[ad_1]

Getty Images

Fundamentally, Volkswagen (OTC:VLKPF) is undergoing turbulence amid near-term macro headwinds. Over the long run, though, VW looks set to ride the secular transition towards electric mobility, leveraging its superior economies of scale to get EV profitability on par with its legacy combustion engine (ICE) business.

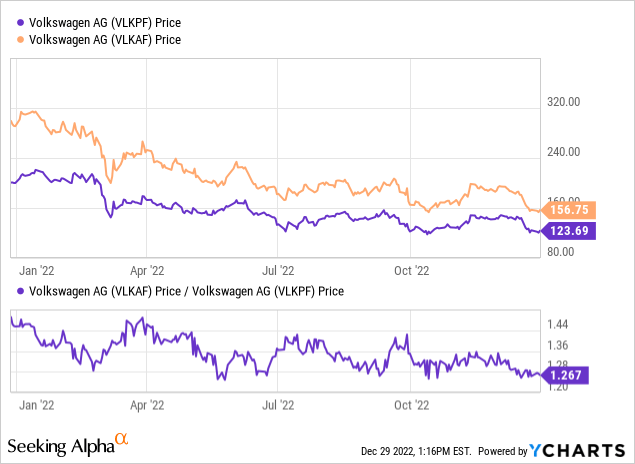

Yet, the implied valuation of the VW business ex-Porsche has further lagged following the Porsche SE (OTCPK:POAHY) listing, with Porsche’s post-IPO outperformance leading to Porsche commanding an implied market cap far in excess of VW. Between the ordinary share class and the preference shares, I would favor the latter – it has a larger % free float and trades at a wide discount to the ordinary shares. Potential near-term catalysts include the Planning Round 71 (PR71) event in March 2023 and the Capital Markets Day in Q2 2023, where CEO Blume’s updated views on key topics like mobility and China, as well as progress on the ten-point plan, will be worth monitoring.

EV Transition on Track but Hitting Road Bumps

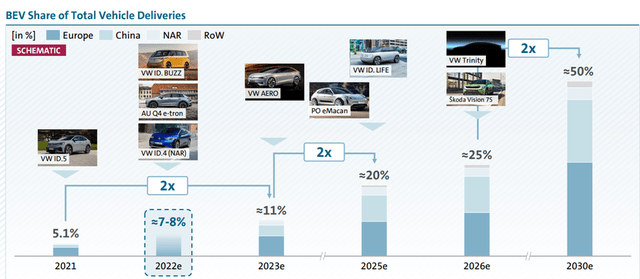

VW was one of the first global mass market ICE players to commit to the battery electric vehicle (BEV) transition with its dedicated MEB platform in 2019. Since then, its efforts appear to be paying off – the outsized investment in BEVs has led to a relatively high BEV market share for VW. While the near-term outlook will be challenging for VW, following widespread global semiconductor shortages and emerging consumer weakness, deliveries have been strong. Relative to VW’s 7-8% target range, its share of BEV deliveries is up to ~7% this year, paving the way for a raised mid-term bar at the upcoming PR71/CMD events next year.

Volkswagen

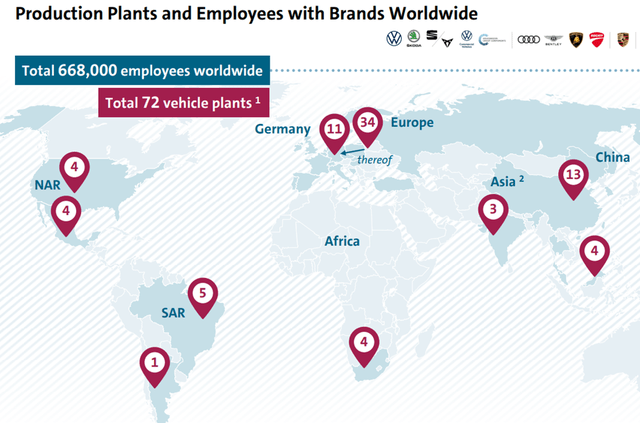

My key concern, however, is VW’s significant scale and manufacturing footprint in Germany. With most of its production currently ICE-based, the transition process will be more complex and require strong execution relative to its nimbler, EV-focused peers.

Volkswagen

In the meantime, management will also need to contend with prolonged product cost headwinds into the coming years, particularly on raw materials and labor costs. In recent months, the YTD rally across many of its input commodity metals has eased, but lithium, a key input cost for EVs, remains elevated.

With the Russia/Ukraine conflict also showing few signs of moderating, expect energy-related costs and raw material headwinds to continue into FY23 as well. By extension, management’s ability to limit wage hikes will be key – negotiations with the IG Metall labor union have already seen VW give out a ~9% pay increase over FY23/24 (including bonus payments), and similar wage inflation could soon follow in its other operating regions.

A More Discerning Capital Allocation Policy

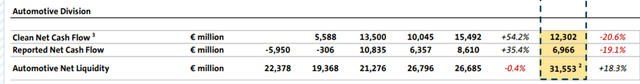

Since VW’s decision to ramp up its total expenditure through FY26 to EUR159bn (up from EUR150bn prior) at its last Planning Round, the adverse shift in operating conditions might necessitate a budget realignment. On paper, VW has enough liquidity to fund its plans – the company has sustained automotive net cash flow of EUR14-15bn (i.e., after capex) in recent years and has raised additional funding from the recent Porsche listing and hybrid equity issuances.

The question, however, is whether VW’s current levels of underlying free cash flow are sustainable as we head into a weaker macro/consumer environment next year. For now, VW’s massive >EUR30bn automotive net liquidity position gives it optionality.

Volkswagen

While the current VW valuation indicates market expectations for more near-term funding increases to buffer against the near-term risks, management seems to (rightly) favor pulling back on underperforming investments. The decision by Ford (F) and VW to stop investments in Argo AI is a case in point, although it will also entail one-off impairment charges ahead (F has already taken ~$2.7bn in Q3 for Argo). While pre-tax impairments will hurt the headline P&L numbers, it allows VW to strategically funnel cash flow into more productive areas within the e-mobility space. Perhaps most importantly, a more discerning allocation strategy negates funding/dilution risks for investors.

A Deeply Discounted Play on the EV Transition

Despite the near-term production headwinds, there remains a lot to like about the long-term VW story. Relative to the other major ICE manufacturers, the company is at the forefront of the shift towards electrification and software/mobility, with its scale economies allowing for an accelerated path toward BEV/ICE margin parity.

Yet, the valuation is exceedingly cheap adjusted for the ~75% Porsche stake – post-listing, the implied market cap of Porsche prefs is higher than VW Group, and by the end of the month, the Porsche prefers further outperformed VW prefs. Thus, VW offers investors a deeply discounted vehicle to gain exposure to the Porsche growth story and the secular EV transition via its ordinary and preferred share classes. Given the higher % free float and wide discount to ordinary shares, the prefs represent a cheaper way to express a bullish view. From here, key catalysts include PR71 and the CMD event in Q2 2023, along with any new listing announcements by CEO Blume.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.