[ad_1]

Scharfsinn86/iStock via Getty Images

Our most devoted readers know our investment case with Darling Ingredients (NYSE:DAR). For the others, we recommend checking up on our previous publications so that you are well acquainted with the narrative up to now:

- Darling Ingredients Undervalued With Its Diamond Green Diesel JV Valued At Zero

- Darling Is A Decent Hedge Against A Biden Win, A Multibagger With More Renewable Diesel Visibility

This year, we have already followed up about Darling providing some support in case the Blenders Tax Credit was not extended. In addition, we report the company’s latest acquisition and its long-term benefit.

Today, we continue to comment on the quarterly performance. Yesterday, it was show time for the company, which released its report providing another record.

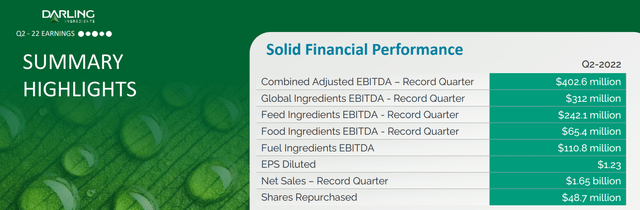

Source: Darling Q2 results

Half-year Results

Cross-checking with Wall Street analyst consensus, the company delivered an adjusted EBITDA of $402.06 million and an earnings per share of $1.23 (GAAP), while analyst expectations were forecasting (on average) an adjusted EBITDA of $376 million and an earnings per share of $1.17. Before analyzing the divisional highlights, it is worth reporting that volumes both on a quarterly basis and on a yearly basis were up by 23% and 13% respectively. CAPEX is in line with the company’s guidance and there is an ongoing buyback that our internal team expects to increase once DGD 3 comes online. We are optimistic about the Q3 future performance given the current fats environment, higher protein prices and the benefits from the inorganic acquisition of Valley and FASA.

After having missed expectations in Q4 and FY results, future performances were set at a lower level and Darling exceeded these numbers. Why?

- In our initiation of coverage, in the sum-of-the-part valuation, we concluded that Darling’s Diamond Green Diesel JV was valued at zero. Our investment was based on the fact that Darling was a vertically integrated company and this quarter provide another positive confirmation to show that our long-term idea is still right. Against other renewable diesel producers, Darling provides a natural hedge versus higher fat prices. It is a headwind to the DGD joint venture margins, but it is a tailwind for the Feed division. Thus, the Feed EBITDA delivered $242 million. This was also driven by Valley Protein’s performance which records important volumes and stable margins;

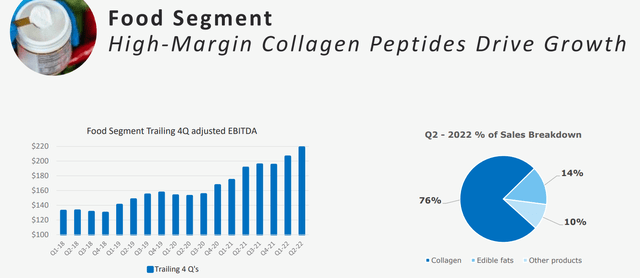

- It was a record quarter for the Food segment too. In the press release – management emphasized how: “hydrolyzed collagen demand is escalating rapidly as demand for collagen peptides for joint, ligament, hair and skin health grows worldwide”.

Source: Darling Q2 results

Valuation and Conclusion

There is bipartisan support for the Blenders Tax Credit coupled with new partnerships, such as the one with Chick-fil-A Inc, that will drive Darling’s Feed segment EBITDA. As we already mentioned, “with new renewable diesel projects coming online, there is a lot of focus on feedstock availability. Providing feedstock supply will drive better success later on”. Regarding the valuation, our investment case remains intact. Last time, we upgraded our 2024 EBITDA forecast to $1.9 billion and today we reaffirm our buy rating at $100 per share valuing the entity 6.5x on our estimated EBITDA.

[ad_2]

Image and article originally from seekingalpha.com. Read the original article here.