[ad_1]

Pascal Le Segretain

Investment Thesis: I take a long-term bullish view on the stock as a result of growth in revenues and earnings, along with anticipated growth in demand across the Legal Professionals segment.

In a previous article back in June, I made the argument that Thomson Reuters (NYSE:TRI) could see a significant growth in revenue going forward as companies are increasingly expected to demand access to legal intelligence services.

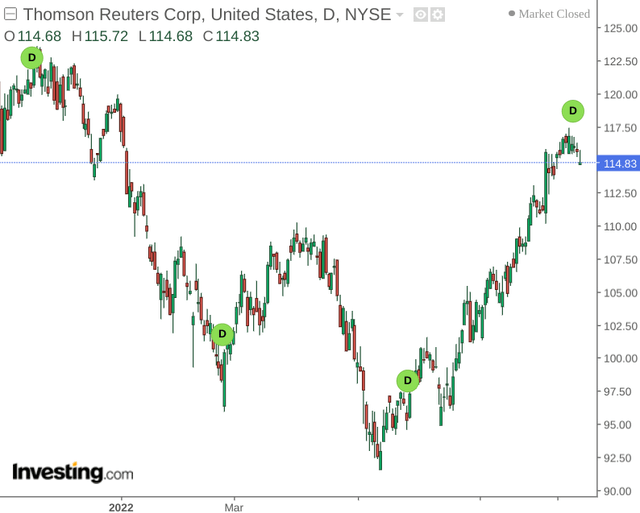

Since then, the stock has seen significant upside.

The purpose of this article is to assess whether the rebound we have been seeing in the stock can continue from here.

Performance

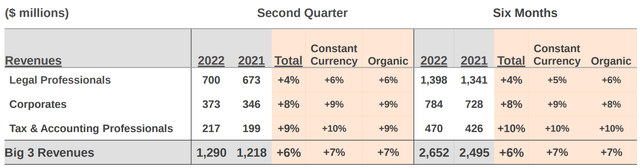

When looking at second quarter results – organic growth over six months came in at 7% overall as compared to the same period in 2021. As the company’s largest segment – Legal Professionals saw the most growth on a dollar basis.

Thomson Reuters 2022 Second-Quarter Results

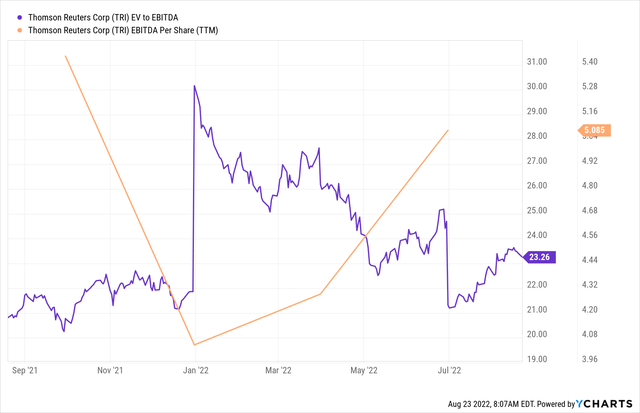

From an earnings standpoint, we can see that EV/EBITDA has continued on a downward trend overall since January – while EBITDA per share has continued to see a strong rise over the same period.

From this standpoint, the stock still seems to be trading at good value in spite of the recent price rise.

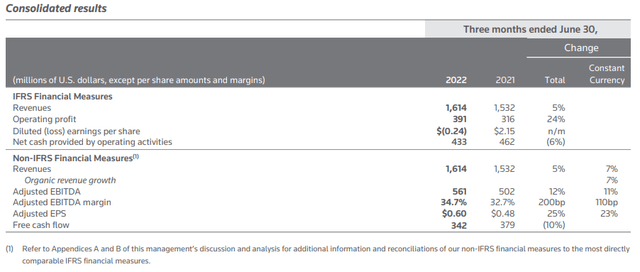

While diluted earnings per share went into negative territory – this was in significant part due to a reduction in the company’s investment in the London Stock Exchange Group (LSEG). However, we can see that adjusted EPS (which excludes the effect of the change in the LSEG investment value) has risen by 23% from the prior year.

Thomson Reuters: Second Quarter Ended June 30, 2022

When looking at the company’s quick ratio (calculated as cash and cash equivalents plus trade and other receivables all over current liabilities), we can see that this has fallen over a six-month period – indicating that the company has less cash available to meet its current liabilities.

| December 2021 | June 2022 | |

| Cash and cash equivalents | 778 | 461 |

| Trade and other receivables | 1057 | 984 |

| Current liabilities | 2581 | 2729 |

| Quick ratio | 71.10% | 52.95% |

Source: Figures sourced from Thomson Reuters Second Quarter Report Period Ended June 30, 2022. Quick ratio calculated by author.

While I do not see this as being a particularly big concern at this point in time – investors will eventually want to see growth in revenue and earnings translate into significant growth in cash flow, to ensure that Thomson Reuters can meet its short-term liabilities.

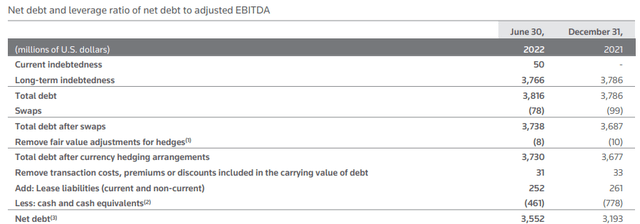

With that being said, we can see that while net debt has been rising – long-term indebtedness has fallen over the same period.

Thomson Reuters: Second Quarter Report Period Ended June 30, 2022

In this regard, I would not see a temporary rise in debt as too concerning for as long as long-term debt does not rise.

Looking Forward

Going forward – I take the view that the drivers of growth for Thomson Reuters to date remain – and expect that demand across the Legal Professionals segment is expected to continue.

The company reports that with sanctions against Russia continuing as a result of the ongoing situation in Ukraine – many financial institutions have had to either “de-risk” by avoiding business with Russia entirely, or have had to incur considerably greater expense in ensuring compliance with regulations.

Not only has this situation caused difficulties in doing business with Russian entities directly, but financial services firms more broadly face the difficulty of ramping up compliance teams to ensure the legality of financial transactions arising from the potential for attempted evasion of such sanctions.

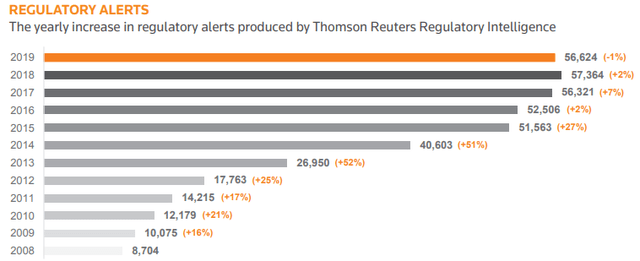

As such, I expect that demand for regulatory intelligence solutions will continue to be particularly strong as companies attempt to navigate an increasingly complex regulatory environment – and Thomson Reuters is in a good position to provide the appropriate data solutions to monitor such an environment.

According to the company’s Regulatory Intelligence brochure – the yearly increase in regulatory alerts from 2008 to 2019 increased greatly – and I anticipate that this trend is set to continue as new concerns regarding data privacy and financial compliance continue to arise.

Thomson Reuters Regulatory Intelligence Desktop

For these reasons, I take the view that we can continue to expect significant revenue growth across the Legal Professionals segment in particular – and the Corporates and Tax & Accounting Professionals segments are also in a good position to grow further from here.

Conclusion

To conclude, Thomson Reuters has continued to see growth in revenue and earnings – and appears to be trading at increasingly good value on an earnings basis. I take a long-term bullish view on the stock.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.