[ad_1]

1933bkk/iStock via Getty Images

Introduction

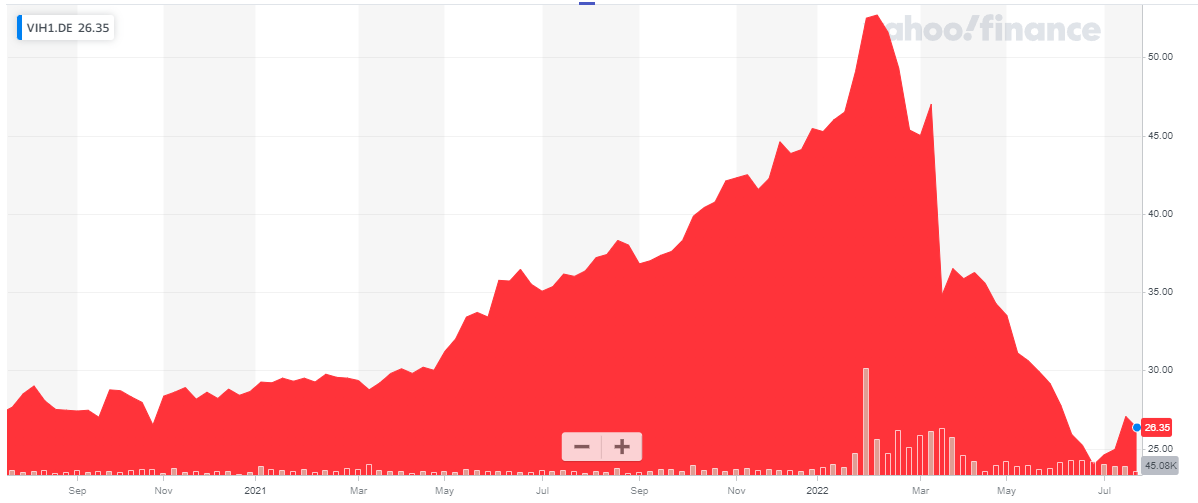

The volatility on the markets and the increasing interest rates create opportunities in the real estate sector. VIB Vermoegen (OTC:VIBBF) (OTCPK:VIBVY) is a developer and landlord in the industrial and logistic real estate segment and that was a well-sought after category. DIC Asset, a German competitor, recently acquired a majority stake in VIB after making a very aggressive offer. DIC ended up paying 51 EUR per share of VIB and not only is that almost twice the current share price, it also represented a premium of 57% to the Net Replacement Value of the assets as of the end of Q1. And now DIC calls the shots, I’m not sure we will see a (decent) dividend from VIB Vermoegen going forward as DIC could just decide to retain the legal maximum of VIB’s cash generation on the balance sheet. And after carefully reading the bidder’s statement, it has become clear DIC has no intention to declare dividends with the VIB vehicle.

Yahoo Finance

VIB’s main listing is on the Deutsche Boerse where it’s trading with VIH1 as ticker symbol. The average daily volume is just a few ten thousand shares per day as the free float has greatly diminished since DIC acquired a 60% stake in VIB.

I’m not a buyer of VIB Vermoegen as the company’s policy is now directed by DIC Asset

From a multiples and metrics point of view, VIB appears to be a “must buy.” Yet I have no interest in buying the stock since there’s a new sheriff in town. Earlier this year, German peer DIC Asset AG (OTCPK:DDCCF) acquired a majority stake in VIB which means DIC now calls the shots. Author Bjorn Zonneveld has done a good job in explaining what happened with DIV and VIB and I would strongly recommend you to read his March article.

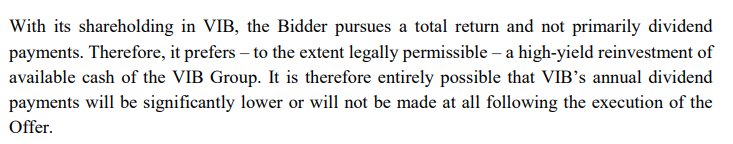

DIC now controls in excess of 60% of the shares of VIB Vermoegen and although DIC initially supported VIB’s dividend proposal (for the FY 2021 results, payable in calendar year 2022), there’s no guarantee DIC will allow VIB to continue to pay a dividend. As DIC can consolidate VIB’s financial results, there’s no need for any cash to be upstreamed to DIC as that would have no impact on the consolidated results. And I’m not painting an ultra-bleak picture here. The image below shows an excerpt from the joint statement of VIB and DIC Asset. It literally states the buyer is pursuing a total return strategy which is corporate speak for “it will very likely cut the dividend to the legal minimum” (which could be zero).

VIB Vermoegen Investor Relations

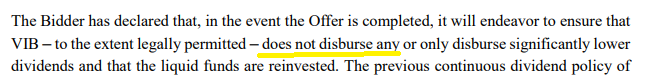

And if that wasn’t clear enough, this can be found two pages further (the highlight is mine). “Endeavoring to ensure” sounds pretty clear to me.

VIB Vermoegen Investor Relations

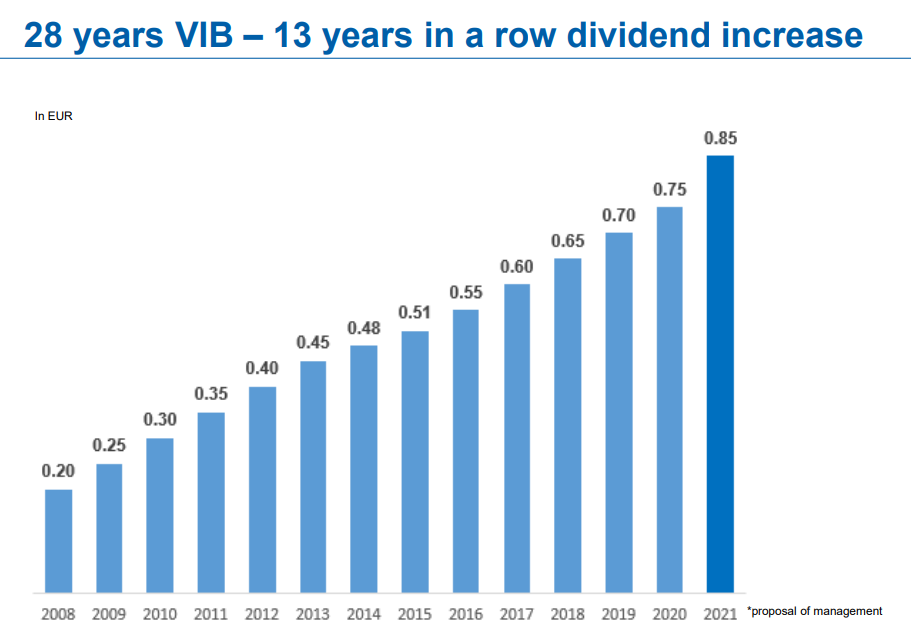

So the question no longer is whether or not DIC will allow VIB’s history of increasing dividends to continue. That ship has sailed and VIB investors can only hope for a few cents per year if there is a regulatory need to pay a dividend.

VIB Vermoegen Investor Relations

The total return policy may not be bad as VIB has an excellent track record

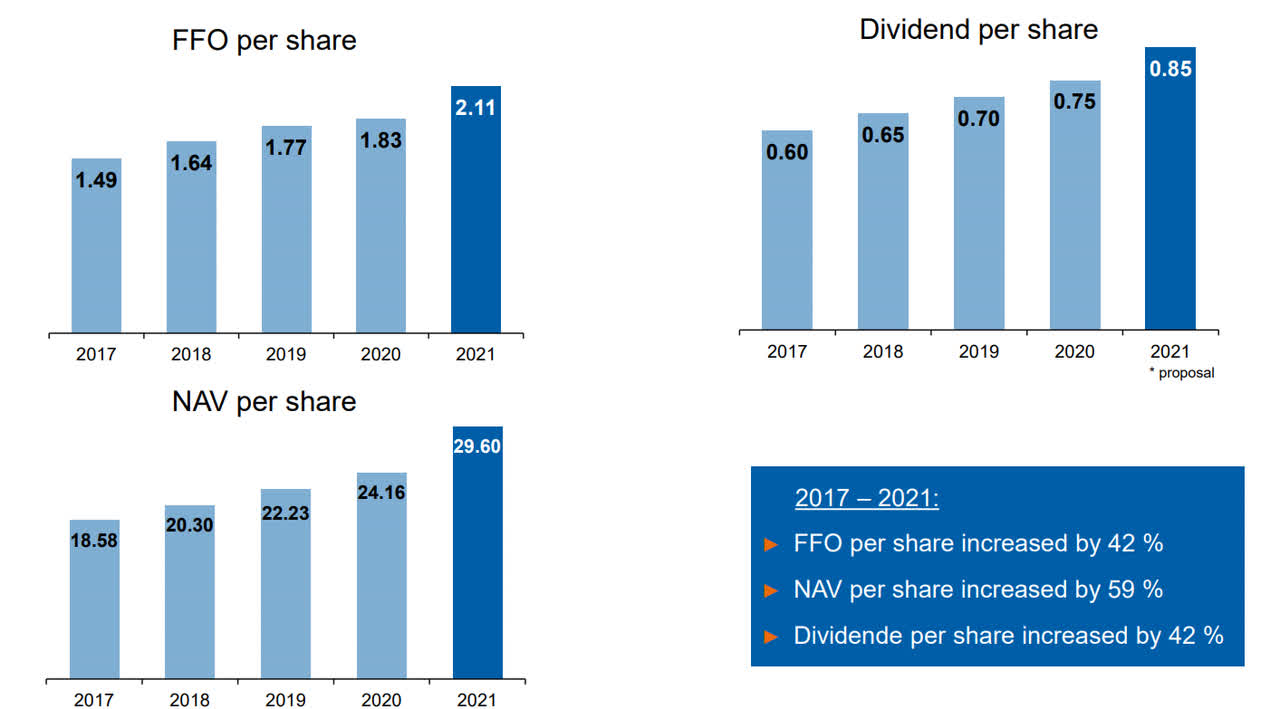

Despite losing the dividend, shareholders may still be interested in VIB’s new total return focus. The past few years, the FFO per share and the NAV per share have consistently increased and even in 2020 and 2021 the company was able to post an attractive earnings increase with an FFO of 2.11 EUR per share in FY 2021.

VIB Vermoegen Investor Relations

And the near-term future looked bright as well. According to VIB’s 2022 guidance, it anticipated posting an FFO of 58-62M EUR. Using 61M EUR (on the higher end of the guidance range), the FFO/share would come in at 2.20 EUR per share. Meanwhile, the LTV ratio would have remained stable in the mid-40s range.

The acquisition of a majority stake by DIC does not mean an investment in VIB is dead money. It simply means the vast majority, if not every single cent, of the 2.20 EUR FFO/share will be reinvested in the company. This will likely help the FFO per share increase even faster as there will be more cash retained within the company to further expand the portfolio. But the lack of a (decent) dividend would for sure be a tough sell for investors as you’re basically “betting” on the market rewarding VIB for a faster growth pace while knowing someone else is calling the shots. There simply is no catalyst that could propel the VIB share price higher unless you’re expecting DIC to make another offer to acquire more shares beyond its current position of approximately 60% of the VIB stock.

Investment thesis

From a fundamental perspective, I like VIB’s valuation down here as the robust balance sheet and relatively low multiple to the anticipated FFO make the stock attractive. However, the past few years we have seen this push in Germany where third parties acquire a majority ownership in companies and subsequently cut the dividends to retain the cash for balance sheet and growth purposes. And as DIC Asset management has increased the LTV ratio on its own balance sheet I wouldn’t be surprised if DIC doesn’t want to pay the minority shareholders of VIB a dividend, retaining the VIB-generated cash on the balance sheet to reduce the LTV ratio.

That obviously also increases the value of both VIB and DIC but it’s less tangible than actually getting a dividend cheque every year. And as the bidding circular literally mentions the possibility the dividend will be cut as DIC is pursuing a total return strategy and has no intention to declare dividends with the VIB vehicle unless it’s bound to do so by law.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.