[ad_1]

imaginima

The Reaves Utility Income Fund (NYSE:UTG) has many positive investment attributes. It has a stable and increasing distribution, currently yielding 7.1%. It invests primarily in defensive utility and near-utility companies. However, as detailed in the Annual report, rising interest rates are a headwind for UTG. Since I believe we are still in a rising interest rate cycle, UTG’s leverage will act as a headwind and cause the fund to underperform. I recommend investors stay on the sidelines or switch to non-levered defensive funds like the XLU for now.

Fund Overview

The Reaves Utility Income Fund is a closed-end fund (“CEF”) that primarily invests in equities and bonds of companies that operate in the utilities sector. The fund has $2.2 billion in net assets.

Strategy

The fund’s strategy is to provide tax-advantaged dividend income and capital appreciation to unitholders. It invests at least 80% of its total assets in dividend paying common and preferred equities and bonds of companies in the utility industry. The remaining 20% may be invested in other equity and bond securities, including derivative instruments on utilities.

The fund manager, Reaves Asset Management, employs a combination of qualitative (management interviews, field research, macro analysis) and quantitative processes (modeling, valuation, technicals) to select its investments.

As detailed in UTG’s annual report, the fund mainly uses simple equity option strategies such as writing covered calls and purchasing calls or selling puts. The fund may also use interest rate swaps to hedge interest rate risk, although none were used as of the annual report’s date (October 31, 2021).

UTG may employ modest amounts of leverage to achieve its goals. As of July 31st, UTG has a $450 million leverage facility, or 21% leverage.

Portfolio Holdings

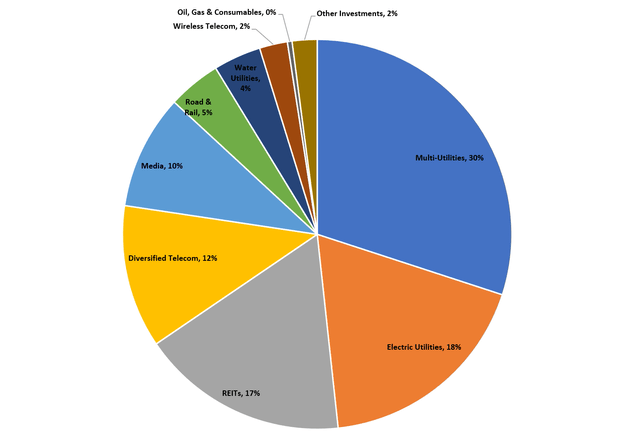

As mentioned in the fund strategy above, UTG primarily invests in equities of utility companies. Figure 1 shows UTG’s investment allocation as of the Q3/22 holdings report.

Figure 1 – UTG holdings, July 31, 2022 (Author created from holdings report)

The portfolio’s top 10 positions account for 36% of the total portfolio, and there are 41 long positions in total. The portfolio turnover rate is low, at 20% for Fiscal 2020.

Figure 2 – UTG top 10 holdings (utilityincomefund.com)

Returns

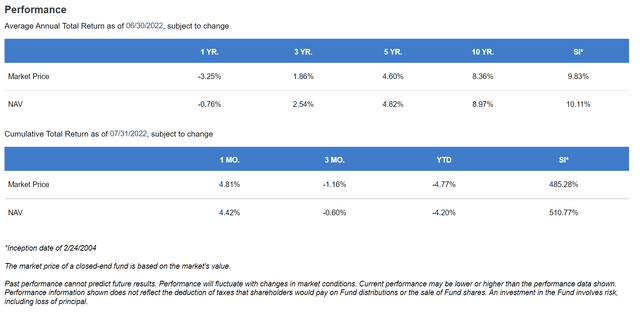

UTG’s returns to date have been mediocre, reflecting the conservative nature of its investment portfolio. It has a 3/5/10Yr average return of 1.9%/4.6%/8.4% respectively, to June 30, 2022 (Figure 3).

Figure 3 – UTG returns (utilityincomefund.com)

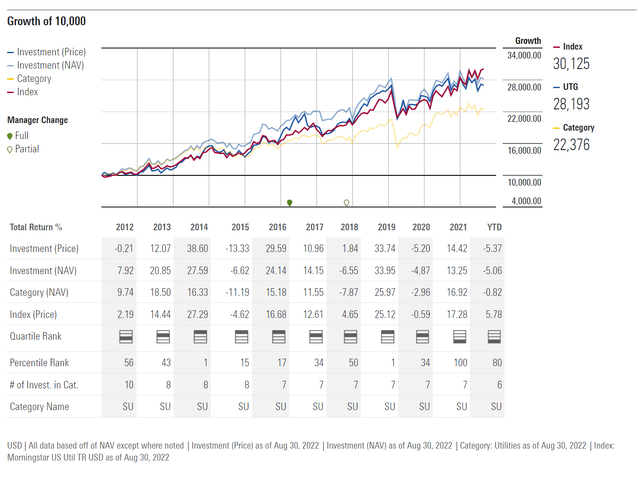

Interestingly, UTG has historically performed well against peer utility funds, ranking in the top 2 quartiles from 2013 to 2020, as shown in Figure 4. However, 2021 and YTD 2022 have been poor, with UTG ranking in the fourth quartile.

Figure 4 – UTG versus peers (morningstar.com)

Distribution & Yield

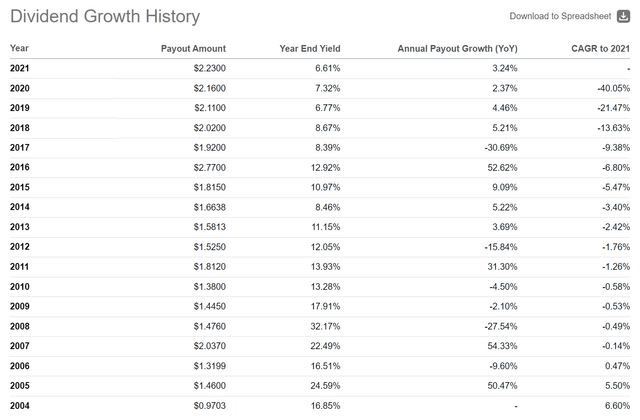

UTG pays a moderately high distribution yield, currently set at $0.19 / month for 7.1% current yield. The fund has consistently paid a monthly distribution since inception, and the monthly base distribution has grown at a 3.5% CAGR in the past 5 years, from $0.16 / month in 2017 to the current $0.19 / month (Figure 5). UTG also pays a special year-end distribution from time to time. The last special distribution of $0.92 / share was paid in December 2016.

Figure 5 – UTG pays a consistent monthly distribution (Seeking Alpha)

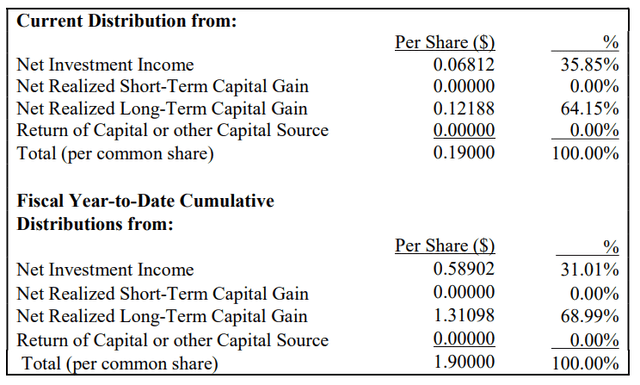

YTD August, about 69% of the fund’s distributions have come from realized long-term capital gains, and 31% have come from net investment income (Figure 6). Historically, UTG have been able to fund most of the distributions from net investment income and realized capital gains. The last time Return-of-Capital (“ROC”) was employed to pay distributions was in Fiscal 2020, when 8.3% of the $2.16 in distributions came from ROC.

Figure 6 – UTG Distribution source, August, 2022 (utilityincomefund.com)

Fees

Management fees for UTG is above average, but not outrageously so like some other CEFs that I have reviewed recently. Reaves Asset Management is paid 0.575% of total assets up to $2.5 billion, and 0.525% of total assets above. Total expenses, excluding interest expense, as a % of average net assets attributable to common shareholders were 1.05% in Fiscal 2021 and 1.09% in Fiscal 2020. Including interest expense, the figures would have been 1.23% and 1.50% respectively.

For context, the Utilities Select Sector SPDR ETF (XLU) has an expense ratio of 0.10%.

Risk

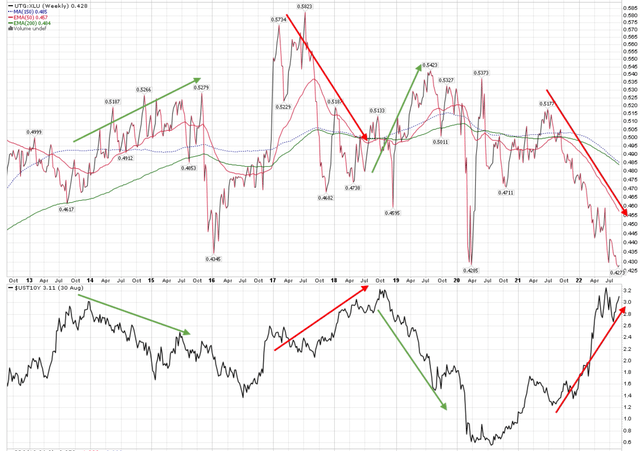

Utilities, as long duration assets, typically react negatively to rising interest rates. As UTG also employs modest amounts of leverage from a floating rate credit facility (OBFR+0.8%), the fund is therefore negatively impacted by rising interest rates on both its assets and liabilities. In fact, this could be the reason why UTG performed poorly (fourth quartile as per figure 4 above) in 2021 as interest rates came off their lows.

When we overlay the relative performance of UTG vs. the XLU ETF (inclusive of distributions), we see that in general, rising interest rates have seen UTG underperform XLU, and vice versa (Figure 7).

Figure 7 – UTG vs. XLU overlaid with US10Yr Yields (Author created with price chart from stockcharts.com)

Also, UTG’s leverage and closed-end nature make it susceptible to panic selling as was seen in mid-2015 during the China devaluation scare, and in March 2020 during the COVID-19 pandemic.

Conclusion

In summary, I can understand the positive attributes that investors see in UTG. It has a stable and increasing distribution, currently yielding 7.1%. It invests primarily in defensive utility and near-utility companies. However, as I personally believe interest rates are still in an increasing cycle, UTG’s leverage will act as a headwind and cause the fund to underperform. I recommend staying on the sidelines for now, or switching to a non-levered defensive fund like the XLU until the interest rate cycle ends.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.