[ad_1]

Marina113/iStock Editorial via Getty Images

Car rental stocks have been stop and go over the last few years during and following a very uncertain macro environment with reduced business travel and soaring gasoline prices. The Road & Rail industry is often seen as an economic bellwether given its cyclical nature, but that also means its tide can shift quickly when growth concerns show themselves. Toss in some meme stock activity, and volatility can really strike fast.

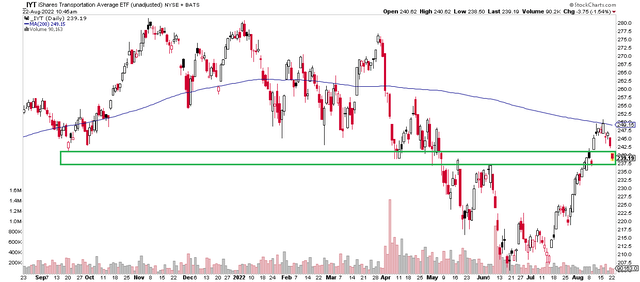

Like so many charts, the iShares Transportation Average ETF (IYT) found resistance when shares rallied to its 200-day moving average last week. I’m watching that indicator as well as the $237 to $242 area on IYT. One car rental company has underperformed IYT, and shares could drop another 10% if we see transports break this pivotal support zone.

Dow Transports: Hovering At Critical Support

According to Fidelity Investments, Avis Budget Group, Inc (NASDAQ:CAR) together with its subsidiaries, provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers. It operates the Avis brand, which offers vehicle rental and other mobility solutions to the premium commercial and leisure segments of the travel industry.

The New Jersey-based $8.2 billion market cap Road & Rail industry company in the Industrials sector trades at a low 3.9 trailing 12-month price-to-earnings ratio and it does not pay a dividend, according to The Wall Street Journal.

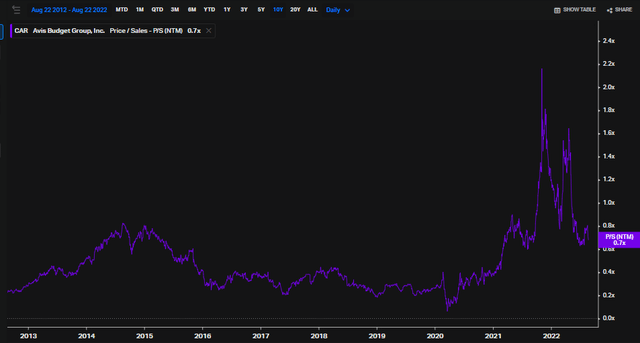

CAR trades at an elevated forward price-to-sales ratio, though. There remain many question marks surrounding how the future of business and leisure travel will look following this summer’s season of “revenge vacations.”

CAR: An Elevated Price-to-Sales Ratio, Though Down From Nosebleed Levels

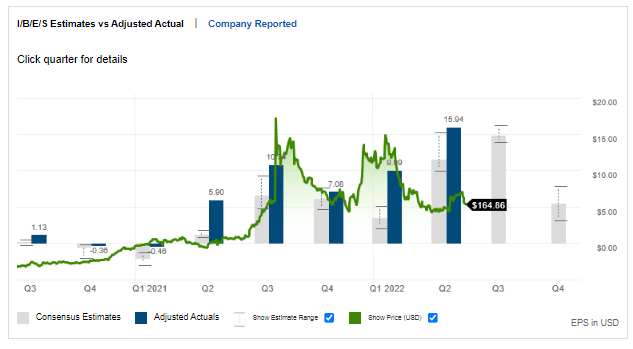

The company does, however, has a strong earnings beta rate history despite a volatile and uncertain operating environment. CAR’s Q2 report was indeed much better than analysts were forecasting, but shares settled lower on August 2 despite a small gap up after that morning’s earnings release. So the fundamental picture is mixed with Avis Budget.

CAR: A Strong Earnings Beat Rate History

Fidelity Investments

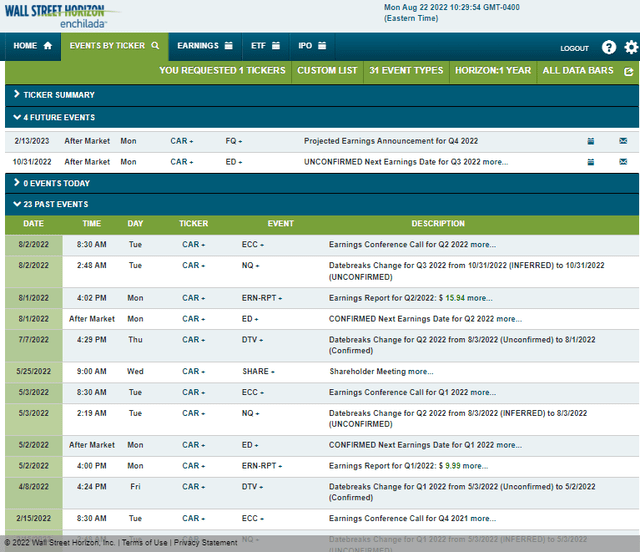

Eyeing the firm’s corporate event calendar, the next several weeks are quiet before Q3 earnings hit the tape on October 31 AMC, according to Wall Street Horizon.

Avis Budget’s Corporate Event Calendar

The Technical Take

Looking past the wild spike on the 2nd trading day of November last year, there are some notable price levels investors should watch. CAR has resistance in the $320 to $328 range – the stock failed to break about that range last April before a sharp breakdown below $236 in May. The bulls stepped up in the mid-$140s, however, so that is key support.

Near-term, the $195 to $203 range is resistance. That was not only the May rebound high, but also where sellers emerged on two occasions this month. The previous four sessions have seen intense selling, so I think shares will retest the mid-$140s soon. Long-term investors should consider accumulating a position there given its low earnings multiple.

CAR: Support Further Down After Backing Away from $200 Post-Earnings

The Bottom Line

Avis Budget Group has important support about 10% lower from here. Thus, I see near-term weakness given the intense selloff in the last few days and since the stock did not climb above key resistance despite a solid earnings report earlier this month. A long position in the high $140s with a stop under $140 looks like the right play.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.