[ad_1]

imaginima

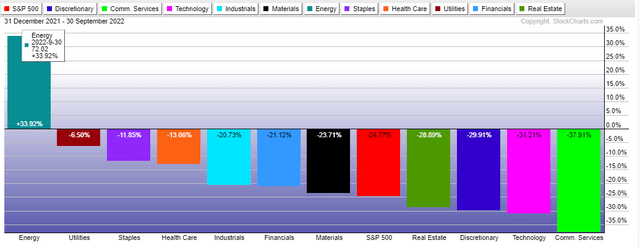

The Energy sector is the lone area of the S&P 500 that is higher on the year. There’s uncertainty today, though, considering increasing chatter of an imminent U.S. and even global recession that could take shape in 2023.

Are oil & gas stocks still the place to be? What about shares of foreign energy companies? One highly profitable oil stock based in Argentina has bullish prospects.

2022 Sector Returns: Energy in the Black

According to Fidelity Investments, YPF Sociedad Anonima (NYSE:YPF) engages in oil and gas upstream and downstream activities in Argentina. The company’s upstream operations include the exploration, development, and production of crude oil, natural gas, and NGLs. Its downstream operations include the refining, marketing, transportation, and distribution of oil, petroleum products, petroleum derivatives, petrochemicals, LPG, and biofuels, as well as in gas separation, natural gas distribution operations, and power generation.

The Argentina-based $5.2 billion market cap Oil, Gas & Consumable Fuels industry company within the Energy sector trades at just 1.6 times last year’s earnings but does not pay a regular dividend, according to The Wall Street Journal.

The firm has upside potential through new growth avenues that could lead to significant EPS increases in the years ahead. Moreover, high prices for refined products in Argentina could lead to additional earnings growth. Any improved political and regulatory developments in the country could lead to more profits for the YPF, as well. Downside risks are numerous too – macro risks and geopolitical uncertainties weigh heavily on the industry, and any unfavorable policy changes could hurt equity owners. If global oil prices fall further, that could lead to reduced profitability.

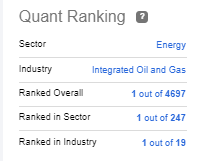

On valuation, YPF Sociedad Anónima boasts an A rating from Seeking Alpha while its growth outlook is mixed. Geopolitical and regulatory conditions, coupled with much higher oil prices, make the P/E ratio extremely low at under 2 using both forward GAAP and operating earnings metrics. Importantly, the company’s price/cash flow is under 1 using forward estimates. Finally, the stock is ranked no. 1 in the quant ratings coverage universe.

Top Quant-Ranked Stock

Seeking Alpha

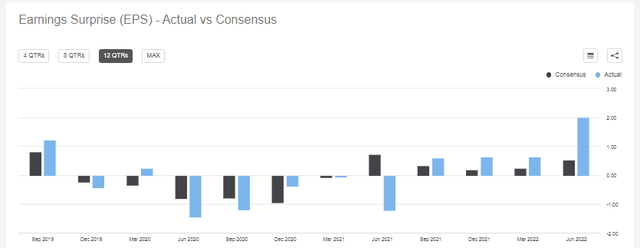

YPF: Big Earnings Beat in the Previous Quarter

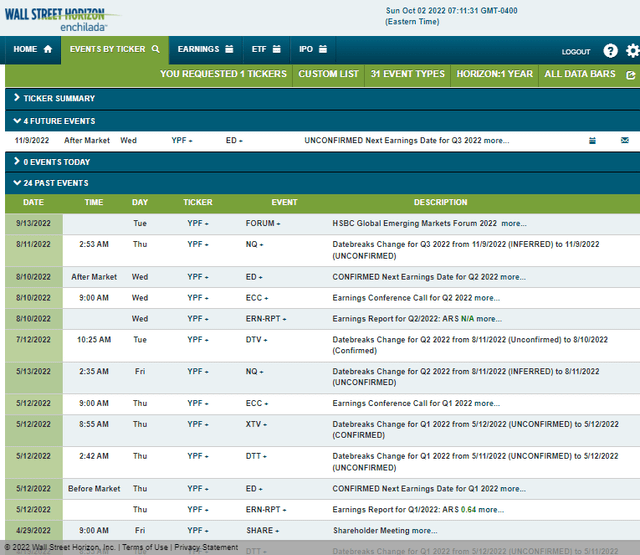

Looking ahead, YPF has an unconfirmed Q3 earnings date of Wednesday, Nov. 9 AMC according to data provided by Wall Street Horizon. As shown above, the firm smashed earnings forecasts in the previous quarter as oil prices skyrocketed during the first several months of 2022.

Corporate Event Calendar

The Technical Take

YPF has two critical price levels investors should monitor for clues on where the next direction might be. I see resistance near $7.30 while support is around $3. Based on a measured move price objective target, a bullish breakout above $7.50 would support the case for the stock to nearly double from current levels to around $11. There is a consolidation range just shy of $10 that could be a place of resistance, too.

On the downside, going long when the stock gets into the $3s is proven to be a good strategy. Notice in the chart below that there have been volume increases each time YPF nears $3. That’s clearly a spot of bullish accumulation. And just recently, there was increasing volume on the way up to $7.37 and there’s been decreasing volume during this 20% pullback off the September high. That signals to me that bullish energy is gathering.

Finally, the $5.60 to $6 range appears to be increasingly important nearer-term support. Going long here with a stop under $5.50 is a solid risk/reward play.

YPF: Eyeing Support and Potential Bullish Upside Breakout

The Bottom Line

The energy bull market has had its fits and starts, but it remains the only sector positive for the year. While there is much uncertainty when investing with foreign small-cap energy producers, YPF Sociedad Anónima is attractive on valuation and sports a potentially bullish chart.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.