[ad_1]

WTI CRUDE OIL (CLc1) TALKING POINTS

- All eyes will be on Fed Chair Jerome Powell later today on his comments around interest rates and tackling inflation.

- Will the API crude oil stock change report maintain it’s upward path?

- $75 resistance handle defended by bears.

Recommended by Warren Venketas

Get Your Free Oil Forecast

WTI CRUDE OIL FUNDAMENTAL BACKDROP

WTI crude oil is coming under pressure this Tuesday morning ahead of the European session on the back of a stronger U.S. dollar. The dollar upside grew from yesterday’s Fed speakers including the Fed’s Bostic and Daly who reinforced their outlook for the U.S. central bank to raise interest rates to 5% and beyond after which they expect a hold before tapering off. Fed funds futures have shown a lack of conviction for this +5% mark as of yet with the terminal priced in at 4.953% currently. It will be interesting to see whether last week’s decline in wage pressures from the Non-Farm Payroll (NFP) report will translate over to the upcoming U.S. CPI release which could then cement a 25bps rate hike for February leaving the dollar vulnerable to further downside. From a crude oil perspective, a weaker dollar may give WTI crude the impetus it needs to push above the $75 per barrel mark once more.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

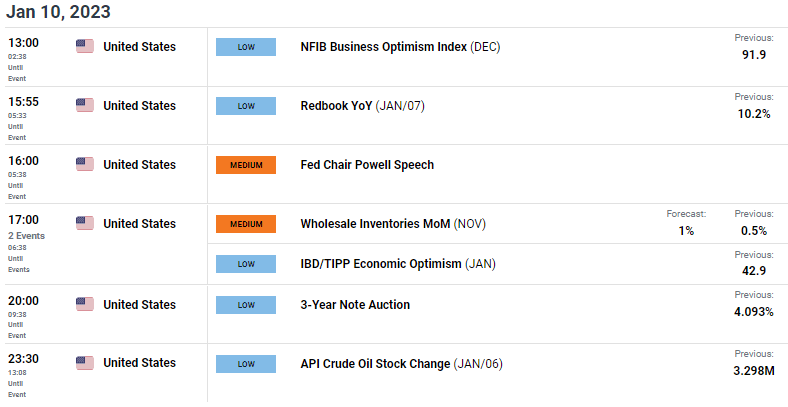

The economic calendar (see below) for today is relatively light but should provide some volatility around Fed Chair Jerome Powell’s speech. The focus will be on whether or not he supports the views of the Fed’s Daly and Bostic which may leave crude oil on the backfoot. The trading day for crude oil will close off via the API crude oil stock change figure which has been increasing since mid-December 2022. Another push higher could leave WTI lagging.

Chinese imports of crude oil have also been reported to rise but has not followed through to crude oil pricing at this point however, Chinese re-opening optimism is still a critical factor for crude oil prices and until such time as more clarity around fiscal stimulus and COVID concerns are gained, crude may remain relatively subdued.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

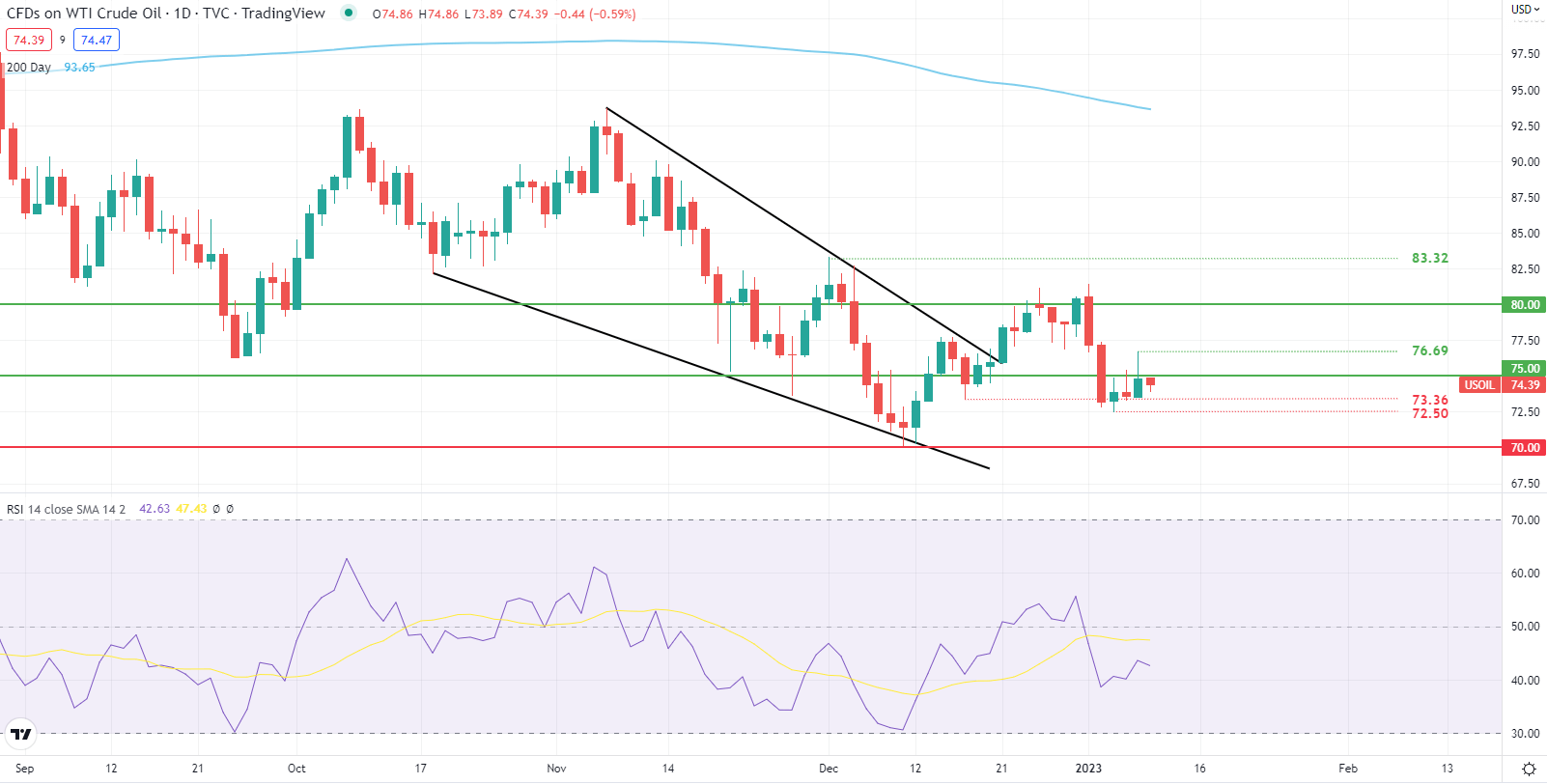

WTI CRUDE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily WTI crude oil price action is finding strong resistance at the psychological $75/barrel handle. This has been the case for the last few daily candles including long upper wicks on two of the prior candle closes. Traditionally, a long upper wick points to subsequent downside which could give bears some motivation.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are NET LONG on crude oil, with 74% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, due to recent changes in long and short positioning we arrive at a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.