[ad_1]

Japanese Yen, USD/JPY, US Dollar, DXY, Fed, Jackson Hole, Yields – Talking Points

- USD/JPY is exhibiting a relationship with Treasury yields

- Overall US Dollar moves are also beholden to US interest rates

- All eyes are on Jackson Hole this week. Will the Fed summit move USD/JPY?

The Japanese Yen remains vulnerable to external factors as it resumed weakening against the US Dollar last week. The broader strengthening of the ‘big dollar’ can be seen through the DXY index.

The DXY index is a US Dollar index that is weighted against EUR (57.6%), JPY (13.6%), GBP (11.9%), CAD (9.1%), SEK (4.2%) and CHF (3.6%).

IF we look at USD/JPY against the DXY index and the 10-year Treasury note yield, the correlation becomes fairly apparent.

Understanding where the 10-year Treasury yield is headed may provide an edge for trading USD/JPY.

The upcoming annual Jackson Hole symposium could set the stage for an opportunity with a keynote address from Federal Reserve Chair Jerome Powell on Friday.

Previous gatherings of central bankers in the ski resort have occasionally revealed significant policy shifts. This time last year the Fed labelled accelerating inflation as transitory. This year, the alarms bells are ringing on eye wateringly high inflation becoming entrenched.

The language will be closely watched for clues on how determined the central bank is to get inflation back toward their goal of around 2%.

Overnight Federal Reserve Bank of Minneapolis President Neel Kashkari renewed his hawkish credentials referring to his concern of the ‘unanchoring of inflation expectations’.

This led to some speculation of a 100 basis-point (bp) hike at their September Federal Open Market Committee (FOMC) meeting. Market pricing is swaying between a 50- or 75-bp rise in the target rate.

The consensus appears to be that Fed Chair Powell will be more moderate in his language. A deviation from this rhetoric could see Treasury yields move significantly, leading to potentially outsized USD/JPY moves.

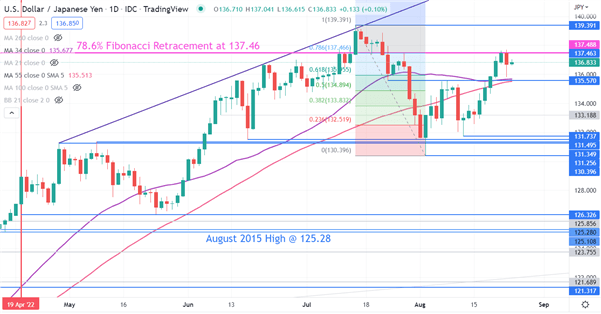

USD/JPY TECHNICAL ANALYSIS

As identified on Monday in USD/JPY price action, 137.46 is the 78.6% Fibonacci Retracement of the move from 139.39 to 130.39. The price has failed to hold above that level and it may continue to offer resistance.

Nearby support could be at the break point of 135.57. The 34- and 55-day Simple Moving Averages (SMA)are also near that level and might support it.

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.