[ad_1]

GOLD OUTLOOK & ANALYSIS

- Technical buying steering XAU/USD.

- U.S. manufacturing PMI in focus today ahead of FOMC.

- Rising wedge still a factor – candle close key.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL BACKDROP

Gold is starting 2023 on the front foot after a significant rally stemming from what seems to be technical dynamics. Considering the U.S. dollar is also in the green this morning (traditionally an inverse relationship between the two), as well as no changes to inflation influences nor economic uncertainty, the move can only be attributed to technical buying. It is unclear if markets are looking through the recent Fed guidance around sustained aggressive monetary policy but if tomorrow’s FOMC minutes reiterate this stance, XAU/USD could slide back below 1830.00 once more.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Looking ahead, the only data point of real significance today will come via the U.S. manufacturing PMI release for December. However, being a primarily services driven economy, the manufacturing read is unlikely to stir major price action on gold.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

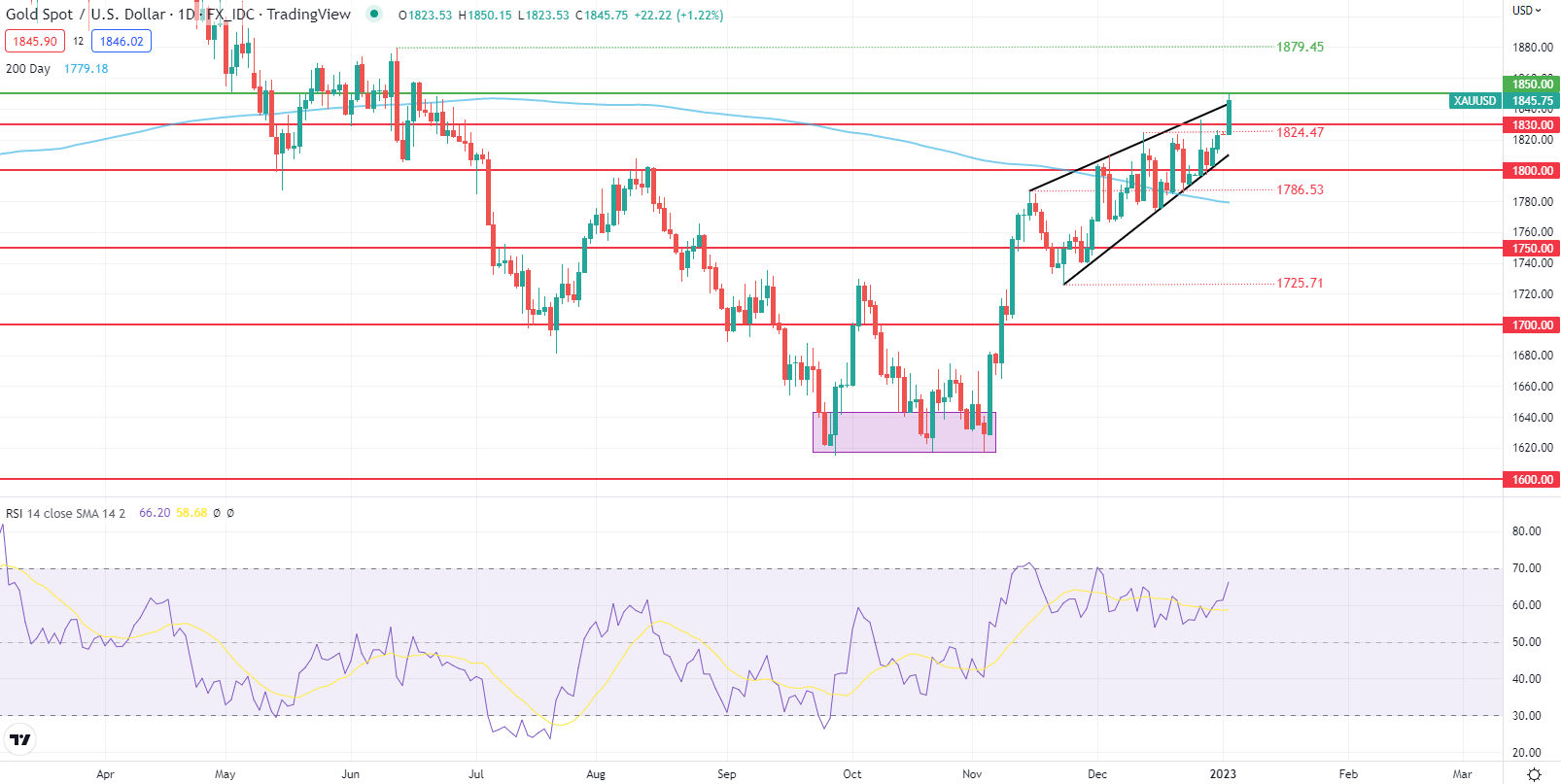

The daily spot gold chart shows today’s daily candle 1.22% higher at the start of the European session with the 1850.00 psychological level already pierced. This does not rule out the developing rising wedge chart pattern (black) just yet but a daily candle close above wedge resistance and 1850.00 could spur another leg higher towards the 1879.45 swing high.

On the contrary, a close below wedge resistance may garner support from bears back below 1830.00. The Relative Strength Index (RSI) could be supportive of this outlook currently exhibiting bearish/negative divergence from gold prices.

Resistance levels:

Support levels:

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are currently distinctly LONG on gold, with 65% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we arrive at a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.