[ad_1]

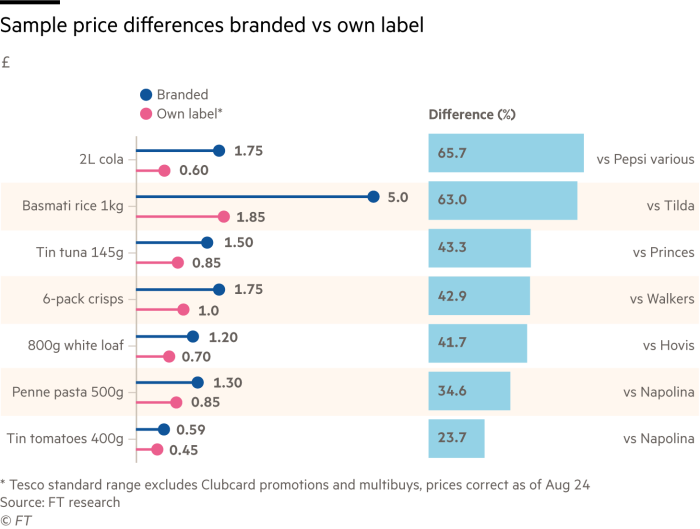

A loaf of branded, white sliced bread costs about £1.20 at Tesco. The retailer’s own-label equivalent costs 70p, or 42 per cent less. It is not surprising that Tesco’s chief executive, Ken Murphy, recently flagged bread as one of the categories where customers are starting to trade down to cheaper alternatives.

That trend is already being felt by the companies that make own-label products — and they expect it to accelerate. “We are seeing an increase in our own-label volumes, especially in bread where the value for money gap is very clear,” said the managing director of one bakery products group.

“The increase in the energy price cap is likely to focus minds even more,” he added, noting that the soaring cost of energy in the UK meant this downturn was “moving at a far quicker pace” than previous ones and that “a lot of households will have to batten the hatches down”.

During the pandemic and before inflation took off, people sought the reassurance of branded goods. But Mike Watkins, head of retailer and business insight at consultancy NielsenIQ, said that habits were shifting again, with own-label sales outgrowing branded in recent months amid the biggest squeeze on UK wages in two decades.

Last month Unilever, one of the world’s largest producers of branded goods, warned that sales had been hit by consumers choosing cheaper versions as prices of its products rose.

Fraser McKevitt, head of retail and consumer insight at another consultancy, Kantar, said own-label goods now made up 51.6 per cent of grocery sales by value, the highest level it had ever recorded.

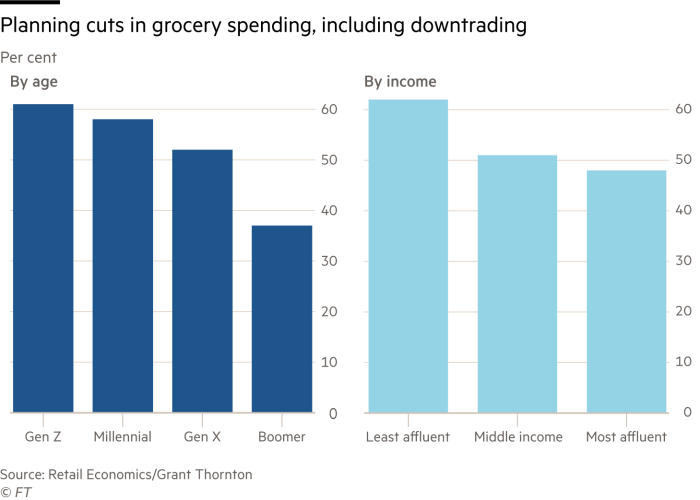

Its figures show own-label sales rising 7 per cent in the 12 weeks to August 7, while a recent survey by consultancy Retail Economics suggested that half of all shoppers were planning to buy more own-label products.

Much of the growth in own label over the past decade has been driven by the expansion of discounters Aldi and Lidl, which between them have an 18 per cent market share, compared with 8 per cent in 2011. Both sell almost entirely own-label products under names such as Village Bakery for bread and Baresa pasta.

Some own-label products are made by big companies that also make branded goods. Hovis and Kingsmill, for example, both make own-label bread. But the sector is dominated by relatively small and usually privately owned companies. Some are significant producers in particular categories, such as Veetee in rice and Lovering Foods in canned fish.

The shift to own label is broader than just trading down on staples.

The growth of Tesco’s Finest, J Sainsbury’s Taste the Difference and other ready-meal offers as a cheaper alternative to restaurants and takeaways has been a big factor in the higher than average sales of own-label food in the UK compared with Europe and the US.

“This is where own label comes into its own,” said Lydia Gerratt, a consultant and former buyer at a big supermarket chain. “These products are not developed to be the cheapest, but to offer your core customers something they want that they are not getting elsewhere.”

However, higher demand for own-label products is unlikely to translate into bigger profits for manufacturers, because they are already working on thin margins and face rampant inflation.

The bakery products manufacturer said that rising sales were “in no way offsetting the rises in prices of almost everything we touch”.

“Wheat is up but the big thing is gas,” he added.

James Logan, UK commercial director at Refresco, which supplies water, fruit juice and fizzy drinks to supermarkets across Europe, agreed the cost increases were across the board. “In the past you might have got a spike in one particular commodity because of something like El Niño affecting harvests,” he said.

“This time there is no respite, costs are rising everywhere in the supply chain.”

The question of how the extra costs are shared has led to high-profile stand-offs between retailers and suppliers of branded goods, such as a recent dispute between Tesco and Heinz that temporarily took some products off shelves. Disagreements with own-label suppliers are less likely on the whole.

“A good own-label supplier will have close contact with the retailer and keep them informed about any developments that might require a difficult conversation,” said Logan.

Clive Black, head of research at Shore Capital, said asking suppliers to take the hit on price was no longer an easy option. Previous pressure from retailers had led to consolidation, he added, meaning there were fewer alternatives, while switching supplier is also not as easy as it was.

The bakery executive said he was having “sensible and constructive dialogue” with customers while McBride, a listed supplier of own-label household cleaning products, recently said it had secured “significant” price increases to help offset the higher costs of chemicals and energy.

Tesco and Sainsbury’s have indicated they will sacrifice some profits this year to absorb price increases from suppliers.

Logan said media coverage of the cost of living crisis had made price discussions easier to initiate. “Nobody can argue they were unaware of what is happening.”

[ad_2]

Image and article originally from www.ft.com. Read the original article here.