[ad_1]

oatawa

Introduction

In a year, Sprout Social (NASDAQ:SPT) has fallen almost 23.98%—a large part being the contribution of the current macroeconomic environment as investors are fearing the interest rate hikes and decreased marketing spending. However, I believe that Sprout Social’s ability to successfully scale itself during the current economic state and its attractive valuation makes the stock a worthwhile “Buy”.

Company Overview

Created for businesses and agencies of all sizes, Sprout Social is a social media management and intelligence tool that enables consumers to manage conversations and uncover practical insights that will have a tangible impact on their business. Sprout Social operates across major social media platforms such as Instagram, TikTok, Twitter, and more. Their main source of revenue comes from the subscription fees to use its platform (this in fact makes up 99% of their revenue). Although Sprout Social faces competition from developing business management tools, they currently have the market leadership due to its premium brand, great customer service, and growing dataset.

Q2 2022 Analysis

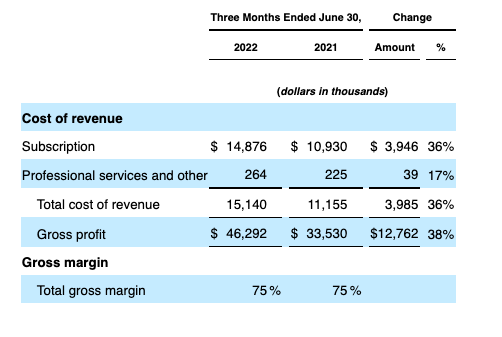

In Q2 2022, Sprout Social reported $61.4M in revenue (representing a 37.4% YoY growth) which beat analyst estimates by $1.09M. In addition, they also reported an EPS of -$0.04 which also exceeded analyst expectations by $0.02. Lastly, for fiscal year 2022, revenue is projected to grow more than 35% YoY and reach $252.68M.

Very Solid Fundamentals

On a fundamental level, Sprout Social’s subscription model is still going strong. In Q2 2022 earnings call, management reported that “retention and expansion trend line stayed consistent with April and May.” This is very good news as management is maintaining and improving their consumer stickiness which is very crucial for a company’s success during these uncertain times.

However, the biggest turn off for investors is that the company is still heavily burning cash and incurring losses in their bottom line, as cash flows from operating activities went from $-11.8M to $-24.37M YoY. Management acknowledges that they could potentially experience negative cash flows in the future despite their recent rebound in generating positive cash flow. I think that this is justified since they have been effective in their investing activities and marketing as sales and marketing costs increased 53% YoY to $30.3 million. Meanwhile, their latest 10-Q reports “customers contributing over $10,000 in ARR grew 47% versus the prior year and customers contributing over $50,000 in ARR grew 88% versus the prior year.“

10Q Report

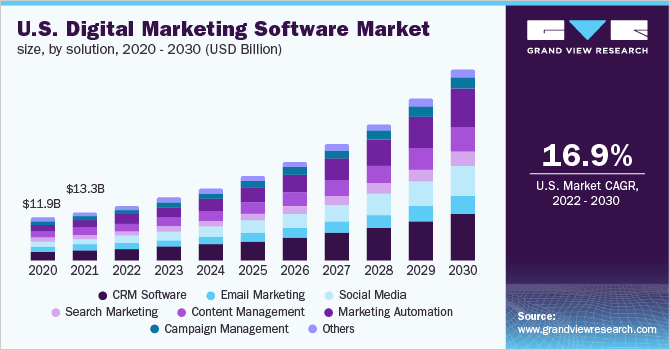

Sprout Social estimates their global market share to be worth $100 billion in 2025, growing at a 20% CAGR. These figures are also closely supported by Grand View Research. In addition, competitive risks would be less significant because Sprout Social estimates that themselves and its competitors represent only a small fraction of the TAM (Sprouts Social claims <1% of TAM). International growth has also been astounding, with 28% of the company’s total revenue coming from international customers, revenue from international users grew 33.4% YoY from $9.65M to $13.16M. I believe that Sprout Social has a lot of room to grow and their international momentum is a big catalyst to reaching their TAM.

Grand View Research

Valuation

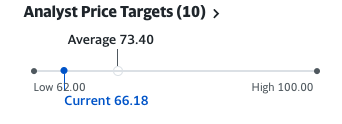

I took into account all of Sprout Social’s growth potential while remaining conservative to get an accurate valuation. I first assumed Sprout Social’s revenue in 2025 to be $500M if the company still retains its 0.5% market share. Next, I used an average conservative software P/S ratio of 12.44. Altogether, this yields a market cap of $6.22 Billion in 2025 and discounting this back to today resulted in a price target of $98.33 and a 48.5% upside.

This price target is also in-line with 10 Wall St analysts reported by Yahoo Finance. They priced the stock at a range between $62.00 to $100.00 with an average price target of $73.40.

Yahoo Finance

Risk

As investors flip their judgements about the impacts of a recession, inflation data, and Fed decisions, there is no doubt that Sprout Social will continue to be very volatile and trade on investor sentiments. In a case of a serious recession, Sprout Social will lose customers as small businesses shut down and bigger companies opt to tighten budgets. The biggest problem with Sprout Social is determining whether or not it is a core business need or simply a “nice to have”. This will vary heavily depending on the type of business that’s using the platform as well as its target audience. Therefore, the impacts of a recession on Sprout Social are hard to quantify.

Should you buy SPT Stock?

Sprout Social is a well-managed company and has ample room to grow. SPT stock has recovered nicely and 48.5% upside is likely based on my valuation. The company has shown itself to be resilient thus far and investors with a shorter investment timeframe should stay cautious and continue to monitor the health of the economy. With all these reasons and more, I recommend a “Buy”.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.