[ad_1]

Lemon_tm/iStock via Getty Images

Introduction

Tripadvisor (NASDAQ:TRIP) has seen a prolonged recovery in line with the hospitality industry. But the hospitality industry seems to be fully recovered now, and we should see this in the rest of the year. Even so, there are major headwinds that could hurt Tripadvisor this year too. Inflation and recession are major economic issues that may quickly offset this recovery. At 26x estimated earnings, the stock is too expensive to buy with these large, looming economic issues.

The Past Few Years

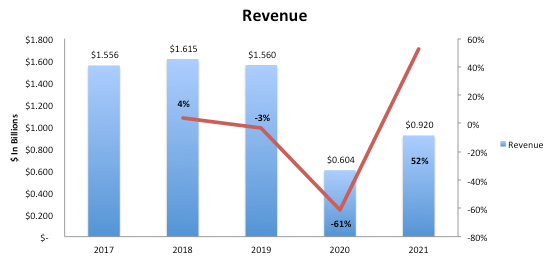

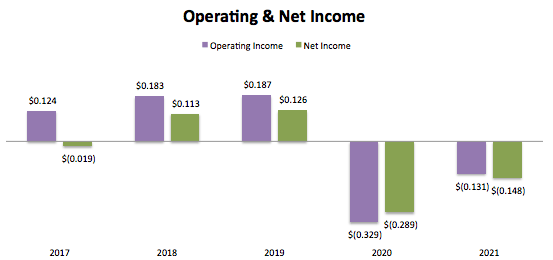

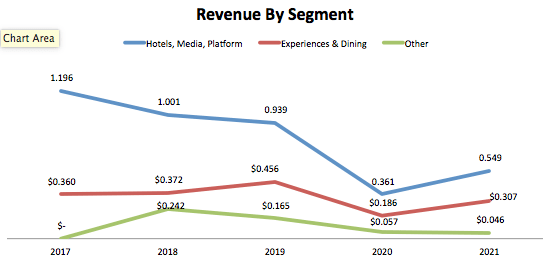

TripAdvisor Revenue (SEC.gov) TripAdvisor Operating & Net Income (SEC.gov) TripAdvisor Revenue By Segment (SEC.gov)

Looking at the above charts shows that Tripadvisor was rather consistent up until the pandemic. This is when the business saw revenues decline 61% and have yet to regain 2019 levels. Operating and net income seemed to just get to a good spot for the company but then declined 276% and 329%, respectively, in 2020. And again, operating and net income have yet to rebound to prior levels. All segments are still down from 2019 levels, with Hotels, Media, & Platform just 58% of 2019 levels. Operating margins for the segment have increased from 4% to 20% this year but are still down 50% from 2019. This is while the Experiences & Dining operating margin has gone negative.

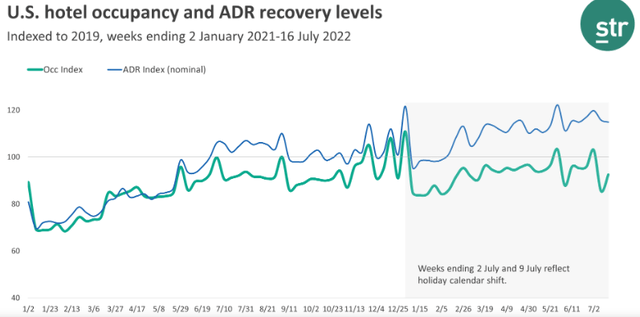

The reason for these results is due to the lackluster hotel and hospitality recovery. In 2021, STR reported that occupancy rates were just 58%, down 12.6% from 2019 still. This is while RevPAR was down 17%, and the average daily rate was down 5%. Tripadvisor just became profitable in 2018, therefore, the company needs a strong hospitality industry to have a positive bottom line.

2022 So Far

The question is if the hospitality industry will rebound anytime soon. Looking at the first quarter of 2022 shows us how Tripadvisor was doing. The company did see revenue grow by 113% compared to the first quarter of 2021. But operating and net income was still down. Operating income was -$20 million (up about $60 million from the prior quarter), while net income was -$34 million (a around $50 million gain). Each segment saw growth, with Hotels, Media, & Platform growing by 82%, and Experiences & Dining grew 229%. Margins for the two segments also drastically improved and thus resulting in an almost breakeven quarter. As for website traffic, Tripadvisor saw 71% of the monthly unique users (MUU) in quarter one as the first quarter of 2019. This is a little bit worse than the 73% comparable of MUUs in quarter four of 2021. Overall, this quarter shows what seems to be consistent results from quarter two of 2021 forward.

The STR graph above shows that occupancy rates have almost fully regained 2019 levels, while ADR has exceeded 2019 levels. Now as quarter two’s reports come out, it seems the company is back to 2019 levels as the STR chart would suggest. In the second quarter Tripadvisor posted revenue of $417 million for 59% growth. This is 99% of 2019’s revenue in the same quarter! Net income was $31 million, a gain of about $60 from prior year. While Tripadvisor did have a great quarter and the reports show a rebounded hospitality industry there are risks. If inflation keeps growing, it may limit consumers’ ability and tolerance to take vacations. It will be key to keep an eye on these factors over the rest of the year.

Balance Sheet

Tripadvisor has a good balance sheet to withhold an industry that arises. The business has great liquidity, with a current ratio of 2.23x. This allows the business to pay any current debts that may arise. Tripadvisor also has a low debt-to-equity of 2.09x, showing the business doesn’t have much debt load to service. Altogether, the business has a healthy balance sheet to keep business running.

Valuation

As of writing, Tripadvisor trades around $20 per share. At this price level, the company trades at a P/E of around 22x if 2019’s EPS is regained. But the current EPS estimate is just $0.78 this year, making for a P/E of 26x. Overall no matter what the EPS is, the stock is overvalued at this time. The hospitality industry still has much uncertainty and could recede with inflationary pressures.

Conclusion

Tripadvisor seems to be fully recovered from the pandemic. The data suggests that the next two quarters should be almost back to 2019 levels. While this will be good for the company, there is the risk of recession and inflationary pressures that could be a huge headwind for the business too. With all of this put together, the company does not seem worth it at 26x earnings.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.