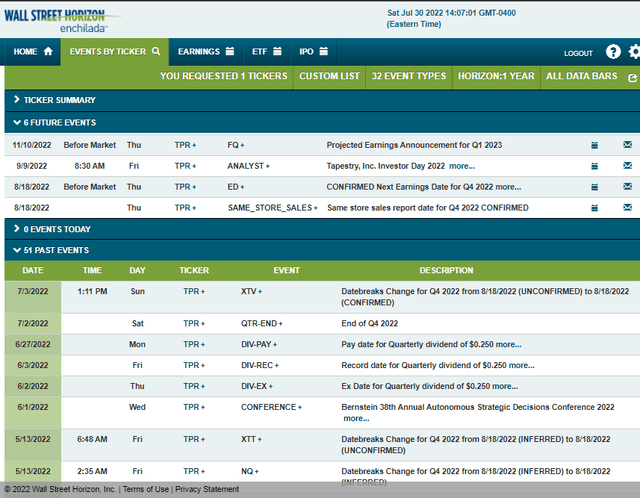

Tapestry, like many retailers, reports earnings the week of August 15. The NY-based firm’s August 18 4Q report crosses the wires before the opening bell that morning. The corporate event calendar does not stop there, however. According to Wall Street Horizon, Tapestry has an Investor Day on Friday, September 9. Investors should expect some volatility around that date as key insights may be gleaned from TPR’s management team.

Tapestry Calendar: Earnings Aug 18, Investor Day Sept 9

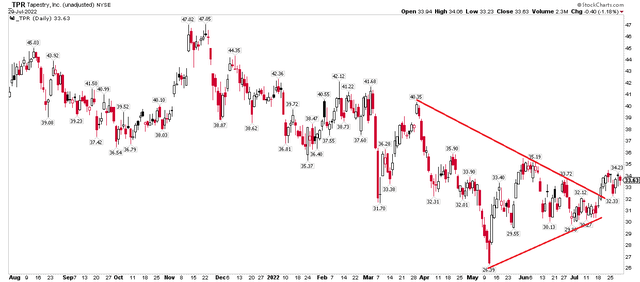

The Technical Take

TPR had coiled in what’s sometimes known as a bullish bottom triangle formation. A price target on such a pattern is found by taking the vertical length from the start of the triangle and adding that on top of the breakout point. In this case, that is $11 plus about $32. That yields a target of $43. Interestingly, the $42 to $43 range was resistance earlier this year, so that’s a natural spot where shares could be headed so long as $32 holds. If $32 fails, look for next support at $26 – the May low.

TPR: Bullish Breakout, $43 Price Target

The Bottom Line

I like what I see with TPR. Shares are cheap and there’s a solid growth outlook. The stock also broke out from a triangle consolidation pattern. I think the stock goes to $43 before taking a pause. Be mindful of the bearish scenario – if TPR breaks down through $32.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.