[ad_1]

USD/JPY ANALYSIS

- USD dictating terms but big fundamental week ahead could change fortunes.

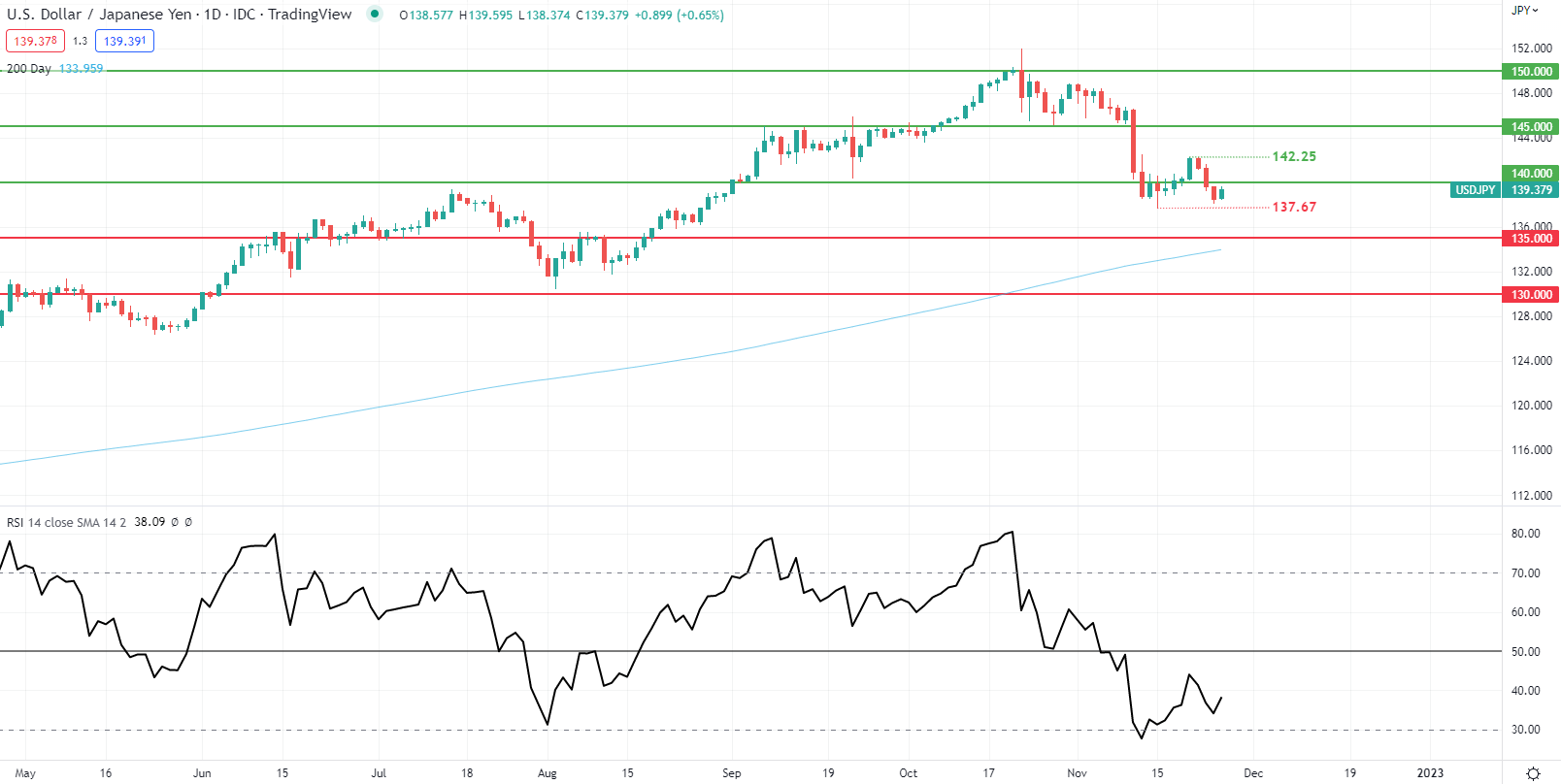

- Technical analysis holds the 140.00 inflection point important for short-term directional bias.

Recommended by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN TECHNICAL FORECAST: MIXED

The Japanese Yen looks to end the week on a high considering the lower volatility created by the U.S. Thanksgiving holiday. In conjunction with the lesser market action, the USD has been under pressure post-FOMC minutes that reiterated moderating interest rate hikes. Next week will be largely focused on the U.S. with high impact events scattered throughout the week (see economic calendar). The core inflation print and Non-Farm Payroll (NFP) will be the highlights and could support the current ‘moderation’ narrative or move against it giving hope to USD/JPY bulls.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

USD/JPY DAILY CHART

Chart prepared by Warren Venketas, IG

The daily USD/JPY chart shows price action sandwiched between the 137.67 swing low and the 140.00 psychological resistance handle. Although the Relative Strength Index (RSI) has recently come out of the oversold zone, the response to the FOMC minutes could spark a change in investor sentiment towards the dollar. This could mean looking for downside as soon as the greenback shows some appreciation. The week ahead will be focused on the fundamental catalysts mentioned above and markets reaction around the key 140.00 zone. A weekly close next week above or below 140.00 could spark short-term directional bias considering the amount of data being digested.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT POINTS TO SHORT-TERM DOWNSIDE

IGCS shows retail traders are currently net SHORT on USD/JPY, with 52% of traders currently holding short positions (as of this writing). At DailyFX we take a contrarian view on sentiment, however, due to recent changes in long and short positioning we favor a bullish bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.