[ad_1]

Justin Sullivan

In an amazing and surprising move, SoftBank (OTCPK:SFTBY) has followed through with unloading shares of SoFi Tech. (NASDAQ:SOFI) pressuring shares lower. The fintech remains an impressive grower, but SoftBank has other reasons for unloading the stock including purchasing shares in fellow fintech Nu Holdings (NU). My investment thesis is ultra-Bullish on an investor being able to load on the stock of SoFi with the gap from the strong earnings report officially closing.

Gap Closed

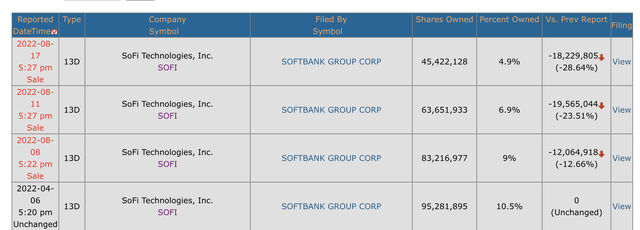

Over the course of the last month, SoftBank has unloaded at least 40 million shares in SoFi. The investment fund originally owned over 95 million shares of the fintech for a position amounting to over 10.5% of the firm and a valuation topping $800 million.

As of August 17, SoftBank saw their position dip to only 45 million shares cutting their position below 5%. The company no longer has to report share sales and one would presumably expect the remaining shares to be sold, if not already. SoftBank might reign in sales with the stock now trading in the $6s with the original shares sold in the higher $7s and into the $8s.

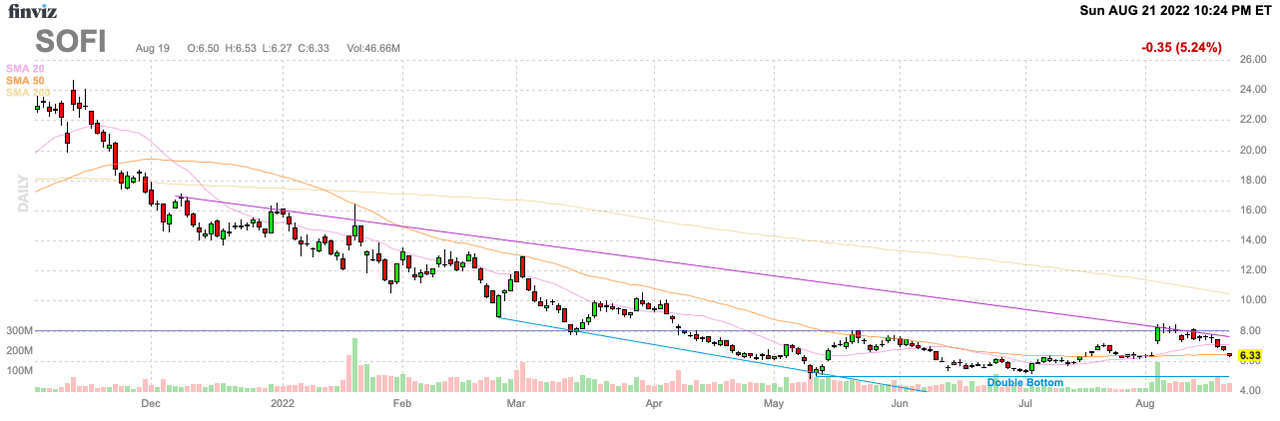

Interestingly, the stock closed the major gap from the Q2’22 earnings beat where SoFi surprised the market by guiding up for the year. The stock surged from a close of $6.63 on August 2 to an open of $7.28 and a close of $8.23 on the next day.

Source: FinViz

The stock wasn’t looking back due to an appealing valuation and signs the online banking platform would maintain strong growth, even during a recession. Investors already knew SoFi was easily overcoming a Biden Admin. moratorium on student loans.

The stock only averages 37 million shares traded on a daily basis. SoftBank selling 40 million shares and possibly all of the 95 million shares have had a material impact on the share price. One might even argue the stock could trade at $9 or $10 now without an influential investment firm unloading so many shares.

The gap close is a technical trading view where traders will hold off buying or selling a security until the gap opened up in the chart closes. With SoftBank unloading shares and the technical aspects of the pending gap close, most traders were on a buyers strike.

Student Loans Not An Issue

SoFi came public via a SPAC with the general business plan focused on refinancing student loans and cross selling members to other financial products. The fintech continues to add new financial products to the platform driving growth, but SoFi is no longer reliant on student loans

The bad news is that the Biden Admin. just forgave another $3.9 billion in student debt. Since President Biden took office, the student loan moratorium has been extended 4 times. The President has promised to make a decision on loan forgiveness by the current deadline of August 31.

The biggest problem with all of the loan forgiveness plans, including the recent $3.9 billion for ITT, is the concept of only forgiving those borrowers with outstanding debt. Anyone that repaid ITT student loans, or even avoiding student loan debt to attend college, will miss out on the loan forgiveness plans.

The whole student debt forgiveness issue is rooted in such tweets from former Ohio State professor and activist Nina Turner.

The problem is that the reality is far different. The vast amount of student loan debt is held by doctors, lawyers and MBAs with graduate degrees and high paying jobs. People in poverty or the working poor likely didn’t take out student loans in the first place. Besides, the government already gives out billions in grants for students of low-income families and a focus on improving such grants would better address the problem.

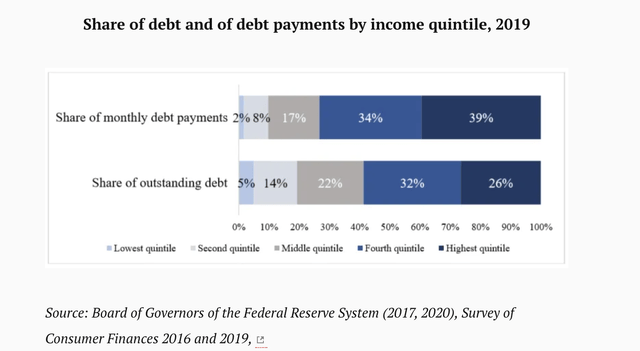

My previous research discussed how study after study concludes that the cancellation of student debt on the books right now is a gift to high-income families. This 2019 study from the Federal Reserve System highlighted how almost 60% of outstanding education debt was held by people making over $74,000 a year (the highest 40% of household incomes).

Source: Federal Reserve System

Clearly, cancelling existing student debt isn’t the answer to opening up the education system to low-income families. Either these individuals aren’t attending college, or they are going the path of limiting loans, or those individuals are now in the high-income households from obtaining a college degree.

If SoFi has closed the recent gap up for any reason related to an extension of the student debt moratorium, the stock move is irrational. The business model no longer relies on refinancing student debt and the likely outcome remains a loan forbearance of $10K for individuals falling outside a certain classification for high-income earners. Such a move would be a boon for SoFi considering the business model targets those in the graduate degree area with high incomes and strong credit scores.

SoFi CEO Anthony Noto already clearly stated that a typical member refinancing $70,000 in student loans might over refinance $60,000 now. The historical impact to the fintech would be rather minimal. Anything that ends the moratorium would be a huge boom to business.

The stock trades at less than 3x 2023 revenue targets. The amounts could get a boost with SoFi not targeting any change to the student loan moratorium in the updated 2022 revenue boost to ~$1.5 billion.

Takeaway

The key investor takeaway is that SoFi is an incredible bargain now having fallen over $2 since the peak following Q2’22 earnings in early August. SoftBank unloading a large portion of their shares provides a great entry point for shareholders.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.