[ad_1]

Altayb/E+ via Getty Images

Thesis

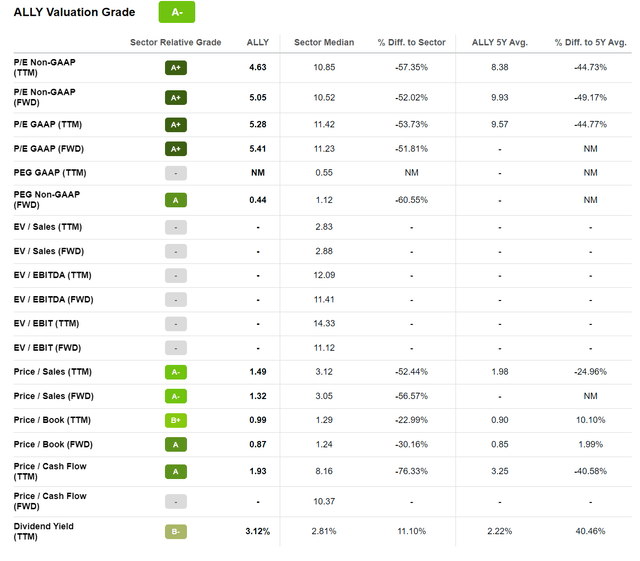

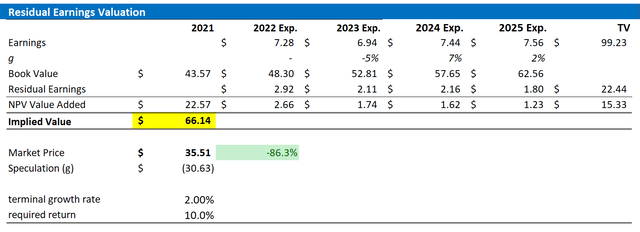

Berkshire Hathaway Inc.’s (BRK.A, BRK.B) SEC 13F filing for the June quarter revealed that Warren Buffett is betting big on Ally Financial Inc. (NYSE:ALLY). Buffett increased his stake in the company by 234.47%, now valued at approximately $390 million, and with a 9.7% stake in the company. This makes Berkshire one of Ally’s biggest shareholders. Is there a value thesis? The short answer is yes. Ally trades at a one-year forward P/E of about x5 and a P/B of below x1. Personally, I believe Ally should be valued at approximately $66.14/share and I see about 85% upside. I anchor my thesis on the results of a residual earnings model based on analyst consensus EPS estimates until 2025.

For reference, Ally stock is down about 35% YTD, versus a loss of nearly 15% for the SPX.

About Ally Financial

To simplify, Ally is primarily focused on sourcing, structuring and operating auto loans and financing across the loan cycle. In recent years, Ally has also pushed a digital banking initiatives and has managed to accumulate substantial numbers of consumer deposits.

Ally Financial is one of the United States’ largest auto lenders and bank holding companies. The company was founded by General Motors (GM) in 1919 and was a subsidiary of GM until 2006, shortly before the company needed to be bailed out as a consequence of the financial crisis by the US government.

The company operates four key segments: Automotive Finance, Insurance, Corporate Finance and Mortgage Finance. Automotive Finance is by far Ally’s largest and most important segment, accounting for about 65% of total sales. Insurance is the second largest with approximately 20% of revenues. Corporate Finance and Mortgage Finance are responsible for slightly more of 5% of sales each. Ally Financials mainly operates in the United States.

Attractive Fundamentals vs Valuation

Ally’s financials are very strong – it is thus easy to see why Buffett likes the stock. From 2018 to 2021, Ally’s revenues jumped from $7 billion to $8.9 billion, growing at a 3-year CAGR of about 8%. Over the same period, net income more than doubled: from $1.5 billion in 2018 to $2.9 billion in 2021 (margin 33%). Ally has not seen a material slowdown amidst the recent macro-economic developments. For the trailing 12 month, the company generated revenues of $9.4 billion and net income of $2.7 billion (margin 28%).

As a “bank,” Ally’s balance sheet is not over-levered. As of June 2022, Ally had $140.4 billion of customer deposits and $129.3 billion of total loans. Total assets were valued at $185.7 billion.

Despite strong financials, Ally is trading relatively cheap. The stock’s one-year forward P/E is estimated at x5 and the P/B x0.9. these multiples are not only below the industry average, but also below All’s own historical average trading multiples for the past 5 years. According to data by Bloomberg as of August 17, Ally’s P/E multiple versus industry peers is 1.5 standard deviation below the 5-year historical average and as compared to Ally’s own history, the multiple is trading at a 1.7 standard deviation discount—which indicates 30% upside.

Residual Earnings Valuation

In my opinion, banks are prime candidates to be valued with a residual earnings (“RE”) valuation, given that the RE framework anchors on both the income statement and the balance sheet as well as accrual accounting. That said, I apply the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2023. In my opinion, any estimate beyond 2023 is too speculative to include in a valuation framework – especially for banks.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of August 15, 2022. My calculation indicates a fair required return of about 10%.

- To derive Ally’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 3% percentage points, approximately the nominal GDP growth, which I think is a fair assumption for an industry leader.

Based on the above assumptions, my calculation returns a base-case target price for Ally of $66.14/share, implying material upside of more than 85%.

Analyst Consensus EPS; Author’s Calculation

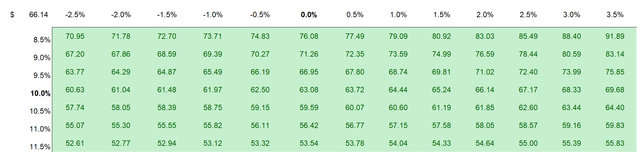

I understand that investors might have different assumptions with regards to Ally’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Risks

While I believe that investments in banks are less risky than the market implies, the tail-risk exposure is still elevated and if materialized this might depreciate Ally’s share price significantly. Remember, during the great financial crisis Ally needed to be bailed out by the government. Accordingly, despite Ally’s cheap valuation, investors should not be disregarding any information that might potentially indicate adverse development for Ally.

Conclusion

Warren Buffett likes to hunt for quality companies at a reasonable price. And Ally Financials fits the screen. Looking at Ally’s fundamentals in relation to its valuation, it is no surprise that the Oracle from Omaha has taken a 9.7% stake in the company – as Ally stock is trading very cheap. Personally, I think Ally stock should be fairly valued at $66.14/share. Strong Buy.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.