[ad_1]

JHVEPhoto/iStock Editorial via Getty Images

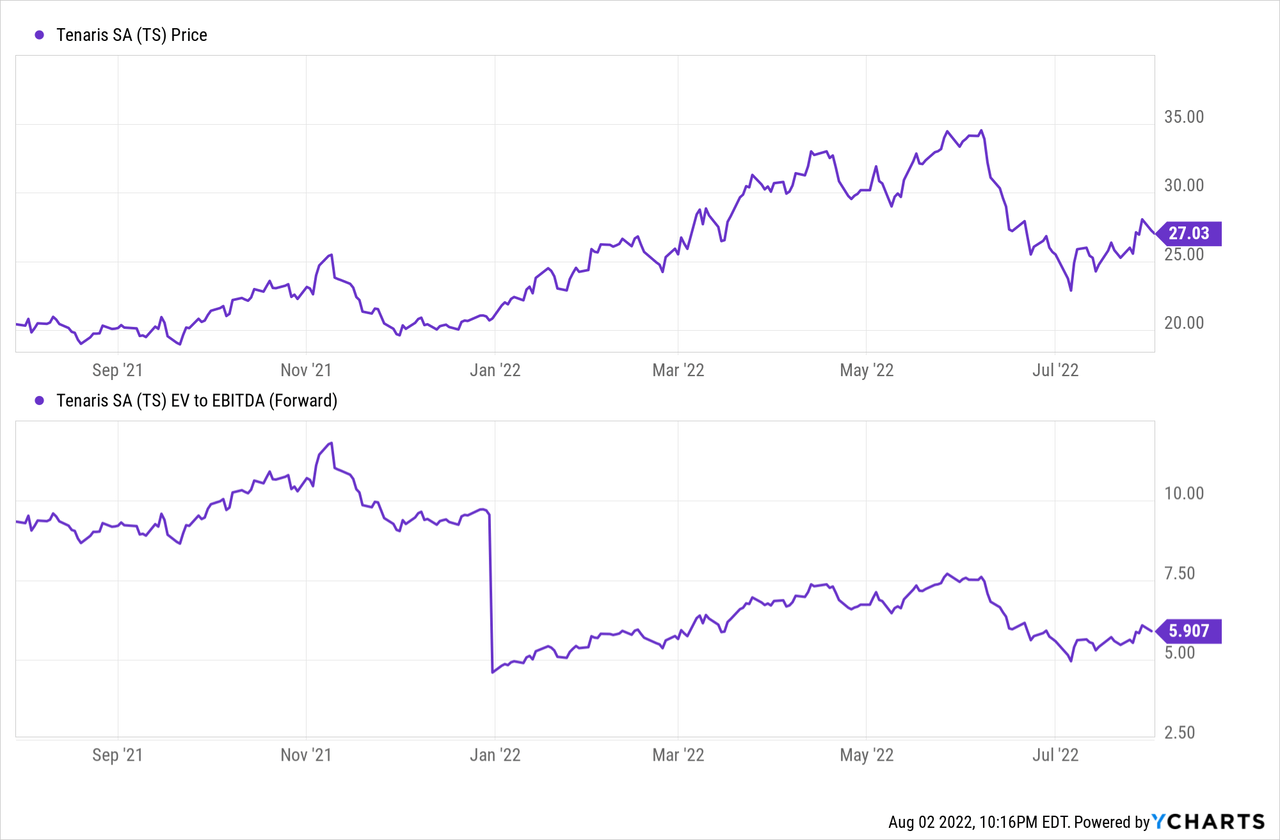

Tenaris SA (NYSE:TS), a leading supplier of oil country tubular goods (OCTG) and related services for the energy industry, recently entered into an agreement to acquire US seamless steel pipe producer Benteler Steel & Tube Manufacturing Corporation for a $460m price tag. As the consideration includes ~$52m of working capital, the net consideration is closer to ~$408m on a cash-free, debt-free basis (or ~2.5% of the current TS equity value). While this acquisition won’t be a needle mover by itself, it solidifies TS’ presence in the US, the world’s largest OCTG market, at an attractive EV/EBITDA valuation. With TS’ cash generation also enhanced post-acquisition, there is room for more accretive acquisitions ahead, depending on how long the industry backdrop can stay favorable. The current ~6x EBITDA multiple screens reasonably relative to the growth outlook as well and thus, I see ample room for the stock to re-rate higher going forward.

Acquiring Benteler Steel & Manufacturing Corporation for $460m

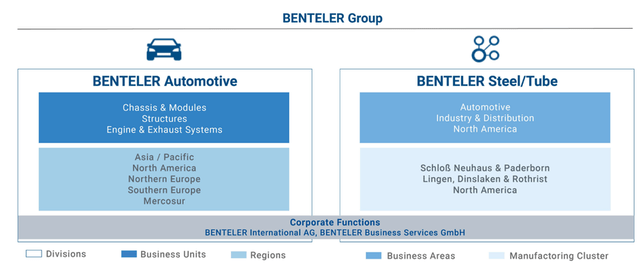

Tenaris’ 100% acquisition of the shares of Benteler Steel & Manufacturing Corporation from Benteler came as a positive surprise – in aggregate, TS will pay ~$460m on a cash-free/debt-free basis, but excluding the ~$52m of working capital included in the consideration implies a ~$408m net payout. For context, Benteler Steel & Manufacturing Corporation is a seamless steel pipe producer with an annual pipe rolling capacity of up to 400kt at its state-of-the-art facility in Shreveport, Louisiana. As the second phase of the Shreveport plant (including the electric arc furnace (EAF) was never built, it is a processing plant only (i.e., rolling and finishing lines). Still, the capacity stacks up nicely to TS’ existing ~1m capacity in the US (and ~4m globally) for seamless pipes. The deal needs to clear several regulatory approvals (mainly antitrust), and if all goes as planned, it should close in Q4 2022.

Strategically Extending its Lead in the US Seamless Market

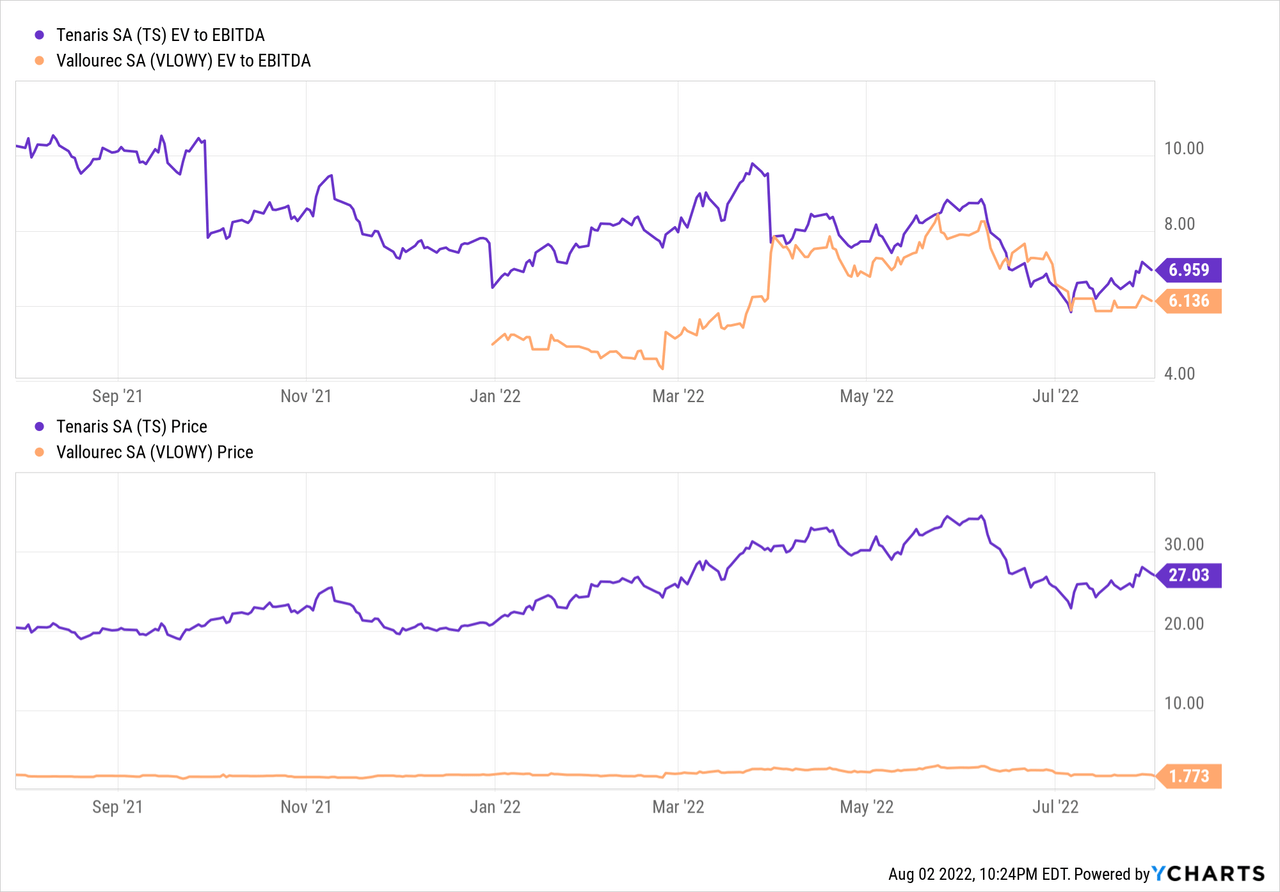

Tenaris has already held a big lead in the US seamless tube market, with ~1mt of capacity in the US, in addition to imports from Mexico (~1.2mt capacity from the Tamsa plant), Argentina (~900kt capacity from Siderca), and Canada (~300kt capacity from Algoma). Post-acquisition, the company would have a total of ~1.4mt of US capacity on the seamless side, as well as ~2.5mt of welded tube capacity, making it the clear market leader. By comparison, the #2 player, Vallourec (OTCPK:VLOUF), only has ~750kt of US seamless tube capacity – effectively half the size of Tenaris. Given Benteler is only at ~50% capacity today, a further ramp-up of its capacity to 100% would entail incremental gains from here – a major advantage at a time when supply remains tight, leading to high market prices.

On the other hand, this deal could stress the balance sheet – not only will Tenaris need to up its capex spending, but it also adds cyclicality to the company’s underlying cash flows. Of note, Benteler’s Shreveport plant only includes hot rolling tube assets and finishing lines but lacks an EAF to make it a fully integrated plant (as planned in phase 2). Thus, Tenaris will likely source pre-material supply (i.e., billets) from its Mexican plant in the near-term before investing in the installation of an EAF to reap the long-term benefits, implying a significant capex outlay ahead.

An Attractive Implied EV/EBITDA Valuation

Assuming the average selling price of >$2.6k/t on the spot seamless market holds, Tenaris could see its acquired revenue reach >$580m based on a ~220k/t production per year (<60% of the nameplate capacity). With EBITDA margins also running at ~30%, the asset could be capable of generating EBITDA of >$170m/year based on these assumptions. Thus, the deal would imply a very reasonable EV/EBITDA multiple of ~3x – well below where Tenaris and Vallourec stock currently trade.

The balance sheet implication is less favorable, though, as Tenaris’ ~$800m of FCF generation this year will likely be offset by working capital movements and the ~$460m outlay for the Benteler acquisition. If we also account for the dividend payout, the company’s net cash position could well zero out towards the end of the year. That said, Tenaris’ new contract in Brazil to supply Petrobras (PBR) with casings for its Buzios pre-salt project could alleviate some of the near-term pressure. For context, this is a four-year contract that will establish a total volume of >100k tons of premium seamless and welded casing, so the incremental revenue should be a net positive for the cash position.

Solidifying its Industry Leadership with Benteler Acquisition

Net, TS gains massively from the addition of Benteler to its business – the acquisition not only reinforces its position as the clear leader in the US seamless market but also looks set to turn highly accretive given the attractive EBITDA multiple. With TS increasingly building its revenue/profit exposure to the Americas markets while still benefiting from a less negative environment in EMEA, expect positive earnings revisions throughout the year as well. Coupled with its strong cash generation and well-covered dividend, Tenaris’s fundamentals screen favorably in a challenging market. The stock trades at an undemanding ~6x EBITDA as well, leaving ample room for upside as the company continues to execute amid favorable US OCTG industry dynamics.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.