[ad_1]

turk_stock_photographer

2023 has gotten off to a good start for stocks overall, but the upward momentum has been rather uneven. For example, technology stocks have seen a strong rally, as inflation concerns ease. However, those industries with hard assets such as infrastructure and real estate haven’t seen much of a bounce, due perhaps to investors rotating out of these sectors back into growth stocks.

This brings me to Williams Companies (NYSE:WMB), which has risen by just 2% since the start of the year compared to the tech-heavy Invesco QQQ ETF, which has risen by 6%. WMB remains well below its 52-week high of $38 and in this article, I highlight what makes the stock attractive for dividend growth investors.

Why WMB?

The Williams Companies, Inc. is a midstream energy infrastructure company that owns and operates the large Transco and Northwest pipeline systems and associated natural gas gathering, processing, and storage assets. Its incorporated as a C-Corporation, which means no schedule K-1 for investors.

WMB’s asset base includes more than 30,000 miles of pipeline system-wide, with major positions in top U.S. supply basins. This includes Transco, which is America’s largest volume and fastest growing pipeline, handling 30% of the natural gas consumed in the U.S. used for clean power generation, heating, and industrial uses.

Notably, WMB gets more than half of its cash flow from rate-regulated gas pipelines, making it more like a utility than a traditional energy company. Plus, recent bolt-on acquisitions of Sequent and NorTex have bolstered WMB’s pipeline and storage positioning along its Transco system and in the Dallas, Ft. Worth region.

Meanwhile, WMB continues to demonstrate respectable growth, with adjusted EBITDA growing by 15% YoY during the third quarter. This was drive by increased demand for WMB’s essential transmission and storage services, as the steady nature of WMB’s midstream assets is designed to capture upside while enabling it to weather commodity price down cycles as it saw in 2020.

Looking forward, WMB is well positioned as the U.S. has an abundance of natural gas, enabling it to serve global energy needs, especially considering the war in Ukraine. WMB aims to capture more upside from this dynamic with a number of high-return growth projects across its portfolio to meet growing natural gas demand in the U.S. and globally.

This includes seven Bcf per day projects related to LNG and five bcf per day of projects for power generation and industrial gas opportunities. Management expects these projects to support respectable long-term growth, as noted during the last conference call:

The NorTex acquisition is also will be included in our Transmission & Gulf of Mexico business, and the continued expansion of our fee-based services on our interstate gas pipeline systems that continue to grow. Within our upstream JVs, volume growth will remain the story in the Haynesville, we’ve stated that we expect an ownership reversion in the first half of ’23, where Williams will own 25% of the PUDs, but we will retain a 75% interest in the PDPs.

Looking beyond 2023, we believe that our projects are supportive of a 5% to 7% long-term EBITDA CAGR. The annual growth rate may fluctuate a bit given the timing of new large projects like Regional Energy Access and our big deepwater projects coming on at the end of ’24 and into ’25, but the bottom line is that we see a clear trajectory to continued earnings growth based on the opportunity set of our footprint today.

Importantly, WMB maintains balance sheet discipline with a BBB credit rating. It’s also seen deleveraging, as its debt to adjusted EBITDA sits at a safe 3.7x, sitting below the 4.0x mark in the prior year period and well below the 4.5x mark generally deemed safe by ratings agencies.

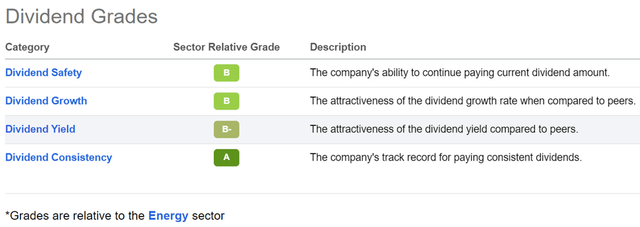

This lends support to the respectable 5.2% dividend yield, which is well protected by a 2.4x AFFO to dividend coverage ratio. WMB has also grown its dividend steadily over the years and has a 5-year divided CAGR of 7.2%. As shown below, WMB scores A and B grades for dividend safety, growth, yield, and consistency.

WMB Dividend Grades (Seeking Alpha)

Turning to valuation, WMB appears to be attractively priced at $32.81 with a price to cash flow of 8.3, sitting at the low end of its valuation range since 2021. Analysts have a consensus Buy rating on the stock with an average price target of $37.20, implying a potential one-year 19% total return including dividends.

WMB Price to Cash Flow (Seeking Alpha)

Investor Takeaway

Williams Companies is a moat-worthy energy midstream stock that has done well at adapting its asset base for long-term success and meeting growth targets in a volatile commodity price environment. Investors should be attracted to WMB’s steady business model, balance sheet discipline, and respectable dividend yield. It’s currently attractively priced for potentially strong total returns going forward.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.