[ad_1]

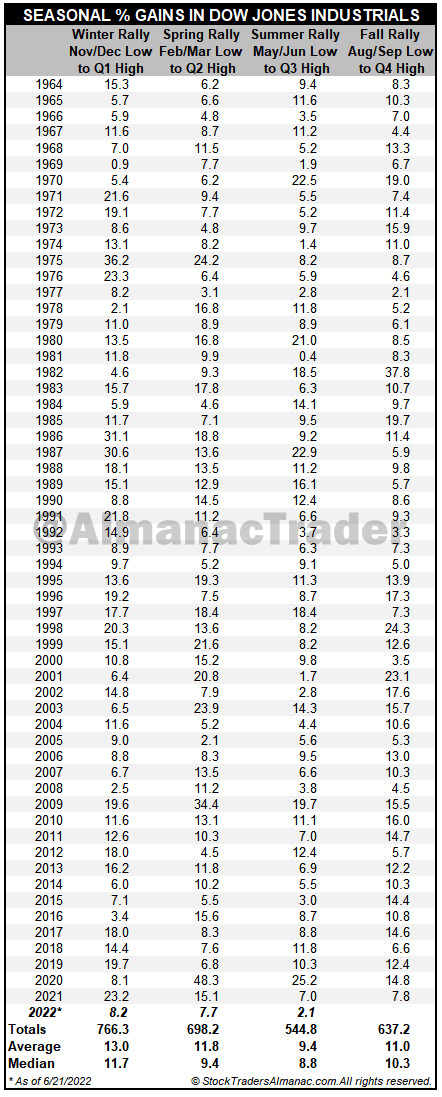

Most years, especially when the market sells off during the first half or is flat, prospects for the perennial summer rally become the buzz on the street. Parameters for this “rally” were defined by the late Ralph Rotnem as the lowest close in the Dow Jones Industrials in May or June to the highest close in July, August, or September. Such a big deal is made of the “summer rally” that one might get the impression the market puts on its best performance in the summertime. Nothing could be further from the truth! Not only does the market “rally” in every season of the year, but it does so with more gusto in the winter, spring, and fall than in the summer.

Winters in 59 years averaged a 13.0% gain as measured from the low in November or December to the first quarter closing high. Spring rose 11.8% followed by fall with 11.0%. Last and least was the average 9.4% “summer rally.” Even 2020’s impressive 25.2% “summer rally” was outmatched by spring’s massive 48.3%. So beware the summer rally hype as it is usually the smallest rally of the year and can fade just as quickly as it began. Following the worst weekly loss since 2020, today’s DJIA 2.1% gain likely has stirred hope that this is the start of a summer rally. More likely, today’s bounce will fade as inflation is still raging and the Fed is still tightening monetary policy.

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.