[ad_1]

byakkaya

By Berlinda Liu

U.S. equities rebounded in July, thanks to earnings from mega-cap technology and major oil companies. The S&P 500® surged 9.2%, posting its best month since November 2020 and reversing its 8.3% loss in June. Nevertheless, the S&P 500 remains in correction territory, down 13.1% from its Jan. 3, 2022, record high.

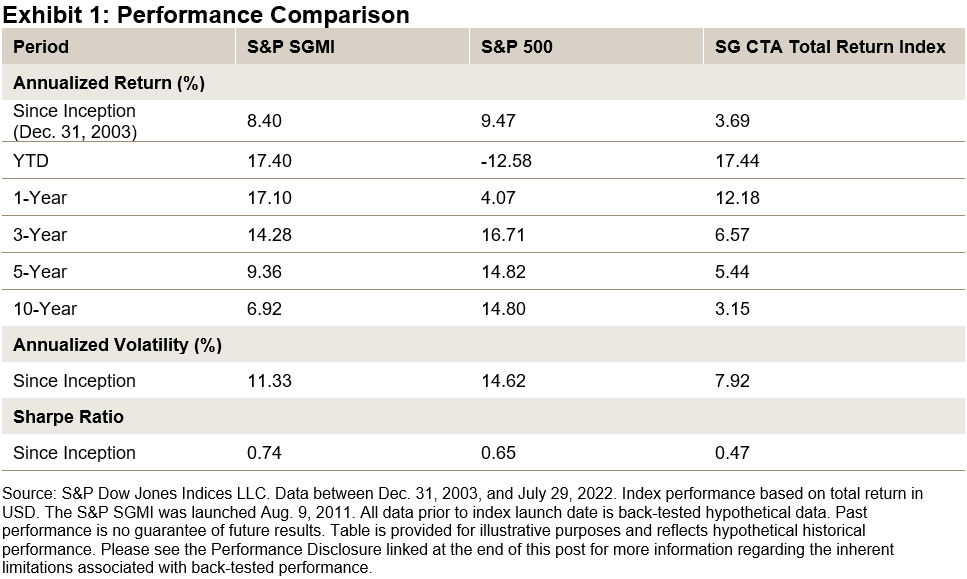

The S&P Systematic Global Macro Index (SGMI) has outperformed the equity market YTD. While the S&P 500 was down 12.6% YTD, the multi-asset trend following index rose 17.4%, similar to the average returns of commodity trading advisors (CTAs) as measured by the SG CTA Total Return Index. In the 12-month period, the SGMI outperformed the broad equity benchmark and the CTA index (see Exhibit 1).

The SGMI is designed to measure a trend-following strategy that takes a long, short or zero position in 37 constituents across six sectors (equities, fixed income, short-term interest rate, foreign exchange, commodities and energy). The trend signal for each constituent is evaluated and established individually via regression. Sectors and constituents are weighted so that they contribute equally to the index risk. The index uses leverage to achieve its 17.5% target volatility.

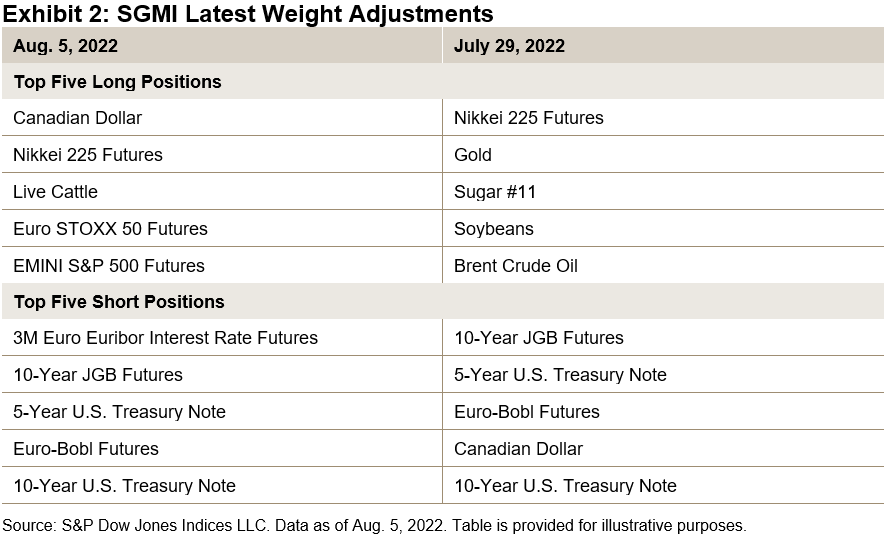

The SGMI is rebalanced monthly. Comparing its allocation in early August with that at the end of July, we can see the index is shifting from commodities to equities (see Exhibit 2). This is not surprising as it is designed to capture and respond to the latest trend in the market. The index continues to short government bonds but has scaled back the size of these short positions.

It remains unclear whether the market has completely shaken off concerns over inflation and rising rates. The S&P SGMI may help market participants seeking to ride market trends via a diversified multi-asset approach.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.