[ad_1]

vm

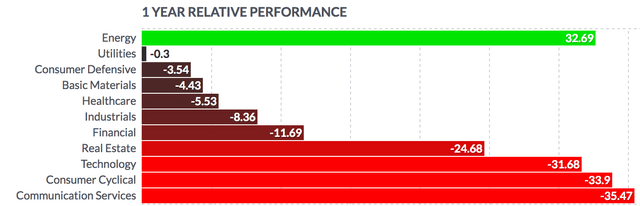

Does your portfolio include any exposure to the utilities sector? This defensive sector was the second-best performer over the past year, behind the surging energy sector. The utilities sector nearly broke even during a year in which the other nine sectors struggled mightily, registering losses from -3.5% to -35%:

fnvz

Rather than trying to stock pick, you can get broader utilities coverage via utility funds, such as the Reaves Utility Income Fund (NYSE:UTG), which is a closed end fund. (Given the problems with wild fire risk for some utilities on the west coast, diversifying via a fund could give you more protection.)

We’ll compare UTG to its sister fund, the Cohen & Steers Infrastructure Fund (UTF) in this article. Although the two funds have different percent sector concentrations, there’s overlap, with UTF having ~39% Utilities sector exposure.

Profile:

UTF’s objective is to provide a high level of after-tax total return consisting primarily of tax-advantaged dividend income and capital appreciation. It intends to invest at least 80% of its total assets in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry. The remaining 20% of its assets may be invested in other securities including stocks, money market instruments and debt instruments, as well as certain derivative instruments in the utility industry or other industries. (UTG site)

UTF’s objective is to achieve total return, with an emphasis on income. Under normal market conditions, the Fund will invest at least 80% of its managed assets in securities issued by infrastructure companies, which consist of utilities, pipelines, toll roads, airports, railroads, ports, telecommunications companies and other infrastructure companies. (UTF site)

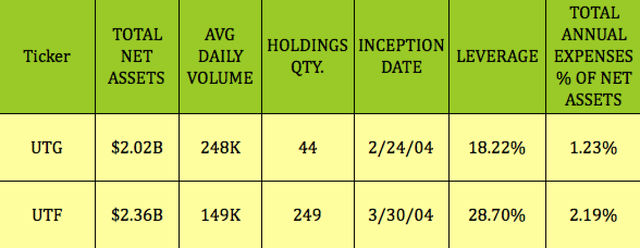

Both funds were established in early 2004, and both use leverage, with UTG using ~18%, and UTF using much more, ~29%. The asset bases are roughly similar, $2B for UTG and $2.4B for UTF, whereas UTG has much higher volume, at 248K, vs. 149K for UTF.

UTG has a narrower holdings base, with 44 positions, vs. 244 for UTF, and also has a lower expense ratio, at 1.23%, vs. 2.19% for UTF:

Hidden Dividend Stocks Plus

Dividends:

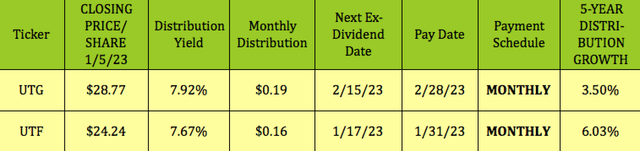

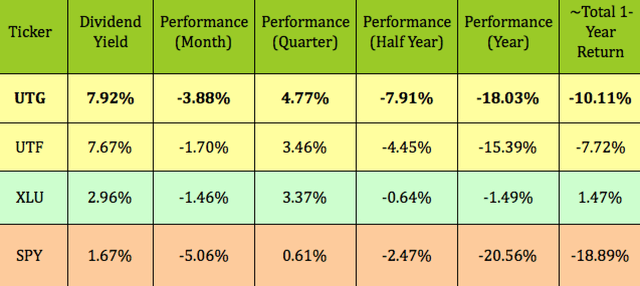

Both funds pay monthly, with UTG having a slight edge in dividend yield, at 7.92%. However, UTF has a much higher five-year dividend growth rate, at 6%, vs. 3.50% for UTG.

Both funds already declared their Q1 2023 ex-dividend and pay dates – UTG goes ex-dividend next on 2/15/23, with a 2/28/23 pay date. UTF goes ex-dividend on 1/17/23, with a 1/31/23 pay date.

Hidden Dividend Stocks Plus

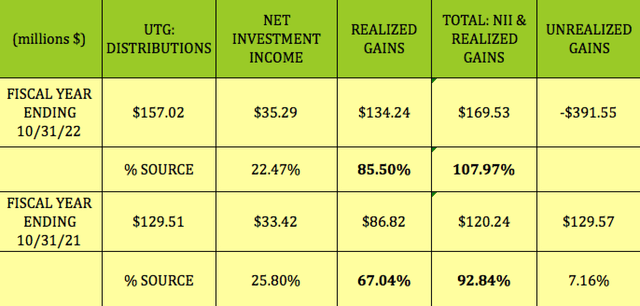

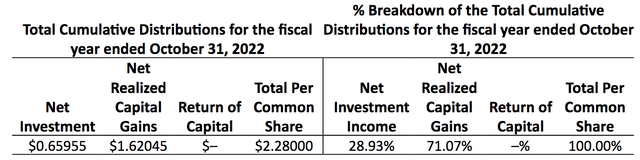

UTG covered its fiscal year ending 10/31/22 distributions by a factor of ~1.08X, with 85.5% coverage coming from capital gains, and 22.5% coverage coming from net investment income. Its overall coverage factor improved, vs. the 92.8% coverage it had for its previous fiscal year:

Hidden Dividend Stocks Plus

Taxes:

UTG’s fiscal year ending 10/31/22 distribution sources were a bit different for tax purposes, characterized as ~71% capital gains, and ~29% Net Investment Income, with 0% Return of Capital:

UTG site

Holdings:

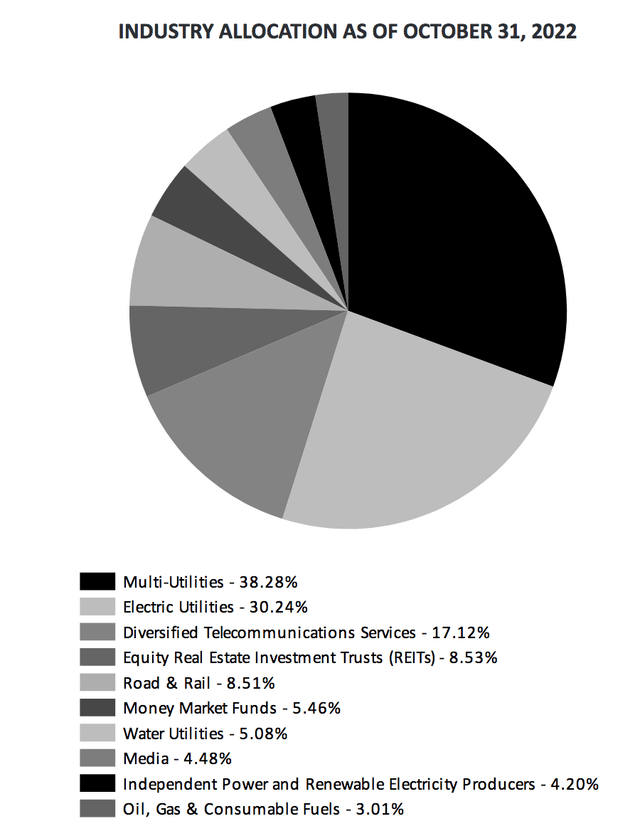

UTG has ~78% exposure to the Utilities sector, with its top allocation being in diversified utilities, at ~38%, followed by electric utilities, at ~30%.

Surprisingly, UTG’s next largest sub-sector holding is in telecoms, at ~17%, part of the beaten-down communications services sector, the worst performing sector over the past year, having lost -35%. UTG also holds REITs and railroad holdings, both at ~8.5%:

UTG site

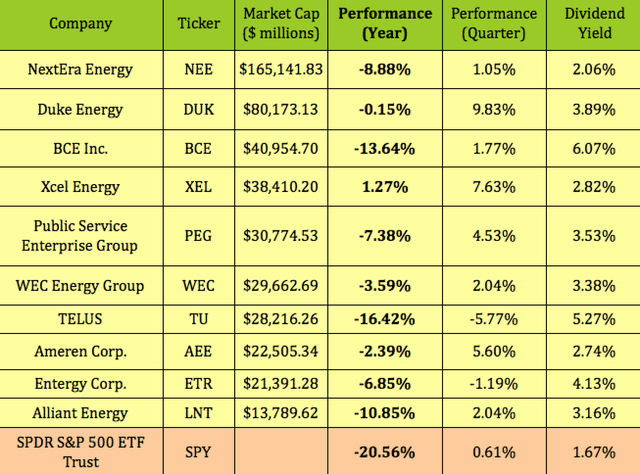

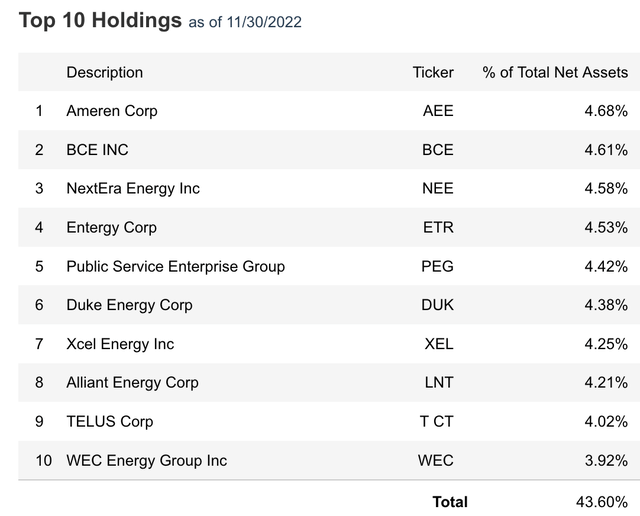

UTG’s top 10 positions form 43.6% of its portfolio, with positions running from ~4 to 4.7%. Management chose well – all of these tickers outperformed the S&P 500 over the past year, and most of them have outperformed it over the past quarter

Xcel Energy (XEL) was the best performer in UTG’s top 10, rising 1.27% over the past year, while Telus (TU) was the worst, falling -16.42%.

Other than Telus and Entergy, all of these top 10 holdings have outperformed the market over the past trading quarter:

Hidden Dividend Stocks Plus

UTG site

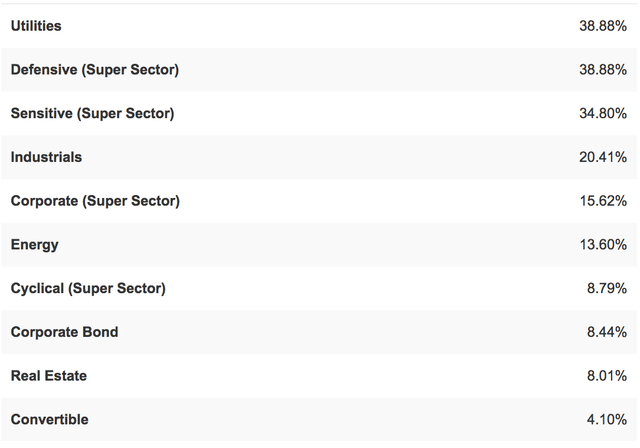

UTF’s sector holdings include 39% exposure to Utilities, followed by 20% in Industrials, 14% in Energy, and 8% in Corporate Bonds and Real Estate.

UTF site

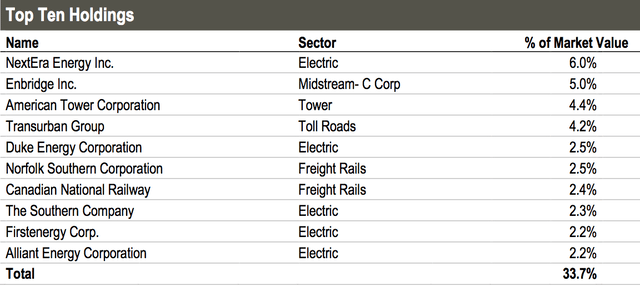

UTF’s top 10 positions comprise ~34% of its portfolio, with ~15% in Utilities, and ~19% in Infrastructure. Enbridge (ENB) was a standout over the past year, gaining 1.6%, while American Tower (AMT) lost -25%, so there was a wider dispersion of performance in UTF’s top 10 than in UTG’s.

UTF site

Performance:

UTG and UTF have both outperformed the S&P 500 over the past month, quarter and past year, with UTF delivering a -7.72% 1-year total return, and UTG generating a -10.11% 1-year total return.

UTF outperformed UTG over the past year, half year, and month on a price basis, and also outperformed it on a total return basis.

Hidden Dividend Stocks Plus

Valuations:

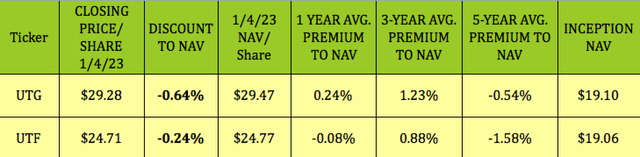

Buying CEF’s like UTG and UTF at a deeper discount than their historical average discounts/premiums ca be a useful strategy, due to mean reversion. CEFs‘ daily NAV/share valuations are calculated after the market close.

As of the 1/4/23 close, UTG was selling at a -0.64% discount to NAV, cheaper than its 1-,3-, and 5-year premiums of 0.24%, 1.23%, and -0.54%, respectively.

UTF’s 1/4/23 discount to NAV/share was -0.24%, cheaper than its 1- and 3-year premiums of -0.08% and 0.88%, but not as cheap as its -1.58% 5-year discount:

Hidden Dividend Stocks Plus

Parting Thoughts:

Will we have another volatile year in 2023? So far it seems that way, with leaps and dips coming fast and furious. If that’s the theme for 2023, some Utilities exposure would probably be a good idea for your portfolio.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.