[ad_1]

bloodua

Office REITs in the pre-pandemic era broadly formed stable investments that had solid fundamentals and a growing dividend profile. The sick man of REITs then was mall owners who faced disruption from the digitization of the shopping experience. The REIT investment orthodoxy has changed dramatically since then with the pandemic and the subsequent establishment of working from home as a core part of the post-pandemic world of work. This has created a material level of uncertainty for the future of New York-focused office landlord Vornado Realty Trust (NYSE:VNO).

Whilst the REIT last paid out a quarterly per share cash dividend of $0.53, in line with the prior payout, there is a high likelihood of this being cut in the near future with fellow New York office REIT SL Green (SLG) recently slashing its own dividend payout. A REIT with an uncertain dividend future is truly like a fish out of water. I’ve pivoted more heavily to REITs recently and a dividend cut represents one of the worst-case scenarios because it not only results in a loss of income but also a reduction in the price of the commons as investors sell out.

The Commons Are Backed By Stable Financials But A Dividend Cut Is Coming

The company owns 64 properties in Manhattan which consist of 20.1 million square feet of office space in 31 of the properties, 2.6 million square feet of street retail space in 58 of the properties, and seven residential properties with an aggregate of 1,671 units. Vornado Realty also owns an office in San Francisco and Chicago including the iconic Merchandise Mart. These all meant revenue for the company’s last reported earnings for its fiscal 2022 third quarter came in at $457.43 million, an increase of 11.8% from the year-ago period and a beat by $21.14 million on consensus estimates.

Leasing activity was somewhat below trend during the quarter at 450,000 square feet, with management blaming a slowing market but with a leasing pipeline in New York of 1.5 million square feet. The key headwind for Vornado Realty is of course rising Fed fund rates against a trailing 12 months debt-to-capital ratio of 56%. This is around 15% higher than its peer group average and saw the company conduct a high degree of transactions to extend its near-term debt maturities and unsecured revolving lines of credit. The former will mean no debts coming due in 2023 and only around $233 million coming due in 2024. Fed fund rates were hiked by 50 basis points in December and are reportedly set for a further three 25 basis point hikes to reach a 17-year high of 5% to 5.25% from its current level next year.

Hence, the company will continue to experience pressure with FFO during the quarter of $0.79 declining by $0.03 from the year-ago comp. Whilst this covers the dividend on the commons, the company indicated during the earnings call that their Board of Trustees is moving to reduce the dividend in 2023 as they now expect FFO to be lower next year.

The Preferreds Offer Safety With A 60% Upside Potential

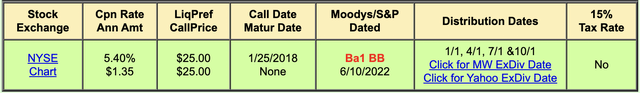

The Series L Cumulative Redeemable Preferred Shares (NYSE:VNO.PL) are an attractive alternative option for prospective Vornado Realty investors. They currently trade hands for $15.71 per share, around a 60% discount to their hard $25 redemption value. These have fallen nearly 38% year-to-date on the back of the broader torrid macroeconomic backdrop characterized by rising interest rates and the specter of a recession.

I think this is a short-term mispricing opportunity and hold the view that these will return back to their intrinsic value as inflation eases and Fed fund rates stop rising. How safe is the coupon? They rank higher than the common share dividends and are unlikely to be cut. Vornado Realty expects some FFO volatility but the company is still experiencing decent leasing demand and FFO is still positive and more than enough to cover the preferred dividends.

Owners of the preferreds are essentially being paid to wait with a safe $1.35 per share annual coupon, which amounts to an 8.6% yield. They are currently trading past their call date by nearly five years but are unlikely to be redeemed anytime soon. Vornado Realty would be unlikely to be able to access financing lower than the current 5.4% coupon rate to fully pay off the $300 million market value of the preferreds.

Even against the working-from-home trend, the preferreds will still have a near 60% upside unless the bears can prove that there should be a permanent discount to a security with a hard intrinsic value. A lot of the current financial headwinds are due to the fiercely destructive rising rate environment. Eventually, this will ease and change the dynamics to the upside. The preferreds are definitely worthy of some consideration here but I’m neutral on the company.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.