[ad_1]

POUND STERLING ANALYSIS & TALKING POINTS

- U.S. housing market data dominates headlines today.

- Weak economic data adds to lack of price action.

- Breakout requires stimulus.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBP FUNDAMENTAL BACKDROP

The British pound has been rather indecisive of late which is to be expected at this time of year with minimal trading volumes and lack of fundamental stimuli. The economic calendar is equally as bare, with no high impact events scheduled for today (see economic calendar below). U.S. housing data will be the focus and with a housing recession being dominating headlines of recent, these metrics will provide important information as to the health of the U.S. housing market. Already the 30-year mortgage rate has come down from +7% giving some relief for home owners and potential new buyers alike.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

Chart prepared by Warren Venketas, IG

GBP/USD 4-HOUR CHART

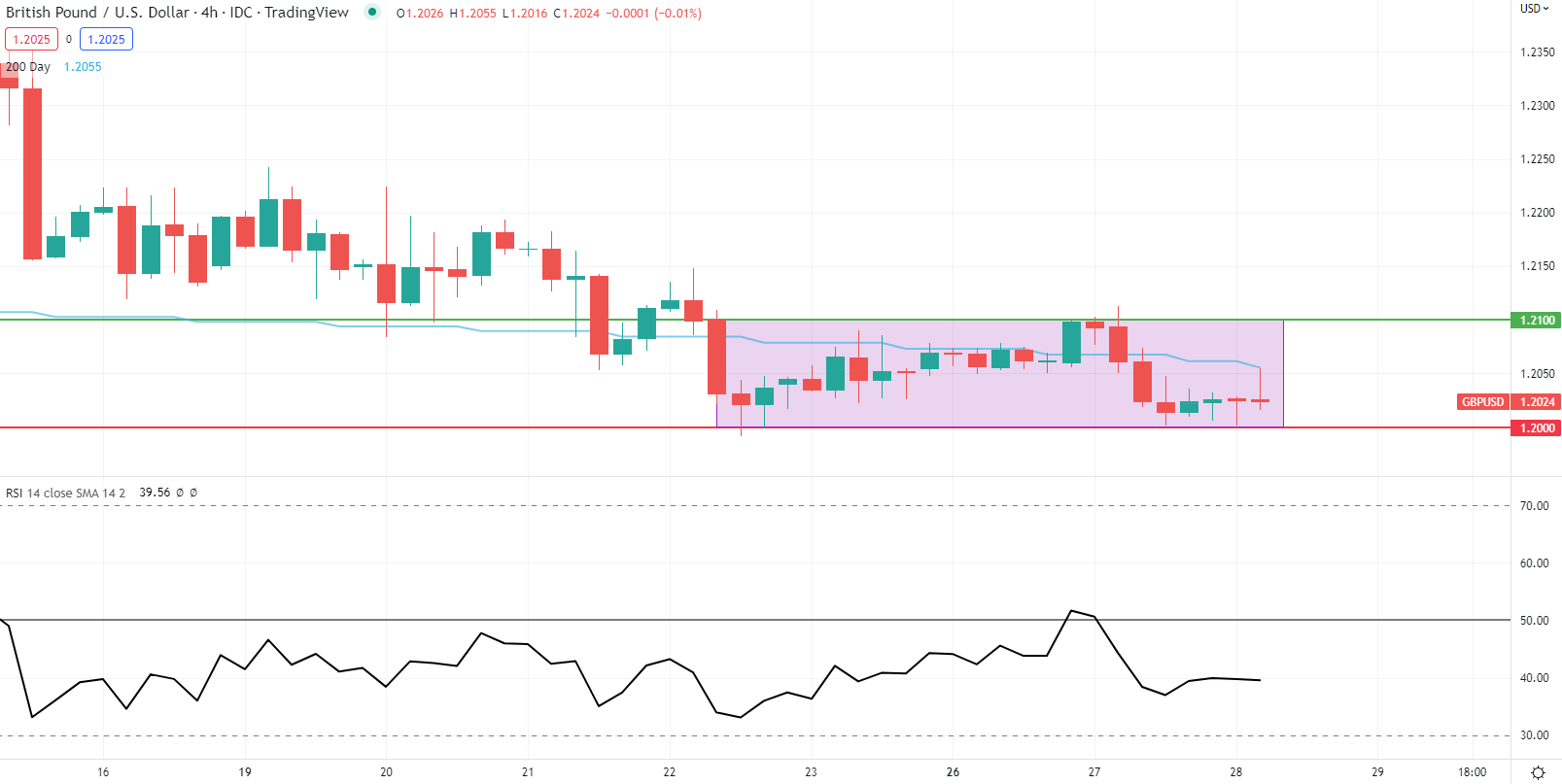

Chart prepared by Warren Venketas, IG

The daily GBP/USD chart shows price action printing a long upper wick on today’s candle and remaining below the 200-day SMA (blue) resistance level. In terms of momentum, the Relative Strength Index (RSI) echoes the sideways price movement reading around the midpoint 50 level that traditionally indicates neither bullish nor bearish momentum.

Moving over to the short-term 4-hour chart, the consolidatory form is far more clear, developing into a rectangle pattern (pink). With little in the way of expected impactful news, this formation may continue. For now, GBP/USD has been respectfully ranging between the 1.2000 and 1.2100 psychological handles.

Key resistance levels:

Key support levels:

BEARISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 54% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.