[ad_1]

da-kuk

Searching for viable high yield income vehicles in 2023? Closed end funds, CEFs, generally offer high dividend yields, but buying them has an interesting twist.

Since CEFs have a fixed amount of shares, they can sell at premiums or discounts to their NAVs, Net Asset Values. Their NAV/Share is calculated at the end of each day, giving investors the current premium or discount the CEF is selling at.

A useful strategy when buying CEFs is to try to buy them at deeper discounts or lower premiums than their historical averages, due to mean reversion.

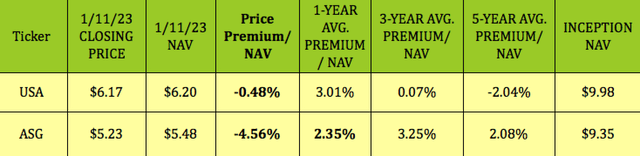

The two CEFs we’re covering in this article, Liberty All-Star Equity, (NYSE:USA) and its sister fund, the Liberty All-Star Growth fund, (ASG), were both selling at discounts to NAV/Share, as of the 1/11/23 close, but ASG had a much deeper discount.

USA’s -0.48% premium is cheaper than its 1- and 3-year premiums of 3% and 0.07%, but not as cheap as its 5-year -2% premium, whereas ASG’s -4.56% premium was much cheaper than its 1-, 3-, and 5-year premiums of 2.35%, 3.25%, and 2.08%, respectively:

Fund Profiles:

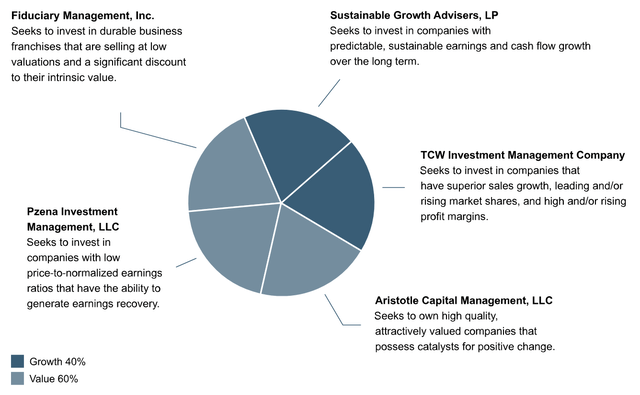

USA takes a multi-pronged approach to its investments, using 3 value portfolio managers and 2 growth managers with expertise in different slices of the market:

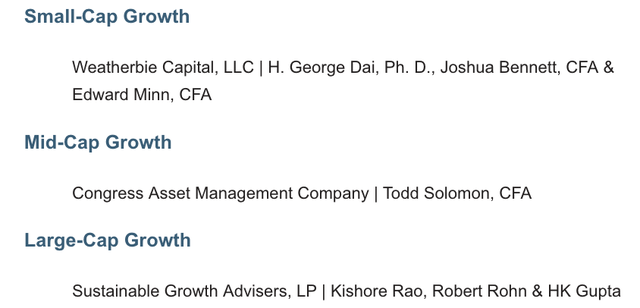

ASG specializes in growth equities, utilizing 3 managers, each focusing on different market cap sizes:

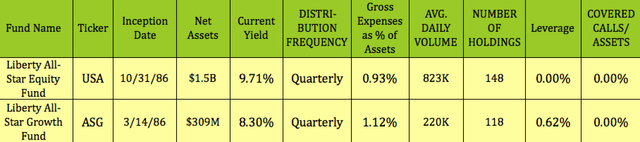

Both funds were launched in 1986, and both pay variable quarterly distributions. USA’s policy is to pay distributions on its shares totaling ~10% of its NAV per year, payable in 4 quarterly installments of 2.5% of the Fund’s NAV.

ASG’s policy is to pay distributions on its shares totaling ~8% of its net asset value per year, payable in four quarterly installments of 2% of the Fund’s NAV.

USA is a much larger fund, with $1.5B in assets, vs. $309M for ASG. USA holds 148 positions, vs. 118 for ASG, and has much higher average daily volume of 823K, vs. 220K for ASG.

USA’s expense ratio is 0.93%, while ASG’s is a bit higher, at 1.12%. ASG uses a very small amount of leverage, 0.62%, while USA uses no leverage.

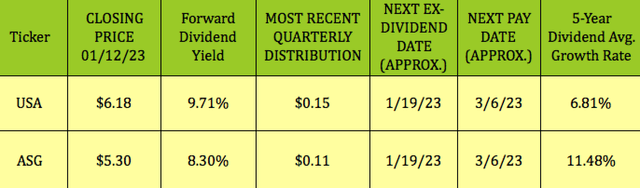

Dividends:

USA holds the edge for dividend yield, as of the 1/12/23 close it yielded 9.71%, vs. 8.30% for ASG. Both funds go ex-dividend on 1/19/23, with a 3/6/23 pay date.

After raising their dividends in 2021, both funds had declining dividends in 2022, with USA’s dropping from $.21 in Q4 ’21 to $.20 in Q1 ’22, then to $.18 in Q2 ’22, $.16 in Q3, and finally to $.15 in Q4 ’22, where it remains.

ASG’s quarterly payout dropped from $.18 to $.14 in Q1 ’22, to $.14 in Q2 ’22, to $.11 in Q3, and to $.10 in Q4 ’22. It rose back to $.11 for Q1 ’23.

ASG also paid a $0.34/share distribution for Q4 ’21 to meet its 2021 distribution requirement for federal excise tax purposes.

Holdings:

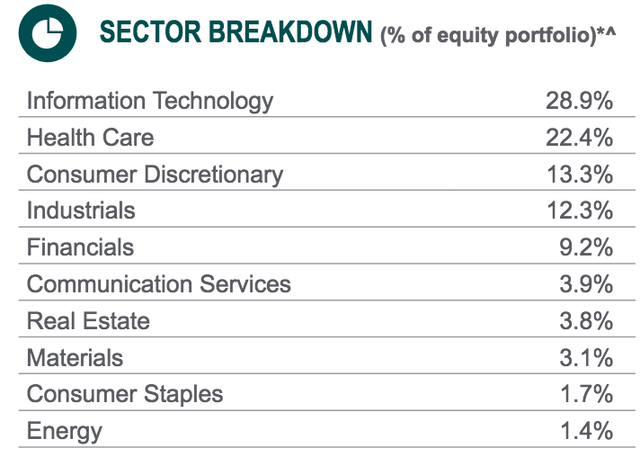

USA and ASG had very similar sector exposures, as of 9/30/22, with Tech, Health Care, Consumer Discretionary, and Industrials forming ~79% of USA’s portfolio, and ~75% of ASG’s holdings.

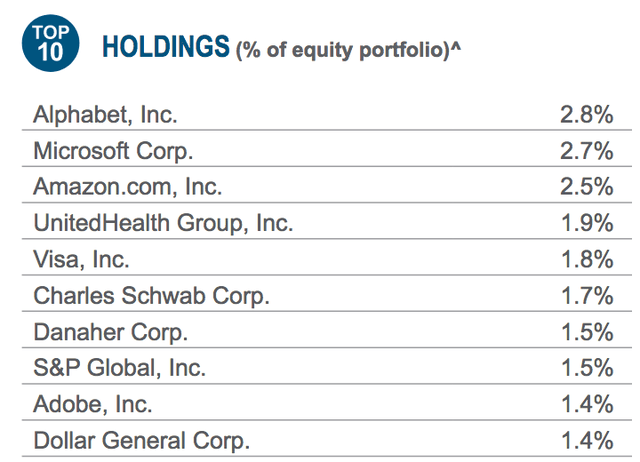

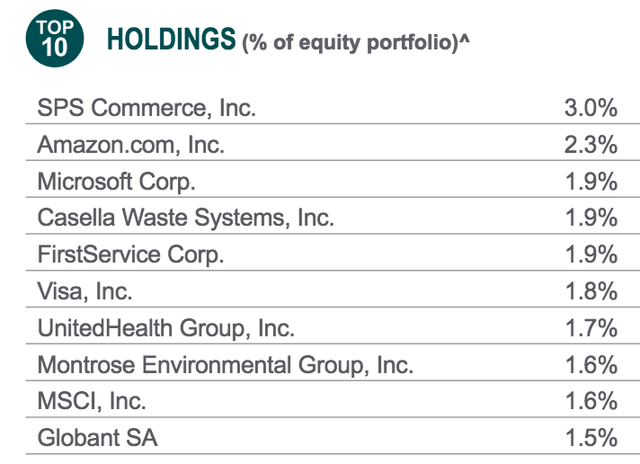

USA’s top 10 holdings formed ~20% of its equity holdings as of 9/30/22, with Alphabet, Microsoft, Amazon, and United Health in the top 4 spots:

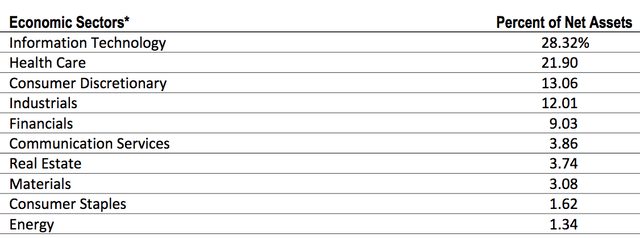

ASG’s sector exposure, as of 9/30/22:

ASG’s top 10 positions also formed ~20% of its holdings, with some less familiar names in the mix, such as Casella Waste Systems, FirstService, Montrose Environmental, and Globant SA.

Performance:

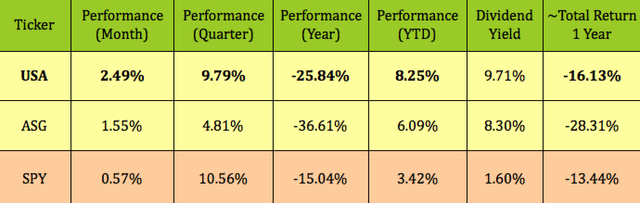

With the market fleeing from growth stocks for much of 2022, USA was able to outperform ASG over the past quarter, month and year, and on a total return basis over the past year. Both funds trailed the S&P over the past year, but have outperformed in the 1st 2 weeks of 2023, with USA up ~8%, and ASG up ~6%:

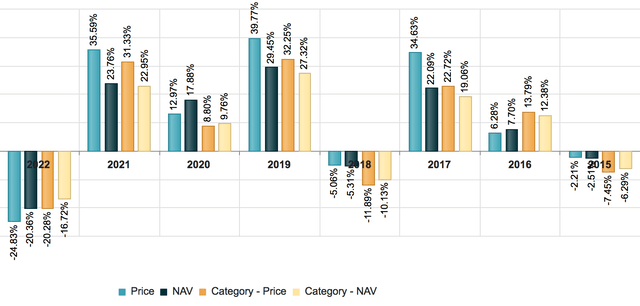

Longer term, USA outperformed the Morningstar US CEF US Equity category in 2017-2021 and 2015, but lagged in 2022:

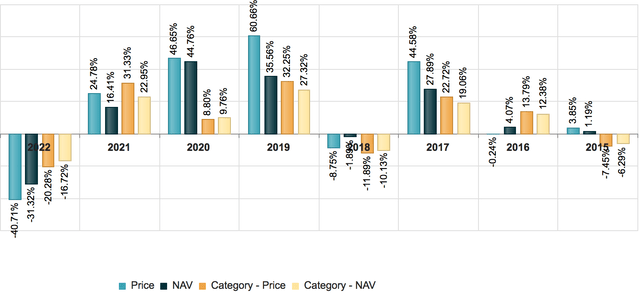

ASG outperformed in 2017-2020, but lagged in 2021 and 2022:

Parting Thoughts:

With both funds basing their dividends on a % of NAV, a down market leads to lower distributions for USA and ASG. No one knows when the Fed will stop its rate hikes, inflation will pull back, and/or the market will bounce back, but when the bull market resumes, USA and ASG could be good bets for income investors.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.