[ad_1]

cmannphoto

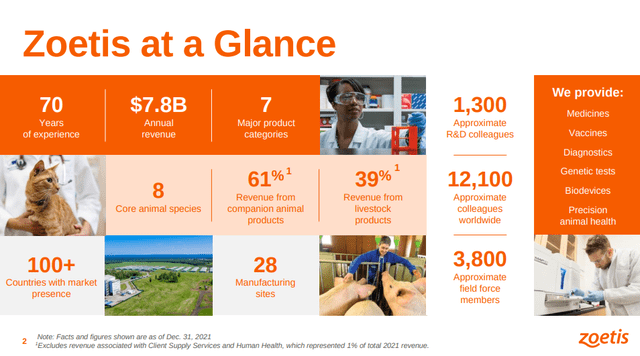

If you’re considering adding Zoetis (NYSE:ZTS) to your portfolio or increasing your position, now is probably a great time to do so. The company, which is a leading player in the animal health industry, has a number of strengths that make it a compelling investment opportunity, and the valuation is looking quite reasonable. The company has a diversified revenue stream, with products targeting a range of animals, including livestock and companion animals, and several different types of medicines and diagnostics.

When we started coverage of the company, we said that the valuation was not cheap but that it could be justified by the quality of the company and the defensive nature of the products it sells. Shares are ~20% down since then, despite the company performing well operationally. While we would still not call shares a bargain, we do believe this is a wonderful company at a very reasonable price, and that shares are now a ‘Strong Buy’.

Competitive Moat

One of the key reasons to consider Zoetis is its strong competitive moat, which is the result of being the undisputed leader in the global animal health industry. The animal health industry is highly regulated, which creates barriers to entry for new players, and the company’s profits are also protected by its vast intellectual property portfolio and well respected brands. Zoetis has a strong track record of developing and marketing innovative products, which has helped it to establish strong brands and a loyal customer base. This strong competitive moat is reflected in the superior financials of the company.

Financials

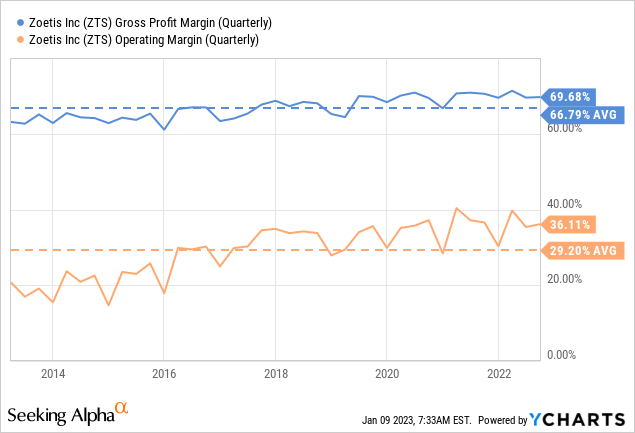

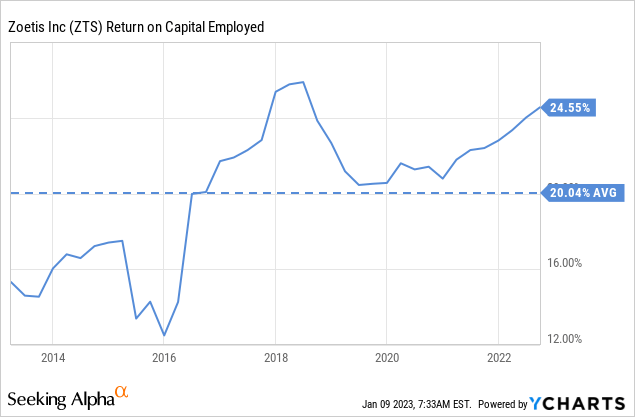

We believe that Zoetis not only has a strong competitive moat, but that it has been growing wider and stronger. As can be seen below, the company not only has enviable profit margins, but they have also been trending up in recent years.

Zoetis is also able to compound returns at a very attractive rate given its extremely high return on capital employed, which has averaged a little over 20% over the last decade.

Growth

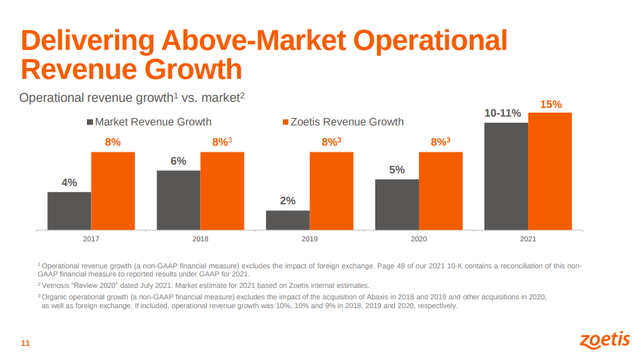

Zoetis is well-positioned to drive continued above-market growth across animal health, driven by factors such as an increasing focus on animal welfare, the growing middle class in emerging markets, and the expansion of the global pet population. Zoetis is well-positioned to capitalize on these trends, with a broad product portfolio and a strong presence in key markets around the world. Importantly, the company has been gaining market share for several years now, as can be seen in the slide below its growth has outpaced the market by a wide margin.

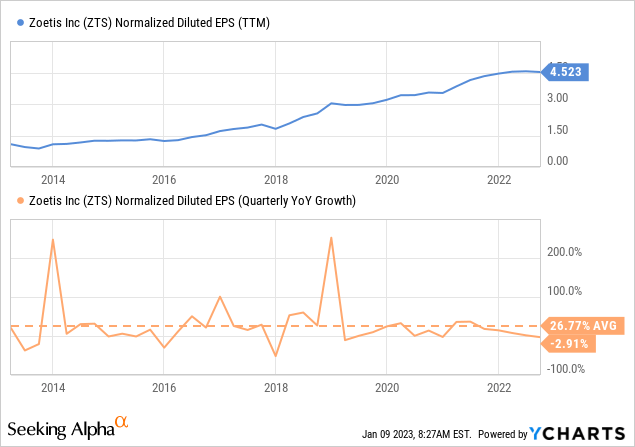

Between rapid revenue growth and improving profit margins, earnings per share have significantly increased during the past ten years. They’ve gone from less than $1.5 per share to more than $4.5 per share. While there has been some volatility in its earnings and revenue growth, for example due to foreign exchange impacts in 2022, we believe the long term trend is clearly up.

Balance Sheet

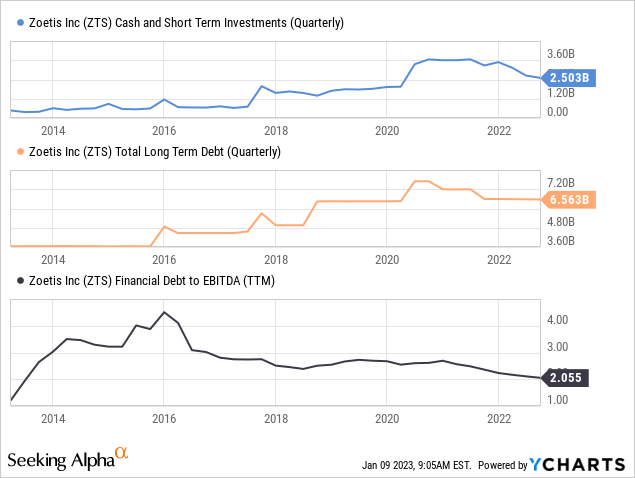

Zoetis has an extremely strong balance sheet with roughly $2.5 billion in cash and short-term investments. It does carry meaningful debt of ~$6.5 billion, but thanks to its ~$3.2 billion EBITDA, leverage remains quite reasonable. Financial debt to EBITDA is ~2x, and net debt to EBITDA is even lower at ~1.2x.

Valuation

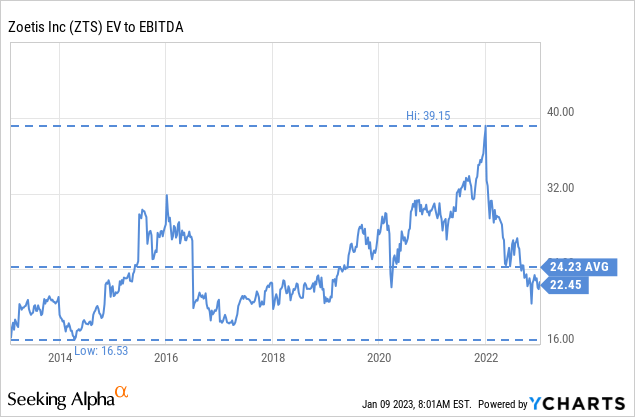

As we’ve already mentioned, shares are rarely cheap. In the past ten years the lowest EV/EBITDA at which shares could be purchased was ~16.5x. The current multiple at ~22.4x is slightly below the ten year average of ~24.2x.

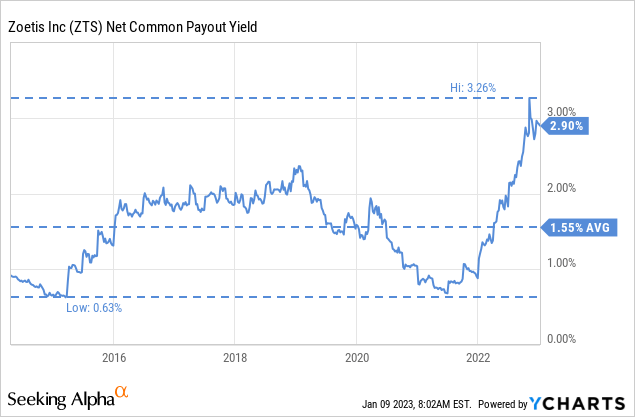

While the dividend yield is quite small at ~1%, the company also returns capital to shareholders through buybacks. The net common payout yield that combines the two is at a very respectable 2.9%, and is close to the highest it’s been in the past ten years. This is one of the reasons we believe it is a great time to buy Zoetis shares.

We estimate the net present value of the future earnings stream at $143 per share, using a 4% terminal growth rate, and an 8% discount rate. Since this is very close to the current share price, we believe the stock is priced to deliver high single digit returns for long-term investors. This reaffirms our belief that shares are not a bargain, but can deliver solid returns at current prices.

| EPS | Discounted @ 8% | |

| FY 23E | 5.39 | 4.99 |

| FY 24E | 6.03 | 4.62 |

| FY 25E | 6.64 | 4.79 |

| FY 26E | 7.29 | 4.88 |

| FY 27E | 7.95 | 4.96 |

| FY 28E | 8.66 | 5.01 |

| FY 29E | 9.44 | 5.05 |

| FY 30E | 10.29 | 5.10 |

| FY 31E | 11.22 | 5.15 |

| FY 32E | 12.23 | 5.20 |

| FY 33E | 13.33 | 5.24 |

| Terminal Value @ 4% terminal growth | 222.11 | 88.20 |

| NPV | $143.19 |

Risks

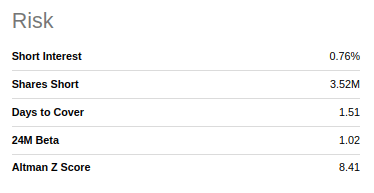

We believe Zoetis to be a below average risk investment, with the biggest risk probably still being the valuation. While shares are trading close to what we consider fair value, there is not much in terms of margin of safety, and if earnings fail to grow at the expected rate that could re-rate shares much lower. On the positive side, the company has an extremely strong balance sheet, and sports an impressive Altman Z-score of ~8.4x, significantly above the critical 3.0 threshold. There are also very few shares sold short, with the current short interest below 1%.

Seeking Alpha

Conclusion

Zoetis is a solid investment opportunity due to its competitive moat and growth potential. With a strong track record of innovation and a diverse revenue stream, the company is well-equipped to continue to grow in the years ahead at a rapid pace. We believe this is a wonderful company at a very reasonable price. While it can be argued that shares are not a bargain at current prices, we believe they are priced to offer long-term investors high single digit returns. There are a few risks to consider, but overall we believe shares are looking attractive at current prices.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.