[ad_1]

jetcityimage

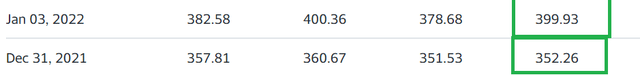

Unless you totally swore off the Internet to begin your new year, you are likely aware that Tesla, Inc. (NASDAQ:TSLA) reported its Q4 delivery numbers. On the bright side, the company crossed the 400,000 mark for the first time, achieving a 31% YoY growth. However, the stock is down more than 5% pre-market as of this writing. What’s the problem, you may ask? Analyst estimates were for a 35% growth, and based on that, Tesla “missed” by about 15,000, as reported by Seeking Alpha here.

All About Expectations

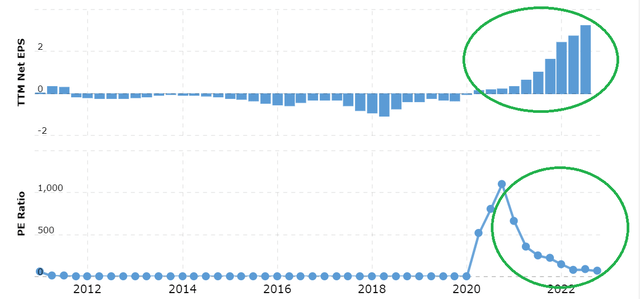

As a kid, did you ever feel that you excelled at something but only received a customary pat on the back while your friend was showered with accolades for a lesser accomplishment? It is also about expectations and baselines. Something that Tesla investors like myself are beginning to acknowledge, even though most of us knew the day was coming. In a recent article, I highlighted multiple compression as one of my biggest worries. And that is exactly what is happening here as the market is punishing “good” numbers as the expectations are/were still for “great” number. It is worth highlighting the chart below again, as we can see the rise in EPS coinciding with the fall in P/E multiple. What if this continues? How do we evaluate the stock?

TSLA Compression (Macrotrends.net)

Intrinsic Value – Not Rosy

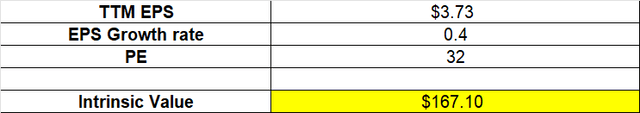

Of all the methods available to calculate the intrinsic value of a stock, I prefer using the financial metric approach, as it involves only one assumption: the expected growth rate, while the other models like discounted cash flow analysis need more variables.

Using my preferred method, Intrinsic value = Earnings per share (EPS) x (1 + r) x P/E ratio, where r is the expected earnings growth rate. Plugging in Tesla’s current EPS and P/E and expected growth rate, we arrive at an intrinsic value of $167, which represents a 39% upside. Given the terrible run the stock has been in, any upside looks appealing here, but this is not much to shout about, objectively speaking, especially if looking at a 5-year period.

TSLA Intrinsic – As Is (Author)

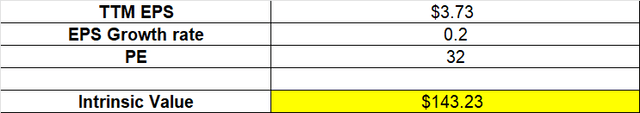

Now, here is where things get worse. The above assumption is based on a 40% growth rate, which is not a guarantee given the increasing competition. If we change the growth rate assumption to 20%/yr, the margin of safety keeps going down.

TSLA Intrinsic Value 20% (Author)

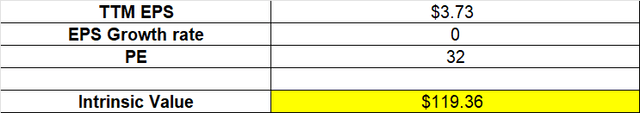

Obviously, using a 0% growth rate, we arrive at the current share price, as the only factors left in this case are the stock’s current P/E and current TTM EPS. If this (no growth) were to happen, the multiple compression will be heavier. If EPS stagnates, a multiple of 20 represents a stock value of about $75. Ouch.

TSLA Intrinsic Value – 0% (Author )

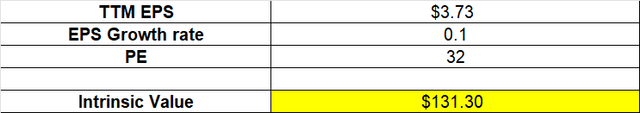

Granted, EPS may not stagnate right here, right now, but as an example of how fast things are scaling to the downside, at the time of the article I linked above, Tesla’s EPS estimate was $4.31. It is at $4.12 as of this writing, a 5% fall in about 2 months. It may not seem like much, but $4.12 represents just a 10% growth from the current $3.73. If we plug in this 10% growth rate, Tesla’s intrinsic value is $131.30, a price we saw just about a week ago. In short, Tesla’s stock is all at the mercy of the market’s (generous) multiple allocation at this point. It was priced in for such perfection (and beyond) that even record deliveries won’t cut it anymore. And let’s not fool ourselves and look beyond auto deliveries yet, as at least 90% of Tesla’s revenue still comes from automotive sales. At a time when the leader in chief is distracted to the extent of there being calls for his ouster, looking at anything beyond the bread and butter for our calculations is too risky in my opinion.

The law of large numbers has caught up fair and square, in the form of multiple compression. So, why am I still holding Tesla stock? Read the conclusion.

TSLA Intrinsic – Current at 10% (Author)

Conclusion

As a Tesla long, if you feel like the first trading day of 2023 is acting like the 366th day of 2022, you may be excused. But Mr. Market has a weird sense of humor and surprises us when we least expect. The first trading day of 2022 saw Tesla jump up more than 13%, as shown below. Little did we know then that the stock would close the year down more than 70% in a free fall with almost no resistance.

With the first trading day of 2023 looking like a -5% day, will the stock surprise us to the upside for the rest of the year? As someone who uses psychology and contrarian indicators, I’ve observed (and traded accordingly) many times that both good and bad news shoot to the extreme. I expect multiple compression to drag Tesla’s multiples into the high teens at some point in 2023. That would represent a price to earnings/growth (“PEG”) multiple of about 0.50, which borders into extreme value territory, a place where I’d be comfortable to average down heavily. If and when that valuation is reached, any accompanying positive news is likely to help the stock recover some of its 2022 losses. What sort of positive news, you may ask? Well, it’s the first trading day of the year, so why not dream a little? Elon Musk calling an end to his Twitter lunacy will be a start.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.