[ad_1]

KEY POINTS:

Recommended by Zain Vawda

Get Your Free EUR Forecast

READ MORE: Inflation, China Covid Response and Ukraine Top 2023 Risk Charts

EUR/USD OUTLOOK

EUR/USD experienced some whipsaw price action yesterday as the pair fluctuated between losses and gains for the majority of the day. The European open this morning has seen a slight bounce higher with a sustained break above the 1.07 level needed for the upside rally to continue.

Currency Strength Meter

Source: FinancialJuice

Keeping EUR/USD supported of late has been the more hawkish rhetoric from the European Central Bank (ECB) in comparison to the US Federal Reserve (FED). ECB policymaker Klaas Knot reiterated this in an interview yesterday stating that between now and July 2023 the ECB would deliver “quite a decent pace of tightening. Knot cautioned that doing too little remains the larger risk with a slowdown to 50bps allowing the Central Bank time to judge the effect of rate hikes. In a rare positive knot claimed the worst may already be behind the Eurozone while a potential recession, should it occur will be relatively shallow and short-lived. Eurozone data of late seems to back up the policymakers claim as data continues to show resilience and in some area’s improvement.

Recommended by Zain Vawda

How to Trade EUR/USD

Optimism around China and their relaxation of Covid protocols has waned a bit from yesterday following rumors that the US may impose fresh restriction on travelers from China. This comes as US officials are concerned about the lack of ‘transparent’ data coming out of Beijing.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

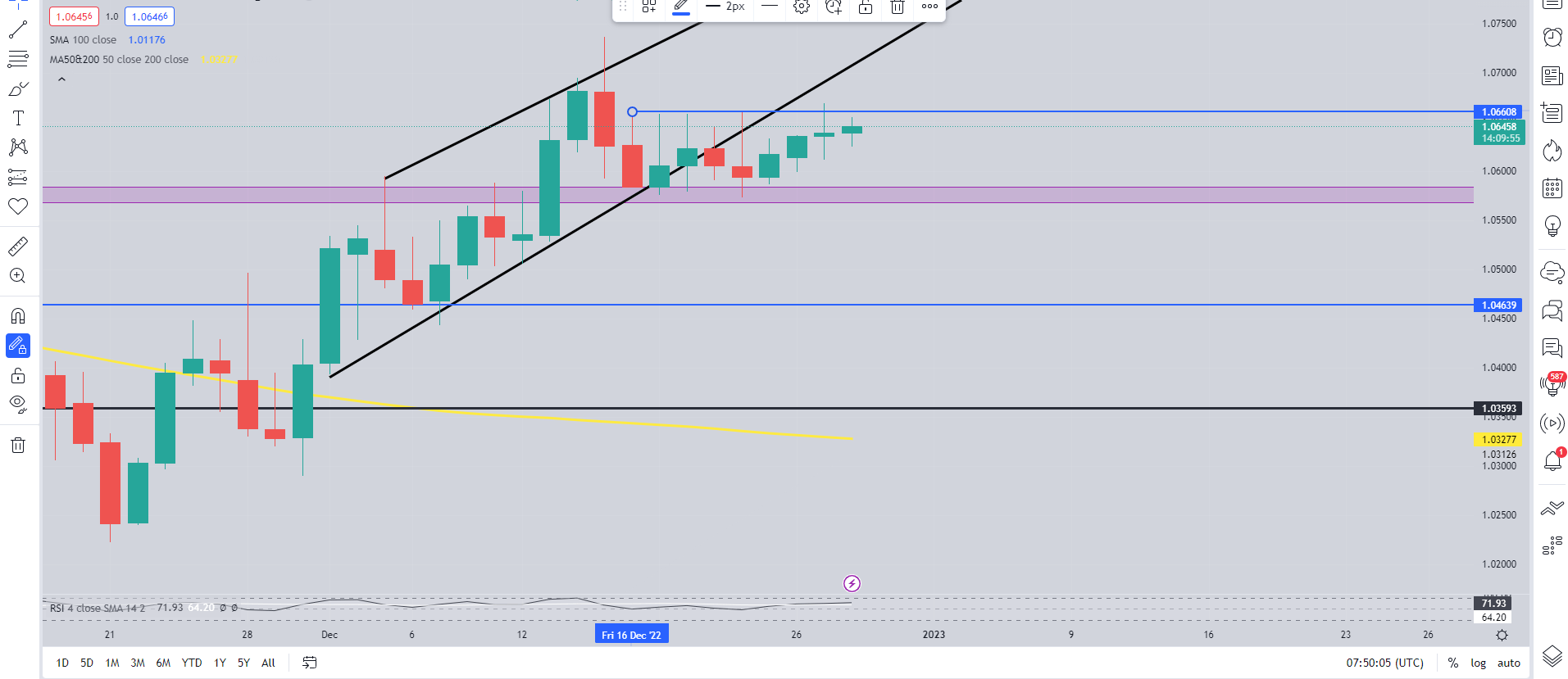

From a technical perspective, yesterday’s daily candle close perfectly encapsulates the markets current mood. EUR/USD printed a doji candlestick close on the daily as markets appear uncertain and neutral ahead of the New Year. The chance of a sustained move in either direction at this stage appears limited without some form of catalyst.

At present the 1.07 level and recent high at 1.0740 provide resistance while the top of the recent range around the 1.0660 level is holding as well. Any downside move may find support around the 1.06 level and further down around the 1.0580-1.0560 area. Intraday ranges may provide the best opportunities in the current market conditions.

EUR/USD Daily Chart – December 28, 2022

Source: TradingView

IG CLIENT SENTIMENT: MIXED

IG Client Sentiment Data (IGCS) shows that retail traders are currently SHORT on EUR/USD with 62% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are SHORT suggests EUR/USD prices may continue to rise.

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.