[ad_1]

Vertigo3d

Blackstone Mortgage Trust, Inc. (NYSE:BXMT) is a well-managed real estate finance company that pays a consistent dividend that is fully covered by distributable earnings.

The mortgage trust also has significant upside to interest rates, which is becoming a bigger issue for investors now that the central bank has delivered two massive 75-basis-point dividend hikes in the last two months.

Black Mortgage is an appealing passive income investment due to the passive income and ongoing strength in originations.

Demand For New Originations Is Robust

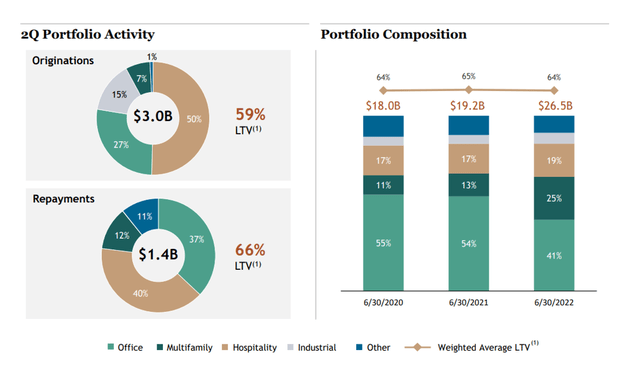

In the second quarter, Blackstone Mortgage originated $3.0 billion in new commercial real estate loans, up from $3.4 billion in the previous quarter. The average loan to value ratio for Blackstone Mortgage’s 2Q-22 originations was 59%, with a loan size of $313 million.

The loan to value ratio is a risk measure for real estate trusts that shows how much leverage an investor is dealing with on an asset level. A loan-to-value ratio of 59% is low and indicates a moderate level of risk in Blackstone Mortgage’s portfolio.

As of June 30, 2022, the trust’s portfolio weighted average loan to value ratio was 64%. The trust’s investment portfolio increased to $26.5 billion after subtracting $1.4 billion in 2Q-22 repayments.

2Q Portfolio Activity (Blackstone Mortgage Trust)

Strong Foundation To Support Growth

Commercial real estate markets in the United States are doing well, which is why Blackstone Mortgage anticipates strong demand for new originations.

Blackstone Mortgage is sponsored by Blackstone Inc. (BX), the world’s largest alternative asset manager with $941 billion in assets under management. Blackstone Mortgage benefits from its affiliation with its sponsor by sourcing new deals through its extensive industry network.

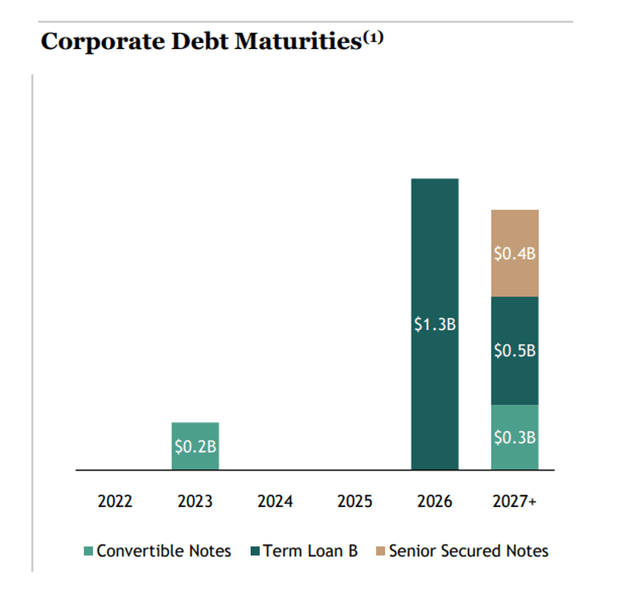

Blackstone Mortgage also has access to substantial liquidity resources, allowing it to capitalize on investment opportunities. On its balance sheet, Blackstone had $284 million in cash and cash equivalents and $1.5 billion in liquidity access. Aside from $200 million that must be repaid in 2023, Blackstone Mortgage has no maturing debt until 2025.

Corporate Debt Maturities (Blackstone Mortgage Trust)

Dividend Is Covered By Distributable Earnings, Earnings Upside

Dividends are consistently covered by distributable earnings in strong trusts. By doing so, they give shareholders confidence that the dividend will be paid even if the real estate market or the entire economy suffers a downturn.

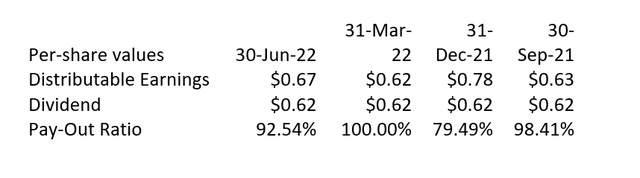

Blackstone Mortgage’s investment loans generated $2.70 per share in distributable earnings over the last twelve months, while the trust paid out $2.48 per share, implying a pay-out ratio of 92%. Because of higher earnings from the trust’s loan portfolio, the pay-out ratio improved QoQ.

Pay-Out Ratio (Author Created Table Using Trust Information)

According to the dividend payout ratio, Blackstone Mortgage has a moderate margin of safety and will most likely be able to maintain its dividend pay-out in the future.

An Added Benefit: Earnings Upside

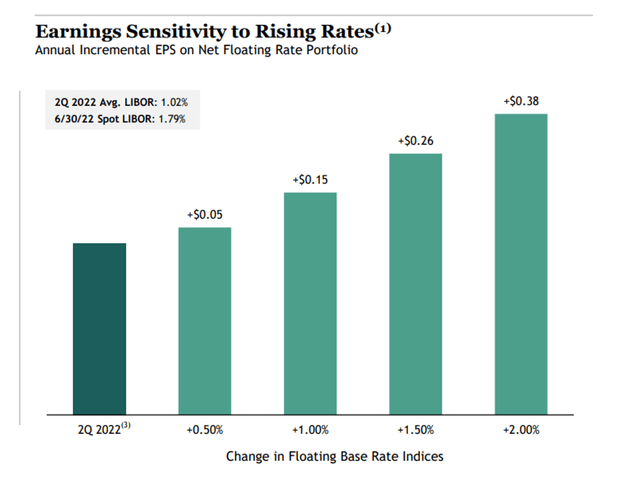

The balance sheet of Blackstone Mortgage is positively correlated with interest rates, which is a useful feature given that the central bank has begun to raise interest rates aggressively in the last two months, with two back-to-back 75-basis-point hikes aimed at containing inflation.

The trust’s real estate loans’ positive correlation with interest rates translates into earnings growth for Blackstone Mortgage. According to the trust’s most recent earnings sensitivity table, Blackstone Mortgage expects earnings per share to rise to $0.38.

Earnings Sensitivity To Rising Rates (Blackstone Mortgage Trust)

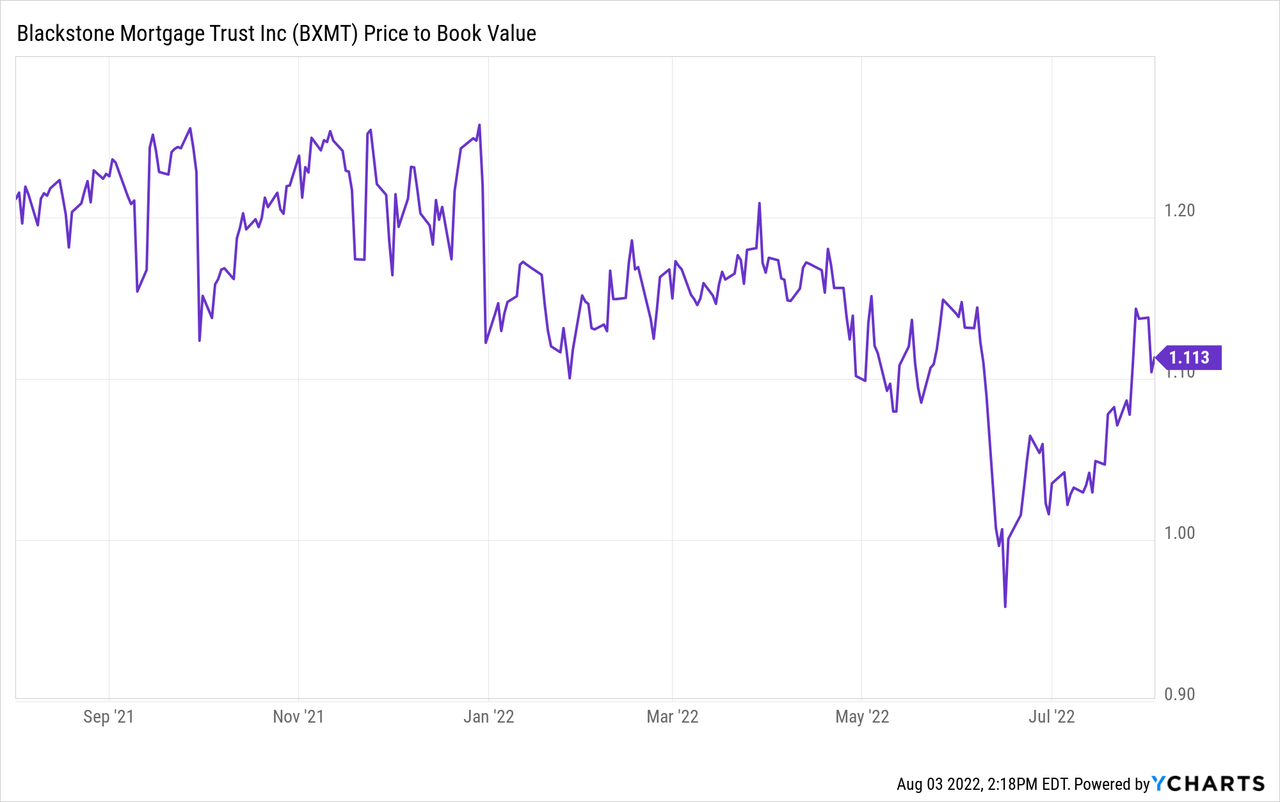

P/B-Multiple

At $31 per share, you don’t buy Blackstone Mortgage for capital appreciation; you buy it for the 8% passive income covered by distributable earnings. On June 6, 2022, the trust’s book value was $27.17, representing a 14% premium to book value. For the majority of 2022, Blackstone Mortgage’s stock has traded at a 14% premium.

Why Blackstone Mortgage Trust Could See A Lower Stock Price

Second-quarter originations, a strong earnings trajectory, and an improved pay-out ratio demonstrate the strength of Blackstone Mortgage’s fundamentals. However, this could change. During a recession, origination volumes typically decrease significantly as real estate investors and developers cut back on new projects and focus on keeping existing projects afloat.

A recession could have an impact on Blackstone Mortgage’s book value growth and ability to increase distributable earnings through new originations.

My Conclusion

Blackstone Mortgage’s originations remained resilient in the second quarter, attesting to the strength of the commercial real estate market and indicating that the trust’s origination business is not yet affected by a recession.

Blackstone Mortgage also continued to cover its dividend with distributable earnings in 2Q-22, indicating that the trust’s business has a high margin of safety. BXMT should be purchased primarily for its 8% passive income.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.