[ad_1]

TongTa/iStock via Getty Images

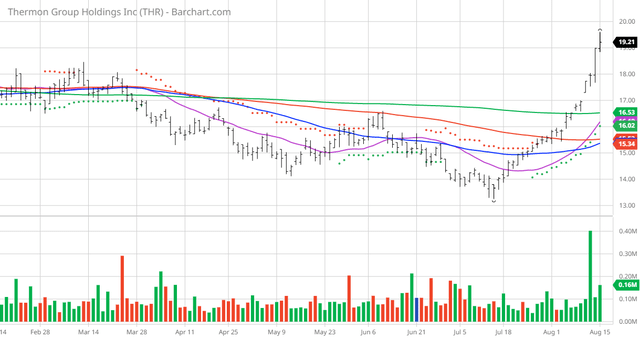

The Chart of the Day belongs to the electrical control manufacturer Thermon Group (THR). I found the stock by sorting the Russell 3000 Index stocks first by the most frequent number of new highs in the last month and having a Trend Spotter buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter first signaled a buy on 7/28, the stock gained 23.94%.

THR vs Daily Moving Averages

Thermon Group Holdings, Inc. provides engineered industrial process heating solutions for process industries worldwide. Its products include electric heating products, such as air heaters and heating accessories, boilers and calorifiers, controlling and monitoring solutions, heat tracing systems, tank heating systems, thermostats, tubing bundles, and system accessories, as well as strip, tubular, immersion, and process heaters; and gas heating products, including enclosure and explosion proof gas catalytic heaters, gas fired blowers, and gas heating accessories that comprise regulators, valves, mounting brackets, and battery cables. The company also offers specialty products, which include CEMS and analytical systems, commercial construction products and services, control panels, engineered products, compressed gas scrubbing systems, temporary power solutions, and snow clearing devices for rail track and switch equipment; and steam heating solutions comprising heat transfer compounds, steam heated bundles, steam supply and condensate return lines, steam tracing solutions, steam trace accessories, and tank heating products. In addition, it provides design engineering solutions that include design optimization studies, product selection assistance, and computer-generated drawing packages; energy audit services; procurement and project management services; procurement and project management services; turnkey construction installation; recurring facility assessment or audit; maintenance services; and technical support services. The company offers its solutions to chemical and petrochemical, oil and gas, power generation, rail and transit, commercial, transportation, food and beverage, pharmaceutical, and mineral processing industries, as well as data centers, semiconductor facilities, and other markets through a network of sales and service professionals, and distributors. Thermon Group Holdings, Inc. was founded in 1954 and is headquartered in Austin, Texas.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 24% technical buy signals but increasing

- 23.70+ Weighted Alpha

- 14.10% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 19 new highs and up 36.82% in the last month

- Relative Strength Index 87.72%

- Technical support level at 18.84

- Recently traded at 19.21 with 50 day moving average of 15.37

Fundamental factors:

- Market Cap $635 million

- P/E 17.10

- Revenue expected to grow 10.00% this year and another 2.60% next year

- Earnings estimated to continue to compound at an annual rate of 12.00% for the next 5 years

Analysts and Investor Sentiment – I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts have 2 strong buy opinions on the stock

- Analysts gives average price targets at 22.00

- The individual investors following the stock on Motley Fool voted 14 to 0 that the stock will beat the market with the more experienced investors voting 1 to 0 for the same result

- 750 investors are monitoring the stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector

Industry

Electrical Components and Equipment

Ranked Overall

Ranked in Sector

Ranked in Industry

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.