[ad_1]

Sean Gallup

Background

Vonovia (OTCPK:VONOY) (OTCPK:VNNVF) is Germany’s leading residential real estate company. Vonovia currently owns and manages ~550k of residential units mostly in Germany but with some apartments also in Austria and Sweden.

Whilst rental income from holding residential apartments is its main business, it also has additional segments that include:

1) Property development segment

2) Recurring sales (disposal of non-core apartments)

3) Value-add services (e.g., craftsmen, media, etc.).

Vonovia (VNA) shares remain under significant pressure and are now trading at just over 0.4x net asset value (“NAV”). I see this as an absolutely compelling opportunity with an asymmetric risk/reward profile. I also see a clear path for Vonovia to retrace much of the share price decline suffered this year.

I have already written 2 articles on this opportunity here and here. For readers that are unfamiliar with VNA, I suggest that they read these articles so that you have the full background.

In this article, I will update my thesis and discuss the upcoming catalysts.

To recap, the main reason for the share price collapse is the increased cost of capital due to higher rates in the Eurozone. Currently, Vonovia’s cost of debt is 1.2% with an effective maturity of 7.7 years. To refinance the debt currently, Vonovia’s cost of debt is likely to be in the range of 3% to 4%. As such, this renders its previous business model of debt-funded inorganic M&A not tenable any longer. It is also no longer economical for Vonovia to refinance its debt at such costs and it is effectively forced to deleverage.

The management team reacted and has earmarked EUR13 billion of assets for disposal. However, it didn’t commit to specific timelines for obvious reasons (never a good thing to negotiate with a deadline gun to your head).

The proceeds should be utilized for debt reduction as well as share buybacks.

The apparent concern in the market is that Vonovia will not be able to sell properties quickly enough or at a price that is close enough to book value given macroeconomic uncertainties and higher interest rates. Both of these fears are somewhat unwarranted in my view. In a recent interview with Bloomberg (referred to in this article), the CEO Mr. Buch provided an update:

“We have rarely seen such strong interest in properties that we have for sale,” Buch told Bloomberg recently. Unlike some warning voices, the manager sees no risk of a crash for the German real estate market. According to him, the properties for sale include apartment buildings in major German cities, such as Munich, which would typically attract wealthy buyers, families and municipalities.

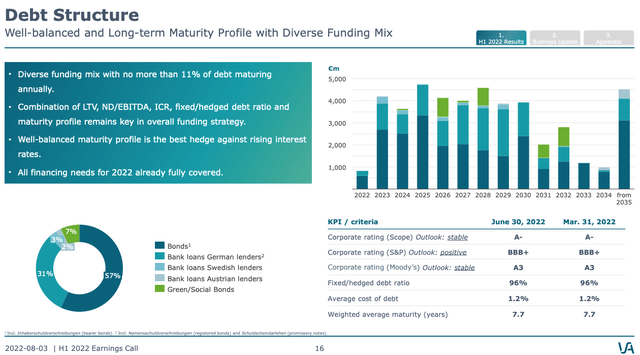

The debt structure

It is important to understand Vonovia’s debt structure and refinancing schedule. As noted above, the average cost of debt currently is 1.2% and the weighted average maturity is 7.7 years. The refinancing schedule is shown in the below slide:

Vonovia Investor Relations

Overall, Vonovia has EUR43.5 of adjusted net debt but maturities are spread over many years. For 2022, the refinancing needs have already been addressed. Vonovia also expects its subsidiary Deutsche Wohnen to dispose of the nursing portfolio (~EUR1.2 billion), so the remaining refinancing needs for 2023 are ~EUR3 billion and for 2024 around EUR3.8 billion. This is very manageable given the disposal program announced and commentary as per above from the CEO on robust demand from investors.

The JV Structure

Vonovia is also in the process of assessing a JV structure. Essentially, this entails institutional investors purchasing an interest in certain portfolios. This is above and beyond the EUR13 billion portfolio earmarked for sale. There are a number of advantages to this structure and these include:

- Vonovia can execute a large transaction quickly and release capital (as opposed to the piecemeal disposal program.

- There are no tax leakages as Vonovia is not selling the underlying property, but rather issues shares in a Special Purpose Vehicle (“SPV”) holding the designated portfolio

- Vonovia retains the income stream for asset management of the portfolio.

All in all, this is a very attractive structure and accretive for shareholders especially if priced near book value and proceeds are applied for share buybacks as well as debt reduction.

The catalyst

The catalyst is very straightforward. Vonovia needs to demonstrate that it can sell properties at or near book value, deleverage (ever so slightly to low 40s LTV), and buyback shares. A JV structure would be a huge positive as discussed above. Progress announced will likely create a short squeeze.

Final thoughts

Investors seem to be throwing the baby with the bathwater. The current share price does not make sense whatsoever, even if you assume a 10% nominal decline in German real estate.

There are also a number of additional tailwinds. These include synergies from the acquisition of Deutsche Wohnen of EUR105 million. Rental income should also materially increase as recent Mietspiegels indicate a much higher adjustment for rents (albeit this will show in the financials materially from 2024 onwards).

Finally, the German real estate market is in chronic short supply in the key geographic areas Vonovia operates in. The vacancy rate is very low, replacement cost is extremely high and construction of new apartments is well below demand levels. Vonovia is well placed to capitalize on these secular trends including modernization and energy efficiency.

I see this as a generational opportunity to arbitrage the private and public market for real estate in Germany. I remain very bullish.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.