[ad_1]

franckreporter/iStock Unreleased via Getty Images

Walmart (NYSE:WMT) is the largest brick and mortar retail media network in the US and has been investing in omnichannel retail for years. Its advertising capabilities include sponsored search, onsite display, and programmatic Ad through its exclusive DSP powered by The Trade Desk (TTD). Walmart’s $2B revenue from Advertising appears invisible relative to its total $573B revenue. But this emerging, and highly profitable business may materially boost Walmart’s bottom line considering the operating margin difference of at least 50% or onsite advertising vs 4% for its retail business.

Retail Media Network is rapidly growing ang gaining shares of Ads budget from Social Network

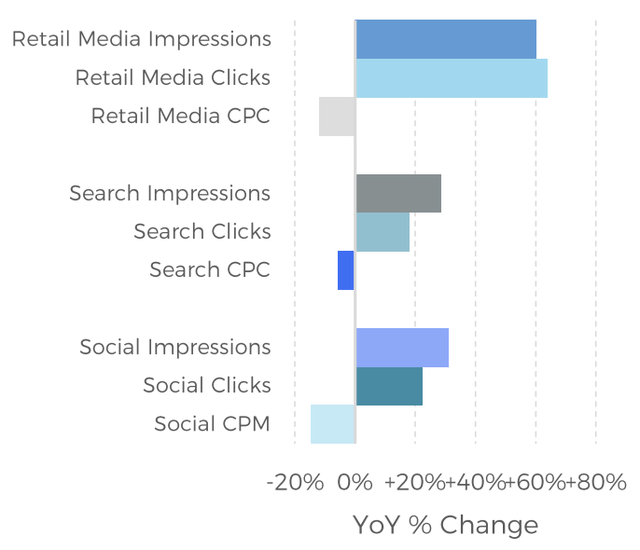

Retail Media Networks (RMNs) refer to ad spending that ties directly back to actual purchases in e-Commerce or brick-and-mortar sales. According to Skai’s Q3 report, Retail Media Ad volume (number of impressions, and number of clicks) growth rates were much higher than search and social, indicating RMNs gaining budget shares. According to IAB, RMN’s share of ad spend grew from 16% in 2019, 21% in 2020, to 25% in 2021.

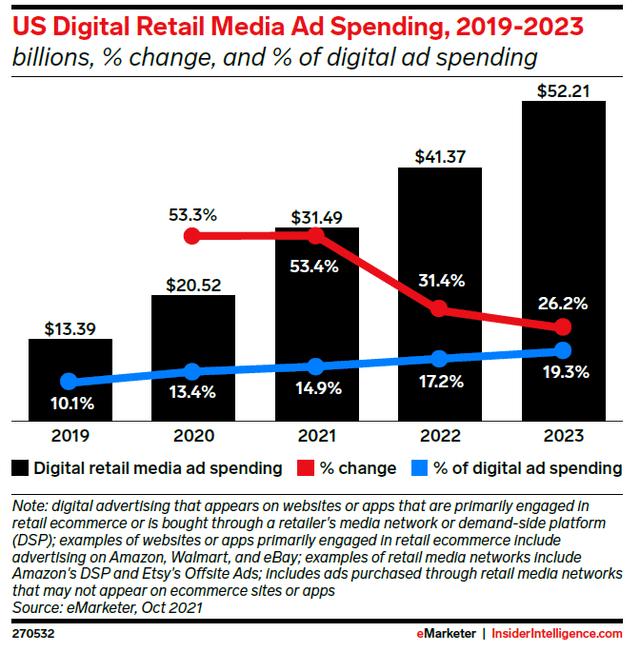

For US alone, Digital Retail Media Ad Spend will grow to $52B in 2023 (+26% YoY).

Retail media is gaining traction from advertisers for many reasons. According to eMarketer, there are five key drivers: 1) First-Party data; 2) Closed-Loop attribution; 3) Contextual relevant Ads; 4) Audience at scale; and 5) Full-funnel ads (performance and brand). IDFA on iOS (2021) and Cookie deprecation on Android (2024) also contribute to the budget shift from Social Ads to RMNs.

Retail media is also a big bet for retailers. Besides how well retailers are positioned for ads monetization, the high profitability of Ads business is another motive, especially considering mid or low single-digit margins of Retail businesses.

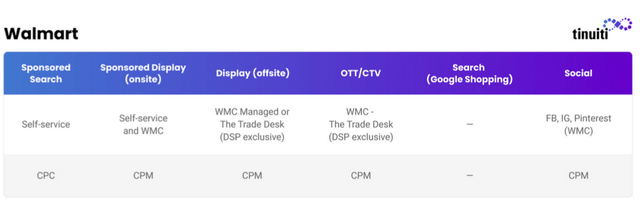

Walmart now has a decent portfolio of Ads products

The following figure shows Walmart’s Ads offerings, covering a full funnel.

Walmart’s innovation has been fast-paced. In Q3-21 it announced the partnership with The Trade Desk, tapping in programmatic ads onsite and offsite. In Mar-22, Walmart announced it was adding formats to its retail media offering, including video and in-store ads. In Jul-22, it introduced a second-price auction model.

Admittedly, it’s still early stage for Walmart, but there are a few things that are leading indicators that investors should take into account when thinking about its future scale.

– API Partners: Walmart has collaborated with 14 API Partners to help drive demand.

– Video-focused closed-loop measurement: Walmart is now offering closed-loop measurement for its innovation partners including TikTok, Snap, Roku, Firework and TalkShopLive.

– ROAS: In Q2-22, Walmart ROAS for its sponsored Ads was $4.83, reaching parity with the best-in-class ROAS.

Walmart’s EPS is estimated to reach $12 in 2026E, as compared to $6 in 2022E

As Walmart continues to grow its scale in Retail Media Advertising, I forecast Walmart’s EPS to double by 2026E from its current $6 EPS. $12 EPS in 2026E is based on 1) Advertising revenue growing from $2.2B in 2022E to $9B in 2026E (a 4-year CAGR of 40%), and 2) Company Operating Margin increasing from 4% in 2022 to 6% in 2026E.

The sanity check we can do here is that if we assume Walmart eCommerce Net-Sales represents 30% of its total Net-Sales by 2026E, the Advertising Revenue as a % of its eCommerce Net-Sales is about 4%. Additionally, my forecast of Ad revenue is close but slightly lower than what eMarketer estimated ($4.2B by 2024E in my forecast, vs $4.5B by 2024E from eMarketer).

Applying 18x P/2026 EPS, I am seeing ~50% upside from its current price.

Conclusion

The growth trajectory I have baked in my forecast requires a lot of thinking-big and high-conviction investments and execution for Walmart to get there. This forecast is somewhere between its base case and its upside scenario. The main risk I am seeing here is whether Walmart’s DSP, CTV, and API partners will be able to execute quickly and help accelerate its growth. At this point, we do not have a lot of evidence. Most of the goodness seems to have just started. Speed matters.

That said, in my opinion Walmart’s omnichannel scale today may allow it to continue doubling down in Retail Media Network so as to generate attractive earnings for its shareholders. It would likely take Walmart several years to develop a best-in-class suite of ads capabilities, but its near-term monetization will directly benefit from its DSP, CTV, and API partners, and show meaningful progress in their 2023 financials. In my forecast I have assumed $3.1B Ads revenue in 2023E, +41% YoY.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.