[ad_1]

Uniparts India IPO Review: Uniparts India Limited is coming up with its Initial Public Offering. The IPO will open for subscription on November 30th, 2022, and close on December 2nd, 2022. It is looking to raise Rs 835.61 crore whole of which will be an Offer for Sale.

In this article, we will look at the Uniparts India IPO Review 2022 and analyze its strengths and weaknesses. Keep reading to find out!

Uniparts India IPO Review – About The Company

Uniparts India Limited, established in the year 1994, is a global manufacturer of engineered systems and solutions. It is one of the leading suppliers of systems and components for the off-highway market in agriculture and construction, forestry, and mining (“CFM”) and aftermarket sectors.

The company has an estimated 14.45% market share of the global 3PL market in Fiscal 2021. Also, it has an estimated 5.87% market share in the global PMP market in the CFM sector in Fiscal 2021 in terms of value.

The company has a global footprint and presence in more than 25 countries with a major focus on serving customers across countries in North and South America, Europe, Asia, and Australia, including India.

The company has 5 manufacturing facilities in India. In addition to that, Uniparts India also has a manufacturing, warehousing, and distribution facility in the United States and a warehousing and distribution facility in Germany.

The product portfolio of the company

- 3-point linkage systems (3PL)

- Precision Machined Parts (PMP)

- Hydraulic Cylinders

- PTO

- Fabrications

The competitors of the company

The company does not have any listed industry peers in India.

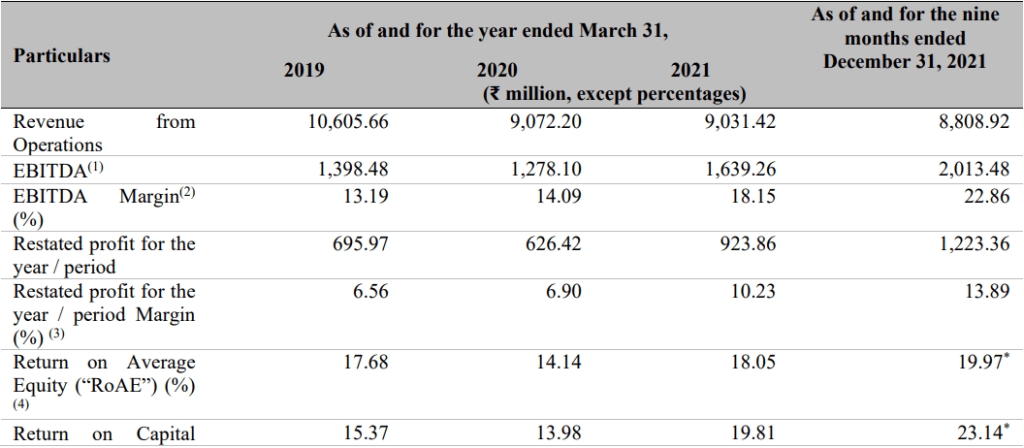

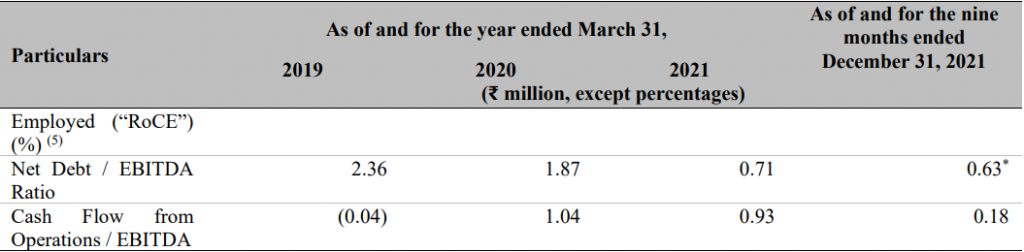

Uniparts India IPO Review – Financial Highlights

(Source: DRHP of the company)

Industry Overview

According to a CRISIL Report, The world market for 3-point linkages (3PL) was estimated at USD 320 million in 2020 and is expected to grow by nearly 6% to 8% between 2020 and 2025 on the back of robust growth in tractor production.

The global market for PMP for articulated joints was USD 520 million in 2020. Going further, demand for PMP products is expected to grow at a CAGR of 7% and 9% between 2020 and 2025, powered by strong volume growth in construction equipment production.

Strengths

- The company has a leading market presence in the global off-highway vehicle systems and components segment.

- The company is a vertically integrated precision solutions provider.

- The company follows a global business model optimizing cost-competitiveness and customer supply chain risks.

- The company has strong and long-standing relationships with key global customers, including major Original Equipment Manufacturers (OEMs).

- They have strategically located manufacturing and warehousing facilities that offer scale and flexibility to the business.

Weaknesses

- The company’s operations are highly dependent on raw materials such as steel, power, and fuel. Any non-availability or changes in price can impact the business.

- The company has overseas operations. Thus it is highly exposed to currency exchange rate fluctuations.

- The products of the company are used in seasonal businesses such as agriculture and CFM sectors. Thus, the nature of their operations is Seasonal.

- The company is labor intensive thus it may be subject to work stoppages, strikes, or other types of conflicts. This will have an adverse effect on the company.

- There are certain legal proceedings involving the Company its Subsidiaries, and its Directors and Promoters.

Uniparts India IPO Review – GMP

The shares of Uniparts India traded at a premium of 13.86% in the grey market on November 29th, 2022. The shares tarded at Rs 657 This gives it a premium of Rs 80 per share over the cap price of Rs 577.

Uniparts India IPO Review – Key IPO Information

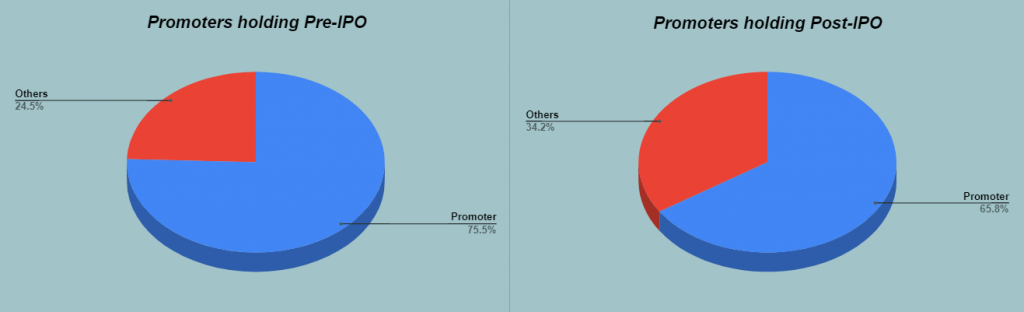

Promoters: Gurdeep Soni and Paramjit Singh Soni.

Book Running Lead Managers: Axis CapitalLimited, DAM Capital Advisors Limited, and JM Financial Limited.

Registrar To The Offer: Link Intime India Private Limited.

| Particulars | Details |

|---|---|

| IPO Size | ₹835.61 Crore |

| Fresh Issue | – |

| Offer for Sale (OFS) | ₹835.61 Crore |

| Opening date | November 30, 2022 |

| Closing date | December 2, 2022 |

| Face Value | ₹10 per share |

| Price Band | ₹548 to ₹577 per share |

| Lot Size | 25 Shares |

| Minimum Lot Size | 1 (25 Shares) |

| Maximum Lot Size | 13 (325 Shares) |

| Listing Date | December 12, 2022 |

The Objective of the Issue

The Net Proceeds from the Fresh Issue are proposed to be utilized for:

- To carry out the Offer for Sale of up to 1,57,31,942 Equity Shares by the Selling Shareholders.

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

In Closing

In this article, we looked at the details of Uniparts India IPO Review 2022. Analysts remain divided on the IPO and its potential gains. This is a good opportunity for investors to look into the company and analyze its strengths and weaknesses. That’s it for this post.

Are you applying for the IPO? Let us know in the comments below.

You can now get the latest updates in the stock market on Trade Brains News and you can even use our Trade Brains Portal for fundamental analysis of your favorite stocks.

Start Your Financial Learning Journey

Want to learn Stock Market and other Financial Products? Make sure to check out, FinGrad, the learning initiative by Trade Brains. Click here to Register today to Start your 3-Day FREE Trail. And do not miss out on the Introductory Offer!!

[ad_2]

Image and article originally from tradebrains.in. Read the original article here.