[ad_1]

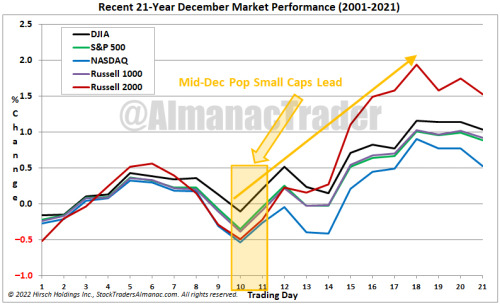

December’s first trading day has been bearish for S&P

500 and Russell 1000 over the last 21 years. A modest rally through the fifth

or sixth trading day also has fizzled going into mid-month. It is around this

point that holiday cheer tends to kick in and propel the indexes higher with a

pause near month-end.

Small caps tend to start to outperform larger caps near the

middle of the month (early January Effect, 2023 Almanac pages 112 &114). The

January Effect is not to be confused with the January Barometer (2023 Almanac page

18), which states as the S&P 500 goes in January, so goes the year.

The “Santa Claus Rally” begins on the open on December 23

and lasts until the second trading day of 2023. Average S&P 500 gains over

this seven trading-day range since 1969 are a respectable 1.3%. The “Santa

Claus Rally,” (2023 STA p 118) was invented and named by Yale Hirsch in 1972 in

the Almanac.

This is our first indicator for the market in the New Year. Years

when the Santa Claus Rally (SCR) has failed to materialize are often flat or

down. As Yale Hirsch’s now famous line states, “If Santa Claus should fail

to call, bears may come to Broad and Wall.”

[ad_2]

Image and article originally from jeffhirsch.tumblr.com. Read the original article here.