[ad_1]

Australian Dollar, AUD/USD, S&P 500, Early US Earnings, Sentiment – Asia Pacific Market Open

Recommended by Daniel Dubrovsky

How to Trade AUD/USD

Asia-Pacific Market Briefing – Nike, FedEx Earnings, Consumer Confidence

The sentiment-linked Australian Dollar outperformed its major counterparts on Wednesday, benefiting from the cautious improvement in risk appetite. On Wall Street, the S&P 500, Dow Jones and Nasdaq 100 gained 1.49%, 1.6% and 1.54%, respectively. Meanwhile, the VIX market ‘fear gauge’ plunged to its lowest since late November. This is in line with fading volatility that tends to occur into the Christmas holiday.

There were a couple of fundamental factors in play that inspired markets. For starters, earnings reports from Nike and FedEx surprised higher. Given the fading liquidity as 2022 comes to an end, traders might have taken these as a sign that the earnings season ahead might be rosier than anticipated. Of course, if that does not transpire, it could make a negative reaction more violent than before the data today.

Meanwhile, the US Conference Board Consumer Confidence for December crossed the wires and beat expectations. The gauge clocked in at 108.3 versus 101.0 anticipated. That is the highest reading since April. Keep in mind that going forward, better data may not necessarily be ‘good’ for markets given that a still-strong economy may push the Federal Reserve to remain hawkish for longer.

Australian Dollar Technical Analysis

From a technical standpoint, the Australian Dollar has confirmed a breakout under a bearish Rising Wedge chart formation. AUD/USD has gotten caught up on the former falling trendline from March. Holding as new support. But, keep in mind that the 200-day Simple Moving Average (SMA) is also maintaining the dominant downside focus. Key resistance is the 61.8% Fibonacci retracement level at 0.6768. Pushing under the midpoint at 0.6654 opens the door to an increasingly bearish view.

AUD/USD Daily Chart

Thursday’s Asia Pacific Trading Session – Eyes on Market Sentiment

Thursday’s Asia-Pacific trading session is lacking notable scheduled economic event risk. That places the focus for traders on market sentiment. This leaves indices such as the Nikkei 225, ASX 200 and Hang Seng Index in a position to perhaps capitalize on the rosy Wall Street trading session. That may also bode well for the Australian Dollar.

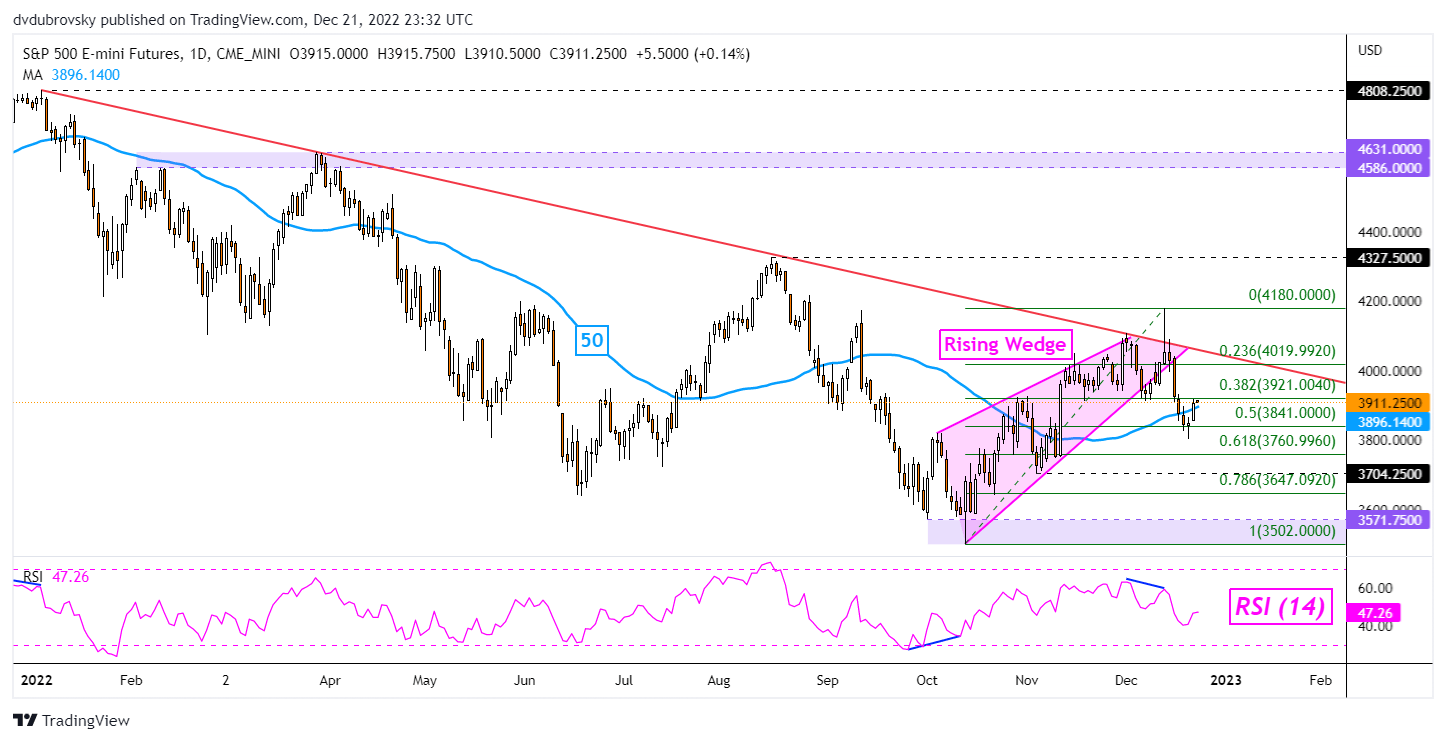

S&P 500 Technical Analysis

The S&P 500 appeared to find support in the aftermath of breaking under a bearish Rising Wedge. The midpoint of the Fibonacci retracement level at 3841 is working together with the 50-day SMA as formidable barriers. Clearing the 38.2% level at 3921 may open the door to extending gains back towards the falling trendline from earlier this year. Otherwise, the 61.8% level at 3760 is in focus.

Recommended by Daniel Dubrovsky

How to Trade FX with Your Stock Trading Strategy

S&P 500 Futures Daily Chart

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.