[ad_1]

The Fed says go, go, go, the markets’ say whoa, whoa, whoa

There is a lot of uncertainty on the Fed outlook and just how fast and how far will the FOMC go in hiking rates in orders to bring inflation down to the 2% average target.

Though Chair Powell gave no clear indication in last Wednesday’s press conference that the Fed was near done with its mission, the markets nevertheless heard what they wanted to hear, putting on a dovish spin and pricing in a pivot to rate cuts in the spring of 2023.

But over the last week policymakers have been out in force, including several doves, strongly contradicting that outlook.

They have stressed the necessity of getting to restrictive territory while playing down the fear that the economy is already in recession.

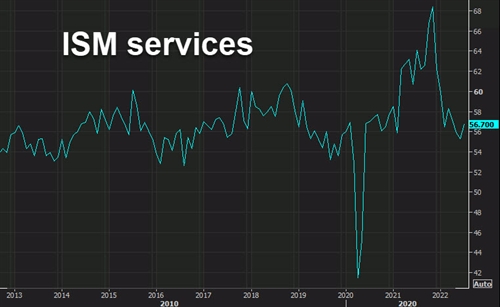

Meanwhile, the U.S. ISM-NMI services index rose to 56.7 from a 2-year low of 55.3 in June that was last seen in February of 2021, translated to an ISM-adjusted ISM-NMI rise to 54.3 from a 2-year low of 53.7 in June.

Today’s rise joins big declines for the ISM, Chicago PMI, Dallas Fed and Philly Fed, but gains for the Richmond Fed and Empire State, to leave an 8-month producer sentiment pull-back from robust November peaks.

Surging interest rates and a flattening in real household spending as prices rise are aggravating the downtrend, though sentiment also faces support as businesses continue to restock.

The ISM-adjusted average of the major sentiment surveys in July fell to a 2-year low of 52 from prior lows of 53 in June and 54 in May. Analysts saw a 62 all-time high in both November and May of 2021. Analysts expect a 52 average in Q3, after averages of 55 in Q2, 57 in Q1, and 60 in Q4.

The futures are now repricing for about a 50-50 risk for a third straight 75 bp hike in September.

Federal Reserve Bank of St. Louis

Meanwhile, the hawk Bullard continues to look for a policy rate around 3.75% to 4% by year-end, though implied Fed funds still reflect a terminal rate in the 3.5% area.

Analysts continue to project a 50 bp boost in September followed by 25 bps in November and December to bring the median funds rate to 3.375%.

STOCKWINNERS

To read timely stories similar to this, along with money making trade ideas, sign up for a membership to Stockwinners.

This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility.

[ad_2]

Image and article originally from www.stockwinners.com. Read the original article here.