[ad_1]

HJBC

The Thesis

Wall Street’s become far too sharp over the years, and quite good at pricing in the cyclicality of earnings. So much so, that they may have overdone it with commodity companies like TTE, which now trades at 7.4x our estimate of normalized earnings. The mantra on the street for decades has been to buy when earnings are near zero and sell when they’re rocketing up. But, we think the better approach is to take the mentality of a business owner. Ask yourself, “What’s the average amount of cash I can expect from this business over the next 10 to 20 years?” And, “Am I happy with those returns?” This mentality led Warren Buffett to outperform the market for the better part of the past 60 years. What’s more interesting is that Warren Buffett’s been buying oil stocks like Chevron (CVX) from those same Wall Street traders. And, even more so, that you can buy a superior business in TotalEnergies (NYSE:TTE) at an almost 50% discount to Chevron.

In the decade ahead, we project enormous returns of 15% per annum.

TTE Is Exceptionally Cheap

TotalEnergies has a strong balance sheet, with an investment grade bond rating, manageable long-term debt, and $27 billion of working capital. Such a company can return a lot of cash to shareholders.

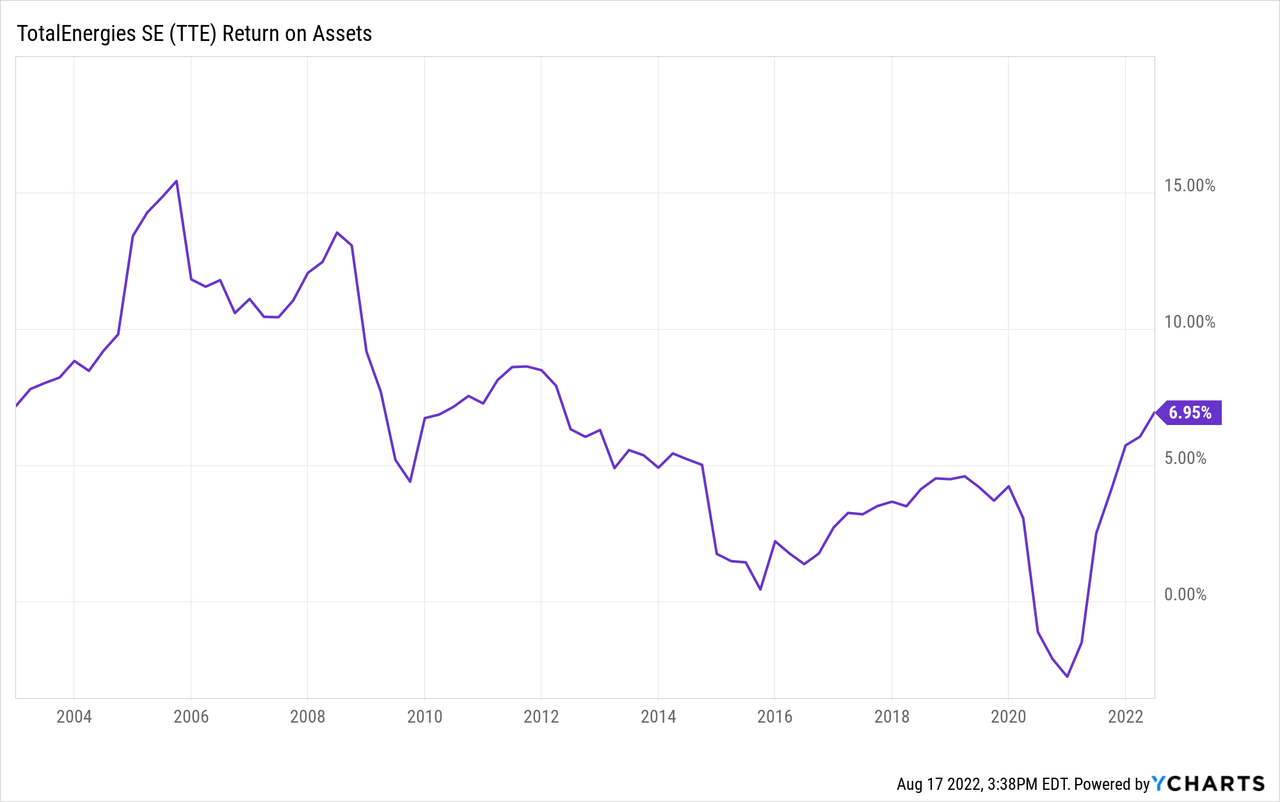

To normalize TTE’s earnings, we looked at how much it earns with Brent Crude at $75 per barrel. We also studied its average return on assets and profit margins. TotalEnergies’ normalized earnings came in around $18.3 billion ($7.15 per share). This gives TTE a normalized PE of 7.4.

Looking at the forward PE, price to book, and free cash flow yield, Total offers about a 45% discount to Chevron:

| As of Aug 17, 2022 | Chevron (CVX) | TotalEnergies (TTE) |

| Forward P/E | 8.8 | 4.9 |

| Price to Book | 2.0 | 1.2 |

| Free Cash Flow Yield | 9.8% | 18.2% |

| Dividend Yield | 3.6% | 5.3% |

| Working Capital | $12 Billion | $27 Billion |

Operational Excellence

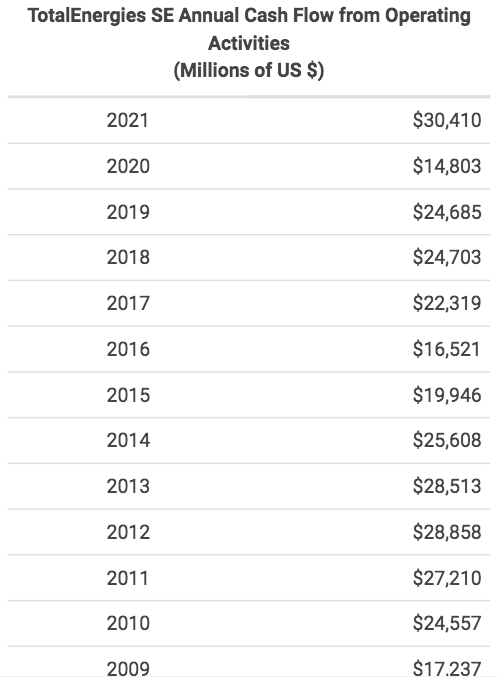

Total Energies has a strong integrated model with both upstream and downstream strength. This means that the next time oil collapses, you can count on Total’s LNG, refining, and chemicals business to carry you through. Despite a tough pricing environment from 2014 to 2020, Total continued to rack in the cash flows through thick and thin:

TTE’s Operating Cash Flow (Macrotrends)

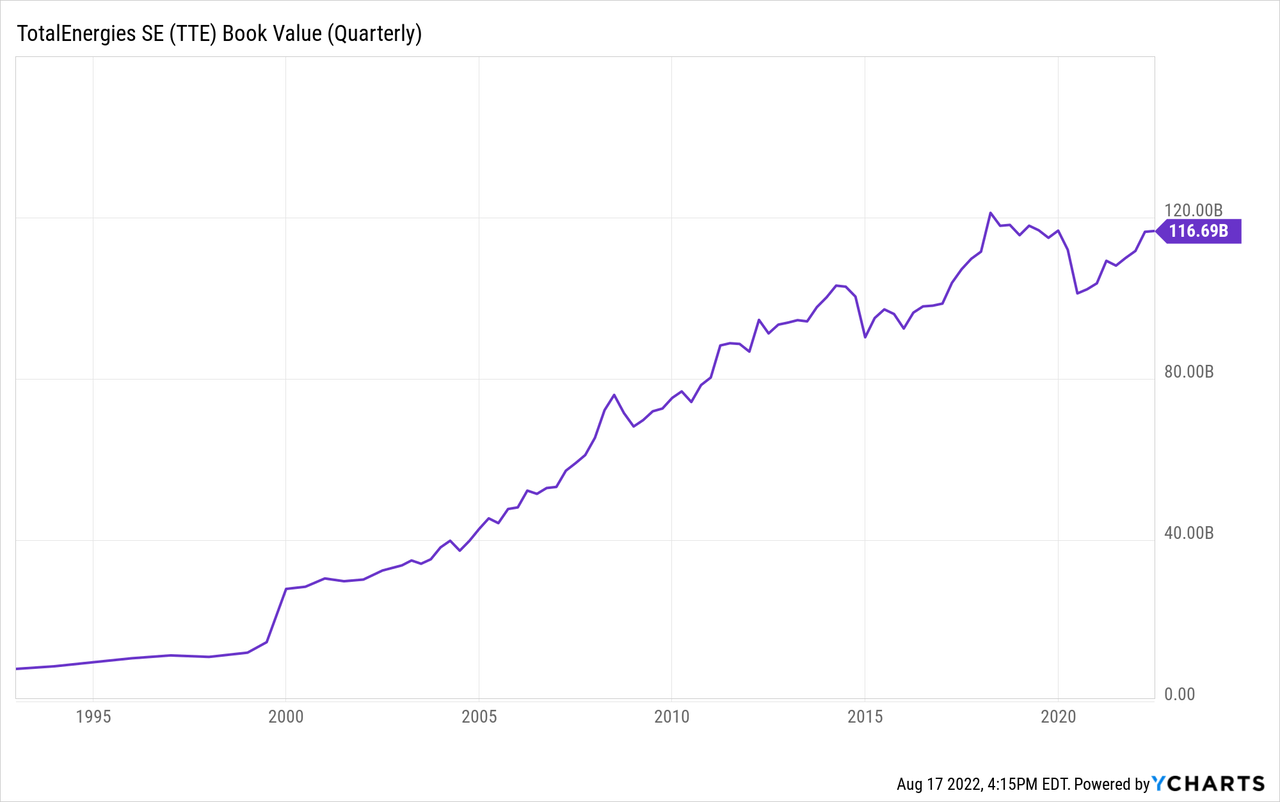

TotalEnergies has a tremendous track record of growing shareholder’s equity over the long-term:

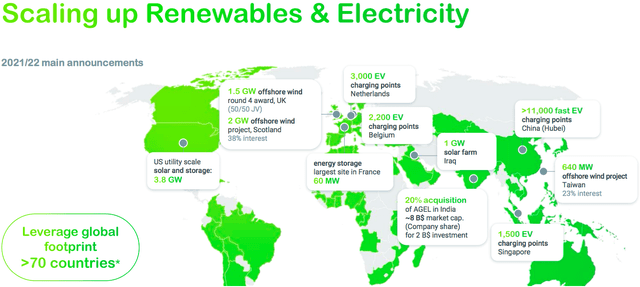

The Hyper-Growth Of Renewables

Management is doing an exceptional job with Total’s integrated gas and renewables business. The segment’s revenue grew by 29% per annum over the past two years. And, operating income in the segment grew 68% per annum. This is what excites us about TTE’s future. Total is involved in wind, solar, EV charging, green hydrogen, you name it.

Global Player In Green Energy (TotalEnergies)

Total’s Competitive Advantage

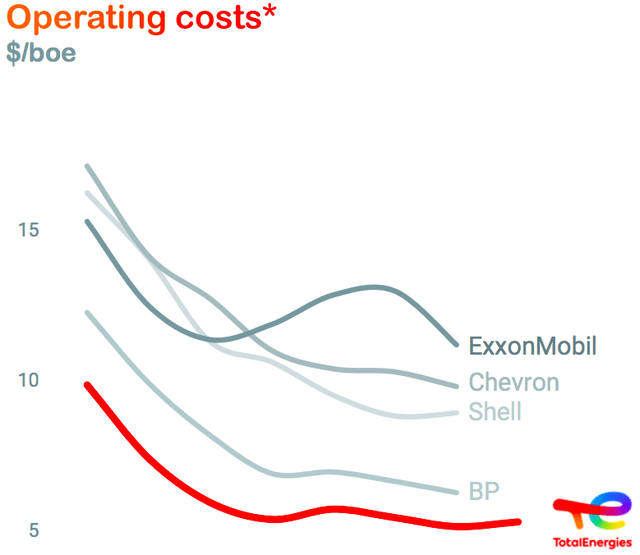

Management at Total claims to have industry leading break-even prices and costs when it comes to producing a barrel of oil. If this is true, TTE shareholders own some of the world’s premium oil and gas assets. Here’s a piece from the companies’ 2021 results, comparing its operating costs to peers:

Operating Costs Per Barrel Of Oil (TotalEnergies)

There’s Always Risk

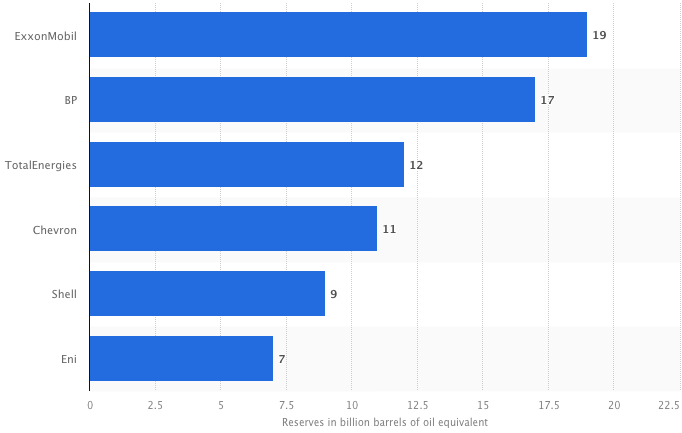

Rather than focus on the short-term, we’re going to look at the long-term risks for shareholders. First, upstream oil businesses will eventually enter secular decline as the world continues to transition to electric vehicles. Oil demand is projected to peak somewhere between 2025 and 2035. We’ve heard TTE’s CEO say he expects demand to peak in 2030, so at least he’s prepared for this change. Meanwhile, TTE’s current oil reserves won’t last forever. Here’s a look at TTE’s proven oil reserves versus its competitors:

Proven Oil Reserves (Statista)

The Balance expects oil prices of $66 per barrel in 2025, $89 in 2030, and $132 in 2040. But, if the industry starts investing heavily in exploration and cost reductions, there’s a chance oil prices could come in on the low end. Oil companies are extraordinarily reliant on what the price of oil does over time.

Long-term Returns

Our 2032 price target for TTE is $151 per share, implying returns of 15% per annum with dividends reinvested.

- We think TTE can easily cover its dividend while growing its normalized EPS at 5% per annum, reaching earnings of $11.65 per share by 2032. We’ve assumed a 2032 oil price of $95 per barrel, allowing for some organic growth in TTE’s upstream business. TotalEnergies’ fast growing LNG and renewables businesses should offset declines in some of its other operations. The company has ample cash to buy back shares at a rate of 1.5% per annum, and to spend approximately $5 billion per year on acquisitions. We’ve assigned a terminal multiple of 13x.

Conclusion

We really like what we see with TotalEnergies, both from a management and a valuation standpoint. This investment could deliver market crushing returns of 15% per annum. Keep in mind that TTE will have to build out its renewables and LNG businesses, and invest its capital prudently to achieve this result. This company has a strong balance sheet, industry leading operating costs, and some very fast-growing revenue streams. We’ve analyzed a lot of oil companies here on Seeking Alpha, and TTE is thus far our favorite. If you know of some hidden risks we didn’t catch, please drop a comment down below. As for now, we have a “strong buy” rating on the shares.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.