[ad_1]

Torsten Asmus

I last wrote about the United States Oil ETF, LP (NYSEARCA:USO) in April 2022, when I argued that after a 350% rally since the crisis that gripped the US oil sector in April 2020, the ETF was a poor investment. After almost halving from last year’s peak, crude oil prices look to be breaking out to the upside, and the USO is a good bet over the next few months. Long term, however, I maintain that the ETF is poor vehicle for benefiting from higher oil prices, and is likely to continue underperforming oil equities significantly.

The USO ETF

The USO’s investment objective is for the daily changes, in percentage terms, of its shares’ net asset value to reflect the daily changes, in percentage terms, of the spot price of light sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the Benchmark Oil Futures Contract. Specifically, USO seeks for the average daily percentage change in USO’s net asset value, for any period of 30 successive valuation days, to be within plus/minus 10% of the average daily percentage change in the price of the Benchmark Oil Futures Contract over the same period. USO held front month contracts until April 17, 2020, at which time following leeway in the prospectus, USO changed the exposure from holding specifically front-month contracts to holding predominantly front-month contracts, 30% next month and 15% contracts with further expiry.

USO Share Price, Market Cap, And Number Of Shares (Bloomberg)

Inflows into the fund surged following the oil price crash in early 2020, with assets under management rising 16x from their January 2020 lows to their April 2020 peak, when new issuance was halted. This rise in interest in the ETF, largely thanks to retail demand, has since declined by almost 85%, leaving assets under management at USD1.9bn as of today, down from a peak of USD5.4bn.

WTI Is Breaking Bullish

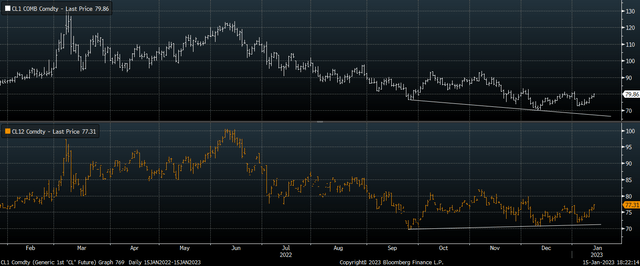

The bear market in WTI looks to have ended with as key down trendline resistance gives way. As the chart below shows, after holding above its December lows earlier this month, front-month WTI looks to be breaking out to the upside. Bulls need a close above USD80/bbl to confirm the breakout, while a close above USD81/bbl would trigger a near-term inverse head and shoulders reversal pattern.

Front Month WTI Price (Bloomberg)

Longer-dated oil futures contracts actually bottomed out in September last year, with the 12-month future failing to post new lows in December in line with the front-month contract, which was the initial signal of the end of the oil bear market.

Front Month WTI Vs 12-Month Future (Bloomberg)

The USO has successfully tracked front-month WTI very closely over recent months, with the 30-day rolling correlation at 0.99%, and any breakout in WTI should send USO higher.

Oil Price Fundamental Outlook Remains Strong

From a fundamental perspective, global oil demand continues to recover from the Covid recession, led by emerging markets. Non-OECD country oil consumption hit a new all-time high in December, driven largely by Asian demand, which hit a new all-time high. The long-term oil price outlook will be determined in large part by the extent to which declining oil consumption in developed markets can offset continued growth in emerging markets. My sense is that investors are overestimating the extent to which green energy policies will be able to reduce demand in developed markets and underestimating the amount of oil that will ultimately be needed to develop and sustain green energy infrastructure. For emerging markets, where tackling air quality and climate change are not particularly important policy objectives among most of the population, efforts to decarbonize are likely to be slow at best. When considering that new large-scale oil discoveries are diminishing and the cost of extracting the discovered oil continues to increase, we should expect higher prices over the long term.

Despite Recent Outperformance, USO Will Underperform Long Term

As I noted ‘USO: Take Your Money And Run‘, since its inception in 2006, the USO has lost 87% of its value relative to WTI. While some of this underperformance can be traced back to the regulatory changes that were imposed upon it during the April 2020 oil price crash, another issue is the negative roll yield as the oil futures market has spent most of the time in contango. Since for the most part the front-month futures contracts are cheaper than those expiring further out in time, the futures curve is upward-sloping, which causes negative roll yield as investors lose money when selling the futures contracts that are expiring and purchasing further dated contracts at a higher price.

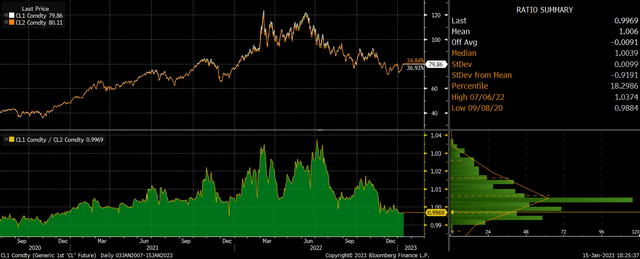

2022 was a rare period of backwardation in WTI prices, with near-term prices trading above those several months in the future. This had an extremely positive impact on the USO, which actually managed to outperform front-month WTI by over 20%. However, such outperformance should certainly not be expected to continue as the futures curve has moved back to its normal state of contango.

Front Month WTI Vs Following Month Future (Bloomberg)

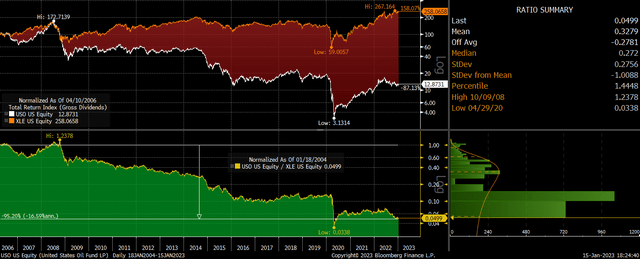

Another drag on the fund’s long-term performance is the high expense fee of 0.79%, which is particularly problematic considering that the USO does not provide any income. When we take into account the negative roll, high expense ratio, and lack of dividend yield, it is difficult to make the case for buying this ETF over the long term rather than energy stocks. The chart below shows the performance of the USO versus the Energy Select Sector SPDR ETF (XLE) over the past 16 years, with the USO underperforming by a shocking 16% annually.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.