[ad_1]

Thomas Barwick

“I think [2022] was probably up there in terms of being one of the most difficult years to get right for the market.”

So states Hani Redha, asset portfolio manager at PineBridge Investments.

Uncertainty marked the year, no question about that.

Where people thought they have a fairly good idea of what was going to happen in the stock markets in 2022, I don’t think anyone really had a grasp of what might occur.

Radical uncertainty.

And, 2023?

One could say, “more of the same,” except the possible outcomes for 2023 are different than they were for 2022.

What is the same is that many of the possible outcomes for 2023 are unknown.

We are saddled with a lot of unknown, unknowns.

That is radical uncertainty.

2022?

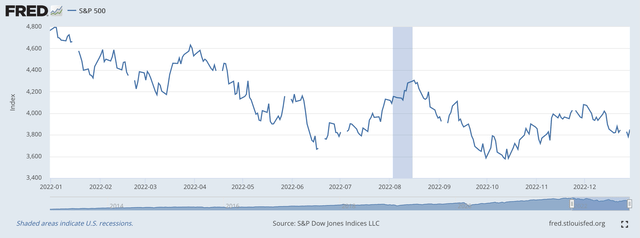

Well, the Standard & Poor’s 500 Stock Index hit a historical high on Monday, January 3, 2022.

The S&P 500 closed at 4796.56 for the day. That was it.

The rest of 2022 was downhill.

At the close on January 30, 2022, the S&P 500 Stock Index closed at 3839.50.

Down, 20.0 percent for the year.

The trip down?

Volatile. Just take a look.

S&P 500 Stock Index (Federal Reserve)

The biggest unknown among all the unknowns faced by investors during the year was the Federal Reserve.

The issue.

Inflation was floating around at a forty-year high.

But, the bump in inflation was just temporary. It would recede soon.

It didn’t.

Finally, the Fed realized that the inflation was not temporary.

So the Fed said it had to really fight the inflation. By March 16, the Federal Reserve had constructed its plan to combat inflation. The Fed raised its policy rate of interest from 0.08 percent to 0.33 percent and the battle was on.

But, then there was the Russian war in Ukraine. Totally unexpected. And, it was not supposed to last. But, the war lingers on, the energy markets of the world got upset and other supply conditions caught many companies off guard.

And, then there was the constant specter of a global recession that moved in and out of people’s perception throughout the year.

Then, investors sensed some weakness on the part of Federal Reserve Board Chairman Jerome Powell.

Powell was seen as a person without strong commitments.

Mr. Powell’s leadership of the Fed during the spread of the Covid-19 pandemic was seen as somewhat wishy-washy. Mr. Powell constantly seem to act on the side of monetary ease. He didn’t want to make an monetary error on the downside.

And, so the Federal Reserve pumped billions upon billions of dollars of liquidity into the banking system. Trillions even.

That got us to where we are today.

The Fed’s actions created an asset bubble, stock prices rose, the price of cryptocurrencies rose, debt spread throughout world and SPACs and other private equity organizations put money into more and more outlets seeking a quick, extensive returns.

Mr. Powell got through the period of monetary ease just fine.

But, now we are on the other side of that, and Mr. Powell has to deal with the excesses that were created.

Mr. Powell now says that “the central bank isn’t likely to consider lowering interest rates until officials are certain that inflation is slowing toward the Fed’s goal of 2 percent sustained inflation.”

But, there are a lot of investors that are saying, “Yeh, sure!”

These investors believe that Mr. Powell cannot sustain the pressure of a crisis happening on his watch.

Mr. Powell, they believe, will “bank off” from the strong statement he made about.

Mr. Powell, they believe, will “pivot” and start to loosen up once things start to get a little tense.

This year has shown over and over again the tentativeness that investors fell with Mr. Powell.

These investors have kept jumping back into the stock market, believing that Mr. Powell will soon get off the monetary brakes and begin to underwrite the stock market once again, as he did for two years in 2020 and 2021.

So far, there has not been a break in either side.

Mr. Powell continues to hold his position about getting inflation back down to around 2.0 percent.

And, investors continue to think that Mr. Powell will break.

This is where we start 2023…lots of uncertainty.

But, there is even more of this uncertainty hanging around.

This year there will be a little more confusion and contention coming from the governmental sphere, with the U.S. Congress split and the U.S. president looking like he is ready for further battles.

The Russian situation in Ukraine does not appear to be producing a near-term solution.

And, world recession seems to grow day-by-day.

The Future

My own expectations are for the world to remain in a state of radical uncertainty.

I believe that the Fed will continue its efforts to combat inflation well into 2023 as it attempts to stick with its program of “quantitative tightening” to offset some of the consequences of its earlier “quantitative easing.”

This will continue to keep the stock market under pressure and lower prices can be expected here.

One can note the rise in Treasury yields here and the impact they might have on financial markets and the economy.

Last year, the yield on the 10-year note is approaching the largest one-year yield gain on record…going back to 1977.

This yield can be expected to go higher in 2023.

These increases will not, over the year, result in the best of outcomes.

And world economic problems.

These are not going to go away. There is too much locked up in the Russian situation, the concerns coming out of China, and then there is the middle east.

All-in-all, a lot of uncertainty, with the upcoming U.S. political scene a problem in itself.

How bad the recession will be in the United States is totally unknown. Some analysts even believe that there will be none.

The year 2023 is presented, accompanied by a big question mark.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.