[ad_1]

October can evoke fear on Wall Street as memories are stirred of crashes in 1929, 1987, the 554-point DJIA drop on October 27, 1997, back-to-back massacres in 1978 and 1979, Friday the 13th in 1989 and the 733-point DJIA drop on October 15, 2008. During the week ending October 10, 2008, DJIA lost 1,874.19 points (18.2%), the worst weekly decline, in percentage terms, in our database going back to 1901. March 2020 now holds the dubious honor of producing the largest and third largest DJIA weekly point declines. The term “Octoberphobia” has been used to describe the phenomenon of major market drops occurring during the month. Market calamities can become a self-fulfilling prophecy, so stay on the lookout and don’t get whipsawed if it happens.

October has been a turnaround month—a “bear killer” if you will. Twelve post-WWII bear markets have ended in October: 1946, 1957, 1960, 1962, 1966, 1974, 1987, 1990, 1998, 2001, 2002 and 2011 (S&P 500 declined 19.4%). Seven of these years were midterm bottoms.

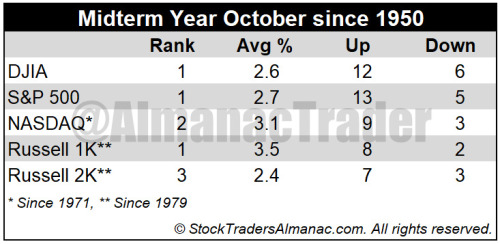

Midterm-election-year Octobers are downright stellar thanks to the major turnarounds mentioned above; ranking number one on the DJIA, S&P 500 and Russell 1000. Midterm October is NASDAQ’s second-best month and Russell 2000’s third best. This is usually where the “Sweet Spot” of the four-year-presidential-election-cycle begins. The fourth quarter of the midterm years combines with the first and second quarters of the pre-election years for the best three consecutive quarter span for the market, averaging 19.3% for the DJIA and 20.0% for the S&P 500 (since 1949), and an amazing 29.3% for NASDAQ (since 1971).

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.