[ad_1]

Slaven Vlasic

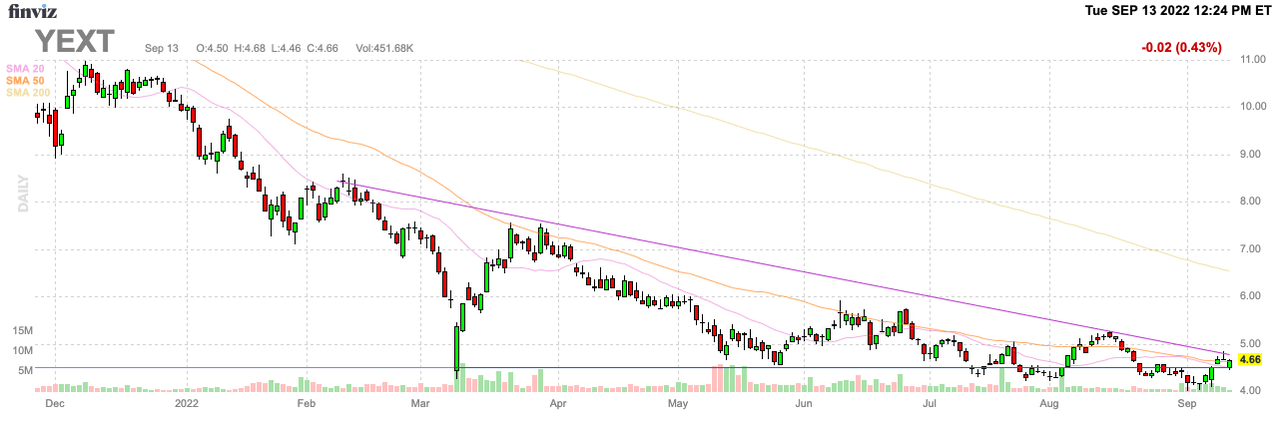

The market has crushed small cap technology companies that haven’t always deserved the severe price reduction. Yext (NYSE:NYSE:YEXT) falls into this category with Covid restrictions hurting sales to retailers closed and now struggling to regain momentum as the world economy reopens. My investment thesis remains Bullish on the stock at $4 as a new management team looks to reignite growth with a more productive salesforce.

Source: FinViz

Better Than Feared

A lot of quarterly financials are difficult to analyze with the Covid hits in 2020, followed by boosts in 2021 and normalization in 2022. Yext saw business flatline during the whole period and the company is still facing headwinds with retail customers, especially in Europe.

The AI search company reported FQ2’23 revenues grew 3% YoY to $100.9 million. Without a currency headwind of nearly 3%, Yext could’ve reported revenue growth of 6% for the July quarter.

Despite all the headwinds of weak retail clients around the globe facing inflation and recession fears and the new management team just taking over 6 months ago, Yext had the business growing at a 6% clip. The business was nowhere as bad as feared with revenues beating guidance by $1.4 million.

The company increased the customer count 8% YoY to 2,870 in an indication that the struggle is more with existing customers expanding usage with the net dollar-based retention of just 98%. Even worse, the customers up for contract renewals only renew at a nearly 80% clip in the last couple of quarters. The whole difference with a strong growth rate is the low retention level for a product set that saves customers money and improves efficiency.

The company continues to expand products, such as Answers. The recent Summer ’22 release of updated products added 60 new features across multiple products, including Search and Knowledge Graph, with a focus on the Yext Answers Platform.

At least Yext became more efficient in the sales and marketing unit with the expenses percentage of revenues declining below 50% now. The AI Search company only spent 48% of revenues on sales and marketing during FQ2, down from 52% last year.

The ability of Yext to turn very profitable and cash flow positive in the next year is obtaining leverage in S&M with gross margins at a strong 75%. The company has a target to return gross margins to 80% levels which would already make the business profitable before completing any other reductions in the SG&A categories.

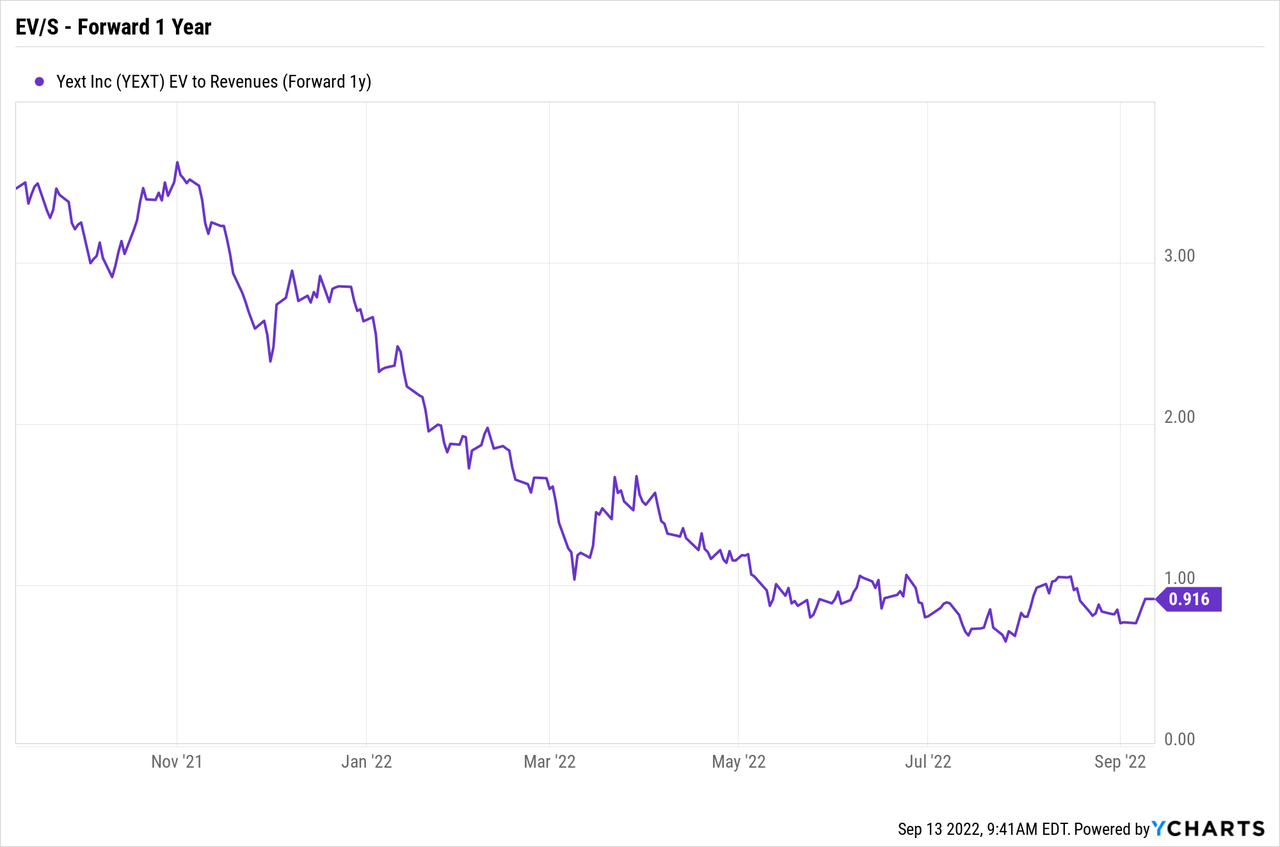

Historically Cheap

The stock is so absurdly cheap that Yext authorized a $100 million share buyback. The company spent $55 million through FQ1 and added another $4 million during the last quarter for a total of $59 million spent on share buybacks this FY.

Yext still has a sizable cash balance of $188 million considering the company only has a market cap of $575 million now. The enterprise value is a paltry $387 million, less than the $400+ million revenue target for the year and especially below the $428 million estimates for FY24 (ends January).

As highlighted above, Yext was still growing 6% even in this tough environment for prime retail clients. A return to historical growth rates in the 15% to 20% range boosts the valuation back to 3x and even 5x sales multiples typical of an AI software company with gross margins of up to 80%.

Analysts forecast meager 7% to 8% revenue growth rates over the next couple of years. These numbers are highly conservative considering the currency neutral growth rate now is 6%.

If the new management team lines up the sales department, Yext could easily normalize back at far higher growth rates. The Answers product still promises a vast improvement to the search technology used by most corporations.

Takeaway

The key investor takeaway is that Yext shouldn’t be a $4 stock with an enterprise value below $400 million. The company has the opportunity to return to historical growth rates with a strong product lineup, which would boost the valuation multiples assigned to the stock by 3x to 5x from current levels.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during the 2022 sell off, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.